Petroleum pricing in Canada — Q4 report

Canadian retail gasoline prices declined in the fourth quarter as crude prices weakened and refining margins contracted. Conversely, retail diesel prices increased in the same period as refining margins widened upon distillate shortages across the planet. Crude prices declined from the previous quarter as recession fears grew. Ongoing high inflation into the fourth quarter led many central banks to raise prime lending rates, further contributing to fears of an impending global recession. Unplanned refinery outages in the U.S. and labour strikes at French refineries also supported falling crude oil prices. Likewise, Chinese demand for crude declined as the government implemented severe lockdowns to reduce COVID- 19 infections.

Gasoline inventories in North America were 2.1 percent lower than in the same quarter last year (EIA). North American gasoline demand averaged 7.3 percent lower in the fourth quarter than the previous year.

So what happens in petroleum next?

Crude oil prices will likely decline heading into 2023 as global crude oil inventories are expected to build upon lower demand from a probable economic recession due to constrictive monetary policies as governments attempt to curb high global inflation. With crude oil prices declining and lower seasonal demand, gasoline prices will trend lower.

Read the full report from Kalibrate Canada to get detailed insight on Canadian petroleum pricing in the last quarter, including:

- A gasoline and diesel market overview

Find out how prices have changed across the nation — with a breakdown of the final pump price, and an explanation of supply, demand, and other influencing factors.

- The market outlook for Q1 2023

Read Kalibrate’s analysis on how volatility will affect the market — and Canadian pump prices in 2023 and beyond.

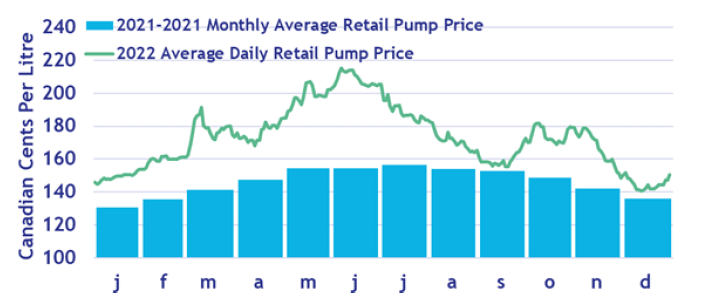

- A deep-dive into 2022’s record fuel prices

Fuel prices such as gasoline and diesel have long been a part of the news cycle as well as topics of discussion between people, particularly when comparing regional prices. 2022 was no exception as retail gasoline prices were incredibly high, outpacing the previous ten-year monthly average and setting price records. We delve into the rate of price increases across the years, and why things have shifted in the 2022.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

The Kalibrate fuel round up: April 2024

In this monthly feature, we look across the industry and mainstream news to uncover some stories of note that we...

Fuel pricing

Would you make €1000 or €100,000 from fuel price automation?

Examining your fuel pricing management processes regularly is critical — because the fight for volume is only...