Location intelligence data and consumer analytics in the banking sector

The banking industry has been at the forefront of shifting consumer preferences and the associated impacts on physical branch deployments for the better part of two decades. In many respects, financial institutions encountered “omnichannel” impacts (e.g., consumers moving to online and app-based banking) earlier than their peers in the retail, grocery, restaurant, and other sectors that are more recently grappling with the role of brick-and-mortar locations in their respective business strategies.

One area where banks have traditionally held a significant advantage over other industries is the presence and accessibility of great customer data and how that can be used to inform data-driven decisions for real estate planning.

In this Q&A session, we’ve asked two senior leaders of our location intelligence business, Dustin Stancil and Kevin King, (both of whom have experience working for banks in market planning capacities) to share their thoughts on the use of consumer analytics and location intelligence data in banking.

Describe the most practical applications of consumer analytics and location intelligence data in banking

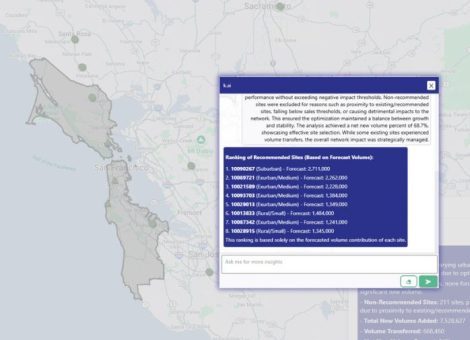

Dustin Stancil: I’d start by saying that banking is not that much different from retail and other sectors in that banks are evaluating local market demographics, conducting detailed customer analysis, etc. However, given the continued shifts that banks are seeing in consumer engagement preference, the main focus of analytics in the banking space is on network optimization and rationalizing their physical branch deployments. Financial institutions need to answer questions like “How can I maximize the number of customers that I serve while minimizing my brick-and-mortar footprint with well-positioned branches?”. Where banking does deviate from other sectors is on the regulatory side – as one example, banks have to be cognizant of what data can be utilized internally to ensure proper coverage within LMI communities from a branch/access standpoint.

Kevin King: I agree with Dustin with respect to the similarities between banking and other sectors that we support. Whether we’re advising clients on branch network planning and/or ATM planning, our custom analytics are predicated on developing detailed insights on the business and consumer customers that banks serve, the distribution of these customer populations within markets, the loan and deposit potential of these populations, and the resultant optimized physical strategy.

There is a lot of rich data to mine and model in banking, making it analogous to healthcare in that regard. Financial institutions have robust first-party data on their customers and the associated loans, deposits, investments, etc. that they possess. In addition, there are numerous third-party datasets that can be leveraged to further understand everything from the loan/deposit levels of competitive branches to the psychographic makeup of consumers through a financial lens.

To what extent do your analytics take different branch types into account?

DS: A common strategy that we see financial institutions employ is utilization of a “hub and spoke” approach. Banks will deploy hub locations that are larger both in terms of square footage and with respect to the service offerings available – think presence of a mortgage banker, loan officers, investment bankers, and tellers that have been trained to do more than just take deposits, etc. Spoke locations may offer specific services based on the consumer profile of trade area households and/or the firmographic profile of trade area businesses. For example, trade areas with a higher proportion of high-tech consumers will see branches with a more significant number of digital offerings while trade areas featuring less tech-savvy consumers will be served by branches with more hands-on tellers and bankers. Other factors that are important considerations to customer experience include evaluating the need for a drive-thru or leaving behind an ATM when closing or relocating a branch. Our analytics can help evaluate both the distribution strategy as well as the format strategy.

There is an incredible amount of consolidation occurring in the banking industry – what role can analytics play in informing prospective acquisitions?

DS: One of the key business questions that our location intelligence offerings are focused on addressing is, “Is this a good opportunity for me to enter a new market?”. The two primary means that a financial institution will utilize to grow it’s physical footprint are organic growth and acquisitions. In the retail world, opening a new store generally provides you with net new customers on Day 1. In the banking sector, new customer acquisition is a much more intensive and expensive undertaking. Banking relationships, both for consumers and businesses, are very sticky – convincing a customer to sever an existing relationship organically is quite difficult. One of the benefits of acquisitive growth is that you’re effectively purchasing an existing book of business and the associated customer relationships.

KK: When our clients are contemplating prospective acquisitions, we are often retained to conduct due diligence analysis on the targeted network. In addition to the custom analytics that we will develop and apply, this process can also involve our team going in market, evaluating current branch locations utilizing a scorecard of relevant, and providing a recommendation as to the resultant impacts that the acquisition might drive. This information becomes a critical input into shaping the investment thesis and ultimate “go/no go” decision.

DS: The diligence analysis that Kevin’s alluded to almost always includes answering questions such as:

- Does the acquisition target’s customer base align with our current or ideal customer type?

- What is the mix of products and services that this customer base is buying, and how does that compare to our current mix?

- Are there further opportunities to optimize the physical footprint of the acquisition target – net new branch/ATM deployments, branch closures, and relocations, etc.?

From my experience in the banking industry, growth via acquisition is both faster and easier than organic expansion.

KK: In instances where we are engaged from a post-acquisition perspective, one of the areas where our work tends to be focused is on evaluating the extent to which our client isn’t oversaturating the market – particularly when there is overlap in the geographic footprint of our client and their acquisition. To Dustin’s point, this process for optimizing the physical distribution of the combined entity commonly involves identifying potential closure candidates. Our post-acquisition analysis is also centered on ensuring that any modifications to the existing brick-and-mortar distribution of the acquired network keep our client in regulatory compliance.

Omnichannel is often talked about in the retail space, but online banking has been a way of life for consumers for some time. How are analytics informing best practices for a bank’s physical and digital strategy?

KK: I would argue that this is the area where most analytics are happening in the banking industry today and will continue to in the future – leveraging data to better understand customer preferences, particularly on the consumer front. Channel usage by consumers has shifted dramatically over the last two decades from a predominantly branch-based interaction to an online-centric relationship. As a result, this shift has also impacted how financial institutions think about growing their consumer base. How you give the consumer the ability to interact with a bank how the consumer wants is the most important thing banks can do now.

DS: When it comes to omnichannel, banks want “low friction” consumers – specifically consumers that will leverage online and app-based banking to facilitate basic transactions. It’s important for banks to transition high-cost customers, those that do all of their transactions in a brick-and-mortar branch location, to increased utilization of online, automated methods. For instance, transferring money between accounts can easily be done online or in an app. We are increasingly being asked to analyze consumer interactions by channel – both to inform real estate-related business questions but also to identify high-cost customers that represent opportunities for conversion to a low-friction banking relationship.

To learn more about how location intelligence works for banks of various sizes and footprints, check out our gold standard approach to site selection or request a meeting with our team to learn more.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...

Location intelligence

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...