C-store changes could decrease revenue in California

It can be hard when opening a store to determine which fuel or c-store brand will be best for your site. Does it pair with your gas brand, does it suit the needs of your trade area, how does it compare to your local competitors, and will it bring you the best returns

Our Single Site Analysis team recently investigated the potential for a new to industry gas station and convenience store location in California. The owner wanted to model the potential profitability of flying the brand of a well-known c-store chain, and compare that to setting up his own independent store.

A full Single Site Analysis was run to discover: Would a well-known brand or an independent c-store yield the most revenue?

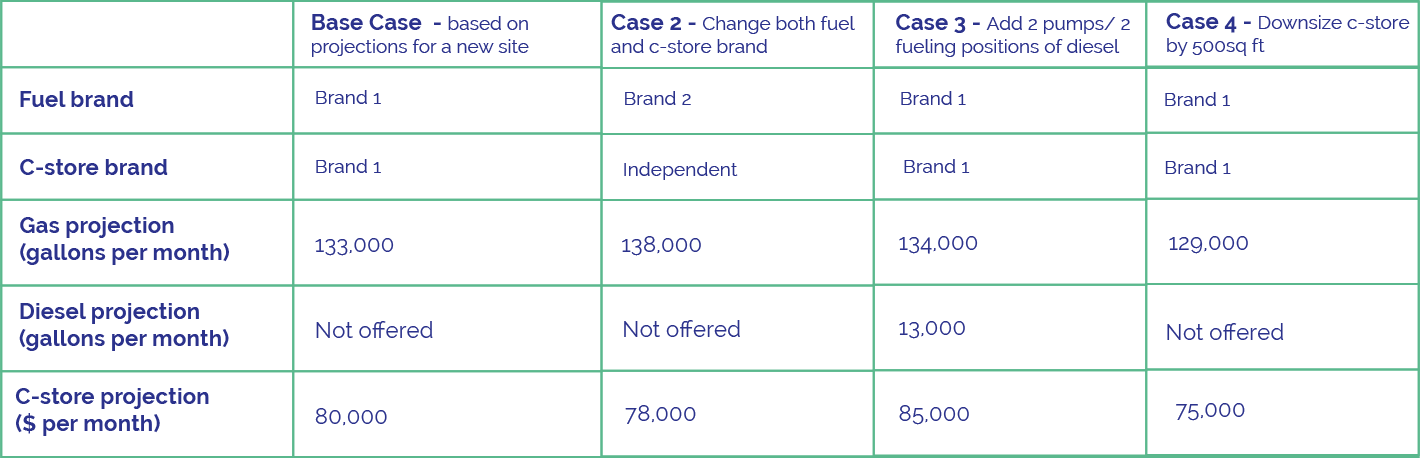

As part of the Single Site Analysis, Kalibrate modeled four different scenarios. Each scenario was discussed with the client and set accordingly. This allowed the client to understand how changing the size of the c-store, number of pumps, and fuel offering would affect the potential return — to identify the combination that would deliver the most revenue.

What did the analysis reveal?

The analysis showed that (in case 2) selecting a different fuel brand for this site could increase gas sales by 4%, resulting in a 5,000 gallon a month increase, but switching to an independent convenience store brand at the same time would result in $2,000 less c-store sales per month in comparison to the base case, and $7,000 less than the highest potential c-store scenario (case 3)

We also projected the impact of introducing diesel to the site with no other changes (case 3), which would increase gas sales by 1%, with a knock-on effect on c-store sales – bringing in an additional 6%.

Lastly, we ran a scenario to understand the impact of downsizing the c-store (case 4), we can see that this would be the least beneficial for the c-store projections with a decrease in sales by 6.25%.

In this case it’s important to review the entire site as a whole and understand how revenue streams from gas sales and convenience stores combine to bring additional profit — learn more about the relationship between fuel and c-store sales here The scenario with the highest fuel volumes is different to the scenario with the highest c-store revenue projection — so the owner needs to understand their expected margins in order to balance the two revenue streams in the most effective way.

Creating this Single Site Analysis helped the owner to establish the best potential scenario for their business. It also helped them understand what size their site needed to be and the facilities they needed to include in the planning process before building to maximize their return on investment, make more profitable decisions and find the best solution for their site.

We can see from this analysis that gut feel isn’t always the correct path to overall site profitability, and looking into various avenues will help you make more informed choices for your business. The Single Site Analysis can provide a full analysis of any sites’ trade area, competition, and customers as a well as fuel and store projections based on your suggested scenarios. Drive better decision making with data.

Request a Single Site Analysis sample today.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

November 2025. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....

Location intelligence

Forman Mills accelerates growth with the Kalibrate Location Intelligence platform

The value apparel and home goods retailer selects Kalibrate to to support its national expansion strategy.