The challenge

To benchmark the retailing characteristics and performance of its retail network against premier competitors.

They asked:

- Why are some competitors better than others?

- How can my network be more effective against all competitors?

The solution

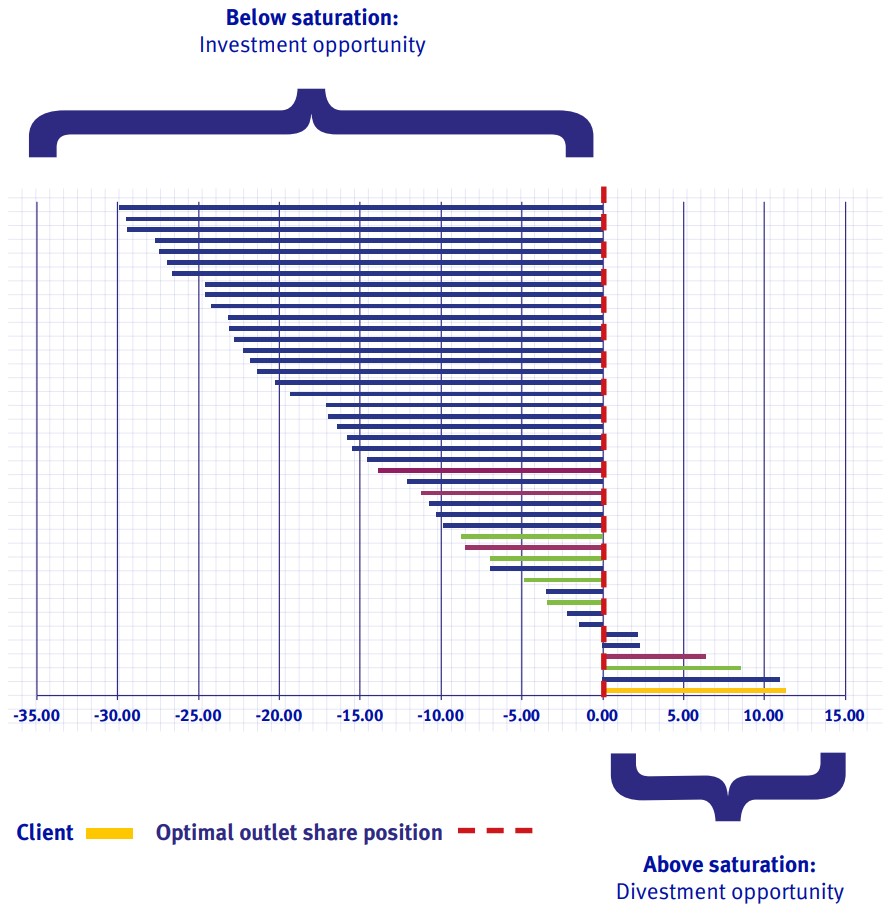

Kalibrate analyzed market intelligence to benchmark the client’s brand, alongside 44 other selected best-practice retailers in Japan, Malaysia, and the US. This analysis was based on Kalibrate’s extensive fuel and convenience retail market surveys. The benchmark analysis yielded a picture of brands’ outlet counts, volume performance, and brand characteristics — such as lot size, fueling positions, and store size.

The outlet share position was plotted for each of the 44 retailers, as compared to the “optimal” outlet share position. The optimal position was defined as the point beyond which a retailer would begin cannibalizing its own network.

The result

The client discovered that it was cannibalizing its retail network at a greater rate than the other retailers. This surprising insight set the client onto a new line of inquiry about strategic improvement. The client said:

The benchmark study helped us look outside the box. In the past, we just compared ourselves against our direct competitors. This study showed us how we performed against leading brands around the globe.

The client gained:

- Ability and confidence to see its strategic possibilities in context with best-practice competitors.

- Insight into a crucial strategic shortcoming that, now visible, could be addressed.

- Knowledge of specific improvement opportunities for their retail network.