Kalibrate for private equity

As a leader in the location intelligence space, Kalibrate has extensive experience in identifying whitespace potential, sales forecasting, and portfolio optimization for the world’s most successful brands.

Your perfect portfolio partner

Kalibrate understands the unique needs of private equity firms, providing meaningful insights both to inform your investment theses and to support and grow your portfolio.

Due diligence to help you know for sure

We partner with investors that take pride in the depth of their research, identifying the true value that prospective acquisitions hold in order to maximize returns for their clients.

- Leveraging the latest in mobility data to understand a brand’s core consumer

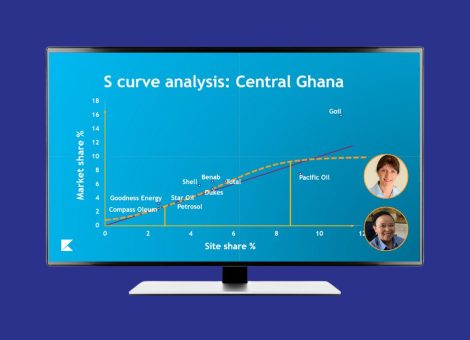

- Building models to understand both the quality of the existing portfolio/pipeline locations as well as the runway for growth in existing and new markets

- Utilizing analysis post-acquisition to provide ongoing strategy and insights

Kalibrate’s due diligence process results in a fact-based, independent assessment that serves as an essential input into shaping your investment decision. We work to provide the greatest level of certainty to de-risk potential acquisitions across a broad range of verticals.

We partner with investors that take pride in the depth of their research, identifying the true value that prospective acquisitions hold in order to maximize returns for their clients.

- Leveraging the latest in mobility data to understand a brand’s core consumer

- Building models to understand both the quality of the existing portfolio/pipeline locations as well as the runway for growth in existing and new markets

- Utilizing analysis post-acquisition to provide ongoing strategy and insights

Kalibrate’s due diligence process results in a fact-based, independent assessment that serves as an essential input into shaping your investment decision. We work to provide the greatest level of certainty to de-risk potential acquisitions across a broad range of verticals.

Deeper analysis to remove the guesswork

Many site selection providers still rely on outdated approaches to market optimizations and runway analysis. Private equity firms should aim higher when quantifying potential.

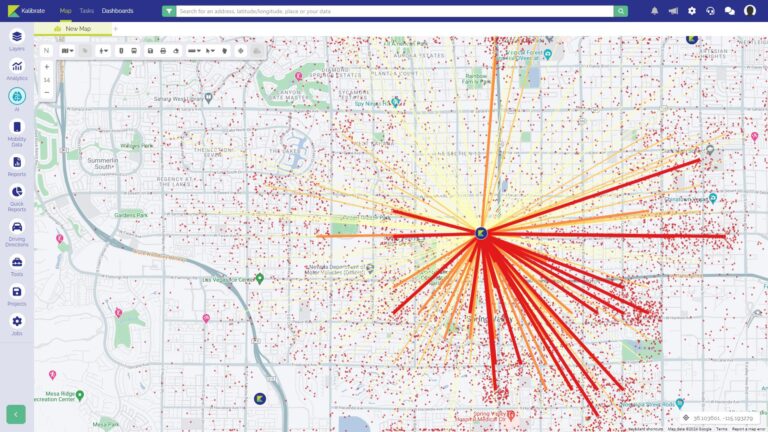

- Go beyond simplistic drivetime polygons – use mobility data to accurately delineate the trade area served

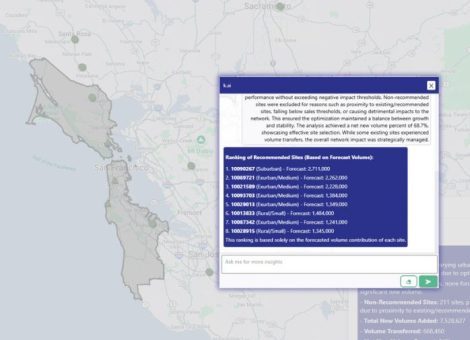

- Understand cannibalization and utilize transfer studies to see how an existing portfolio would be impacted by new store deployments

- Evaluate the impact that various channels have on brick and mortar store deployments

At Kalibrate, we leverage a comprehensive range of third-party data sets to help you get an accurate picture of the market size and opportunity.

