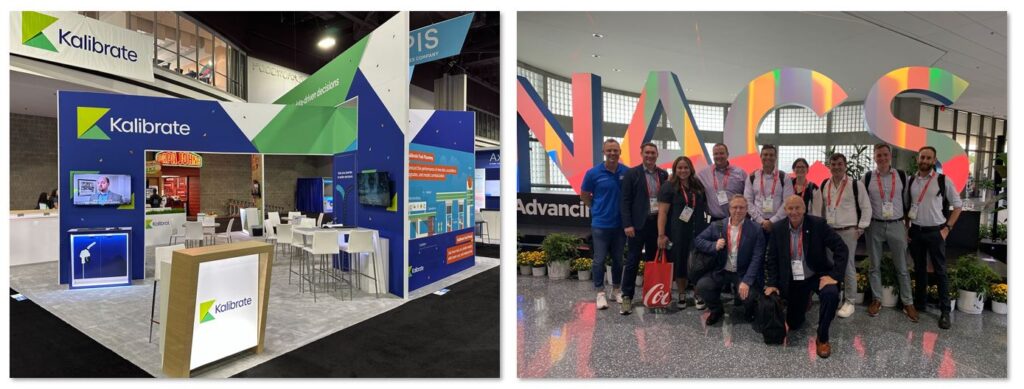

Reflections on NACS in Georgia

It’s always exciting to hear from our clients and others in the fuel and convenience space about how they’re innovating to grow their business while strengthening relationships with their customers. This year’s NACS show was no exception. Here, we give a flavor of the conversations our team on the Kalibrate booth had at the event.

C-store: pump to store conversion

We were asked quite a few questions about how convenience operators could leverage customer profiling to optimize their c-store offer to drive additional revenue from pump utilization. This is a concern we hear a lot more about as fuel retailers seek to diversify their revenue streams.

At a time when costs are elevated elsewhere, the ability to drive maximum value from each visit becomes more critical. Visitors to our booth were impressed with the data that Kalibrate Planning – and our site analysis studies – can provide and how the insight be used to boost c-store sales.

EV

The last few shows we’ve seen interest in EV charging strategies ramp up and the trend continued at this edition of NACS. We had lots more conversations about EV in the context of portfolio management as more retailers think about implementation. Network planners were keen to understand how adoption will accelerate in their markets, where to install charging in the near to medium term, and the point at which fuel volumes will be impacted.

These questions are interrelated. In fact, we’ve already developed an analytical approach that answers them both. If you’re interested in learning more, we’re running a webinar in December that will provide an insight.

We also spoke to quite a few charge point operators who were keen to leverage data to identify where they should be prioritizing their outreach. Associations and consortiums also visited our booth having received requests from their members for EV charging insights. As ever, we were happy to share our knowledge and look forward to continuing those conversions.

Car wash

Continuing the theme of diversification, quantifying the impact of adding car wash was a recurrent theme. There’s been a rapid growth in car washes across the US and more and more operators are seeing the value of driving additional revenue and attracting drivers. Analytical approaches can shed light on the amount of revenue adding car wash might add and we’ve got a ready-made model specifically designed for car washes at gas stations. Attendees were keen to learn – and we were happy to demonstrate.

Mid-market retailers

This year we had a lot of conversations with mid-market operators. Some had 20, 50, 100 sites and were seeking solutions across fuel pricing and network planning.

A recurrent theme within fuel pricing was the determination and implementation of pricing strategies. Our Customer Success Managers – who have a wealth of experience in retail fuel operations/pricing – were attending and happy to assist retailers to understand and implement their fuel pricing strategies into Kalibrate Pricing. We demonstrated how the tool is effective at achieving efficiencies in process, whilst providing the consistency required by a strategic approach to fuel pricing. We also had discussions around data science and how pricing capabilities can help retailers attain their volume and profitability goals.

Some retailers were interested in opportunistic growth and were keen on our site analysis. We had several conversations about projecting performance from individual locations to networks, through to portfolio reconfigurations as retailers reached a scale to start thinking big-picture optimization.

Mobility data

We had lots of conversations about mobility data – and it was great to be able to showcase the power of Competitive Insights. Our approach has always been that mobility data is critical – but it’s part of a toolkit that requires supplementation from other data sources to drive greatest value and avoid blind spots.

We heard from attendees how mobility data was playing a vital role in helping them track competitor performance and get a general sense of how their market was trending. The speed of insight was cited as high value in understanding the potential to better quantify cross shopping behaviors during demos of Competitive Insights.

Food offer

We spoke to many retailers keen to understand the impact of different types of food offering on their overall profitability. Some are leveraging QSRs via third-party chains, others have already brought in proprietary offers. The common tie between all was seeking to quantify the impact investment or change of food offer could have on fuel volumes and profit.

We’ll see you next year!

Read more articles about:

EventsSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Events

Maximizing Performance: The 7 Elements for Fuel and Convenience Retail Success

Learn actionable strategies to boost profitability and drive smarter decisions with data.