Financial services location intelligence from Kalibrate

Kalibrate helps banks, credit unions, tax preparation firms, and wealth management providers gain deeper insights to inform real estate decision-making.

- Understand how demographic, psychographic, and firmographic composition impact performance

- Identify opportunities to open new locations

- Maximize profitability through branch optimization when assessing relocations and consolidations

Get in touch today to book a demo at a time that suits you.

Supporting financial service operators

The ongoing evolution of consumer behaviors is changing how customers interact with financial service providers.

Optimize your branch network

The cost of poor performing brick and mortar locations has never been higher. Developing a fact-based foundation is critical to making sound decisions relating to the placement of branches or offices

Strategic M&A for financial institutions

Kalibrate’s analytics help banks and credit unions assess how a prospective acquisition’s footprint will integrate with their existing network to maximize market penetration.

One platform for every department

For clients seeking on-demand access to Kalibrate’s custom solutions or for those interested in having their own analytical sandbox, Kalibrate Location Intelligence (KLI) offers a SOC-certified and highly configurable platform.

Solutions for financial services

Our platforms and services are backed by the extensive industry expertise of the Kalibrate team

Ready to learn more?

Get in touch to start the conversation.

Answer

What types of question are your clients typically trying to answer?

At present, Kalibrate is engaged with a large number of operators seeking bank branch optimization and credit union branch optimization.

Answer

Do I need to sign up to a software contract?

No. Our solutions are design to ‘meet your where you are’. If you’re looking for the answer regarding where to expand, we offer this as a standalone consultancy engagement which delivers a roadmap of markets and potential locations. Other standalone engagements include white space analysis, hotspot analysis, or portfolio optimization.

Answer

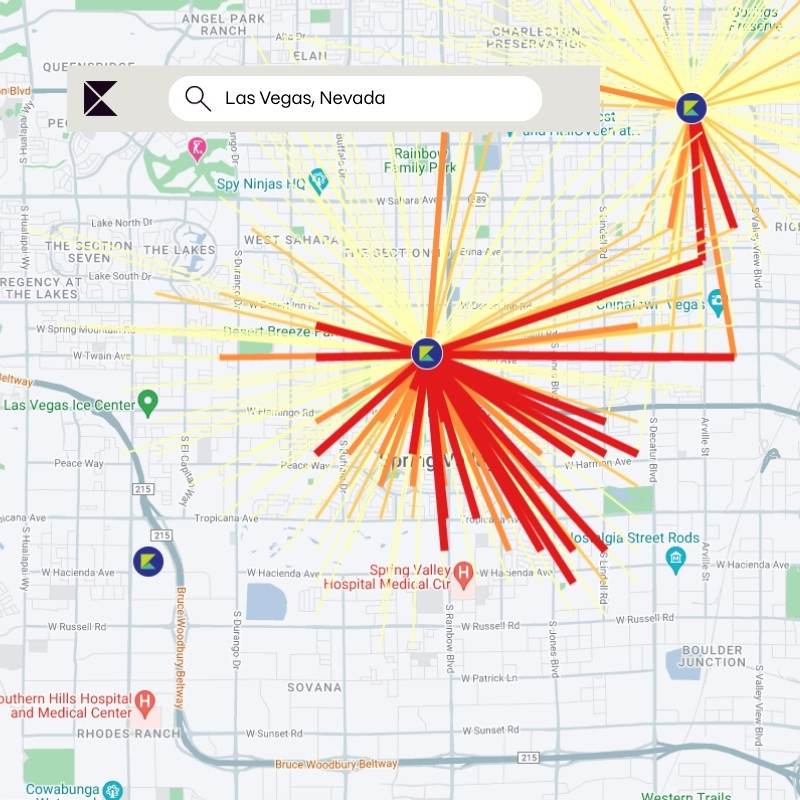

How does data visualization, analytics, and reporting work in the software?

Kalibrate Location Intelligence allows users to view/edit/add any first party data related to your customers, locations, or competitors. Users can run demographic and competitor reports, and create sales forecast reports using models that are developed and integrated for use.

In addition, users can visualize thematic maps, view and report on customer loyalty data, and view and report on mobile/foot traffic data. The platform supports bulk reporting/mapping and has an API for an ongoing transfer of data.

Answer

Can data be imported directly into the platform?

Data can be imported in two ways:

1. End user drag and drop: Microsoft Excel data can be dragged and dropped into the software. As part of this process, data can be automatically geocoded. Once the data is on the map it can be shared with other people in the organization.

2. A secure API can be set up for ongoing uploading and downloading of data.