Many site selection providers still rely on outdated approaches to market optimizations and runway analysis. Private equity firms should aim higher when quantifying potential.

- Go beyond simplistic drivetime polygons – use mobility data to accurately delineate the trade area served

- Understand cannibalization and utilize transfer studies to see how an existing portfolio would be impacted by new store deployments

- Evaluate the impact that various channels have on brick and mortar store deployments

At Kalibrate, we leverage a comprehensive range of third-party data sets to help you get an accurate picture of the market size and opportunity.

One platform for portfolio support

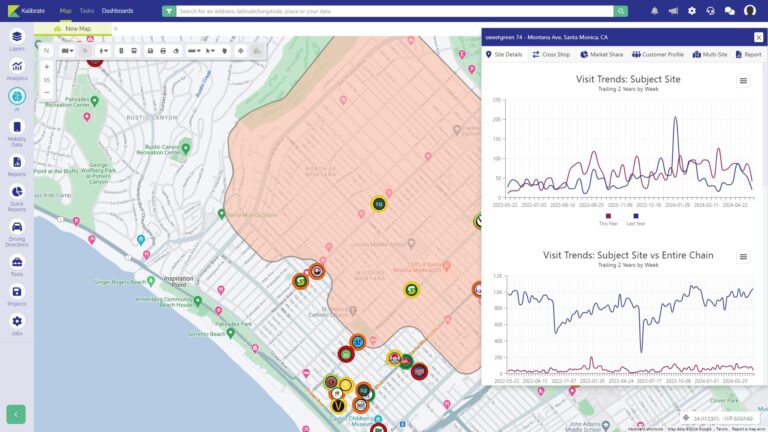

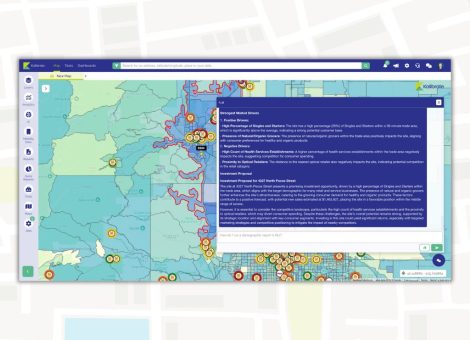

If you’re regularly re-assessing the value and growth potential of your existing portfolio, we can configure the Kalibrate Location Intelligence platform to provide brand-specific views of customer profiles, target markets, optimized network deployments, and growth strategies.

- Build and implement custom solutions to support each brand

- Access on-demand dashboards and reporting to provide your deal and portfolio support teams with key insights

- Create your own analysis across all active investments to track brand-specific performance against goals

While private equity firms with extensive portfolios have historically outsourced growth and optimization support for their investments, today there’s no need. Kalibrate solutions can provide unprecedented access to bespoke analytics, delivering powerful portfolio management across multiple brands within one system.

If you’re regularly re-assessing the value and growth potential of your existing portfolio, we can configure the Kalibrate Location Intelligence platform to provide brand-specific views of customer profiles, target markets, optimized network deployments, and growth strategies.

- Build and implement custom solutions to support each brand

- Access on-demand dashboards and reporting to provide your deal and portfolio support teams with key insights

- Create your own analysis across all active investments to track brand-specific performance against goals

While private equity firms with extensive portfolios have historically outsourced growth and optimization support for their investments, today there’s no need. Kalibrate solutions can provide unprecedented access to bespoke analytics, delivering powerful portfolio management across multiple brands within one system.

Related products

Ready to remove the guesswork from your decisions?

Related resources

Location intelligence

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...