Get ready for EV in 2022

As we near the end of 2021, and what we all hope is the tail end of the pandemic, I want to reflect on what has been a key focus for me this year – the proliferation of EVs, the investment in EV charging, and what opportunities 2022 holds on the road to electrification.

Global sales of electric vehicles increased 168%* in the first half of 2021 (to 2.65m units) compared to the same period the prior year. While it must be noted we are comparing this to H1 of 2020, when COVID hit new vehicles sales across the board, nonetheless, the sales of EVs saw a lesser negative impact than total global sales across all engine types.

While this growth varies from market to market, most major markets reached these record EV sales in H1 of 2021. Europe and China led the way with the US lagging slightly behind. EV Volumes predicts that total sales for the full year of 2021 will reach 6.4m, a growth of 98% over 2020, putting a total of 16 million EVs on the road globally.

So, what has driven this and what does the future hold for the EV market, and when will the US catch up with the success stories seen elsewhere?

What are the factors driving this?

Over the past few years, manufacturers have stepped up their game with the range of EVs on offer to cater to the prospective EV consumer. In the US particularly, we’ve seen the launch of large SUVs and trucks, which puts us in a strong position to counteract the relatively slower uptake of smaller passenger EVs.

We can also attribute much of the global growth in adoption to government incentives, either for EV purchases or charger installation, which has made going electric more viable. Incentives have been coupled with legislation targeted at phasing out ICE vehicle sales. Some cities are also introducing bans or additional charges for ICE vehicles, with a view to meeting clean air targets in areas of high traffic density.

What’s holding the US back?

Though more manufacturers are catering for the needs of US drivers in terms of the selection of vehicles on offer, there are availability issues for some larger models of SUV and trucks.

Additionally, range and charging infrastructure are often cited as reasons for consumers shying away from EVs for their next purchase.

When Kalibrate conducted research earlier this year, we found range anxiety to be the number one factor holding back prospective EV buyers. This is understandable in the US given the longer journey taken when compared with, for example, the UK – which, by the way, could fit entirely into the state of Oregon!

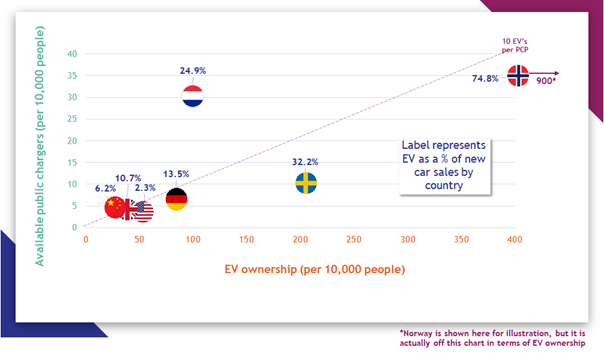

And this range anxiety is not without merit, the deployment of public chargers is struggling to keep pace with the growth in EV sales. A standard set by Europe is to have 1 public charge point (PCP) per 10 EVs. While many key markets are close to this, for most there is still a way to go.

This shows an unprecedented opportunity for businesses with the right offering, alongside their EV charger deployment to capture a significant share of the EV charging market.

Speed of charge was another factor. Consumer habits are tough to break, and the five-minute gas top-up experience is hard to replicate for EV when even the fastest chargers still require a solid 15 minutes to deliver enough juice for any onward journey.

This reveals the need for government and businesses to work side-by-side to grow the charging network to encourage growth.

There is also the question of what facilities are available for the EV driver, creating a compelling destination while their car is charging.

What does this mean for businesses?

Retailers should be looking at all of the above and seeing opportunity. Creating a compelling ancillary offering – such as a great coffee experience, retail offer, or QSR dine-in – could create a more viable ‘EV destination’. For fuel retailers particularly, reimagining how they deliver ‘refueling’ services to the next wave of driver should be central to their plans; as adoption grows, there is no ‘do nothing’ option.

For retailers outside of fuel, we’re seeing grocery operators and hospitality locations stake their claim for their share of the EV driver dollar. Recognizing the value of attracting this affluent consumer segment, many chains are already offering free EV charging to entice additional spend in store.

What steps can we take for 2022?

When working with our clients, we’re usually looking at the existing portfolio to work out which sites would be good candidates for EV deployment. If adoption is growing in the trade area and a site upgrade or reconfiguration is imminent, it makes sense to consider planning for EV chargers now rather than further reformatting in the near future.

Many retailers are still stuck on the business case – and we can help there too. Considerations around conversion from charging to in-store spend can help you attach some potential ROI numbers.

But the consumer offering is complex; you need to truly understand the EV customer segmentation in your trade areas and how it evolves through the adoption curve. Retailers that master when to build, and what experience to deliver, will see the greatest value from their relationships with EV consumers.

As you plan for 2022, reach out to a Kalibrate specialist to discuss how we can help you plan optimally for your EV journey.

* Source EV Volumes

Read more articles about:

Electric VehiclesSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Electric Vehicles

Kalibrate launches EV Pricing solution to transform electric vehicle charging operations

Launching Kalibrate EV Pricing - the intelligent EV pricing software for strategic CPOs

Electric Vehicles

The EV charger pricing challenge

As electric vehicles (EVs) become more prevalent, the task of managing EV charger pricing presents unique challenges...