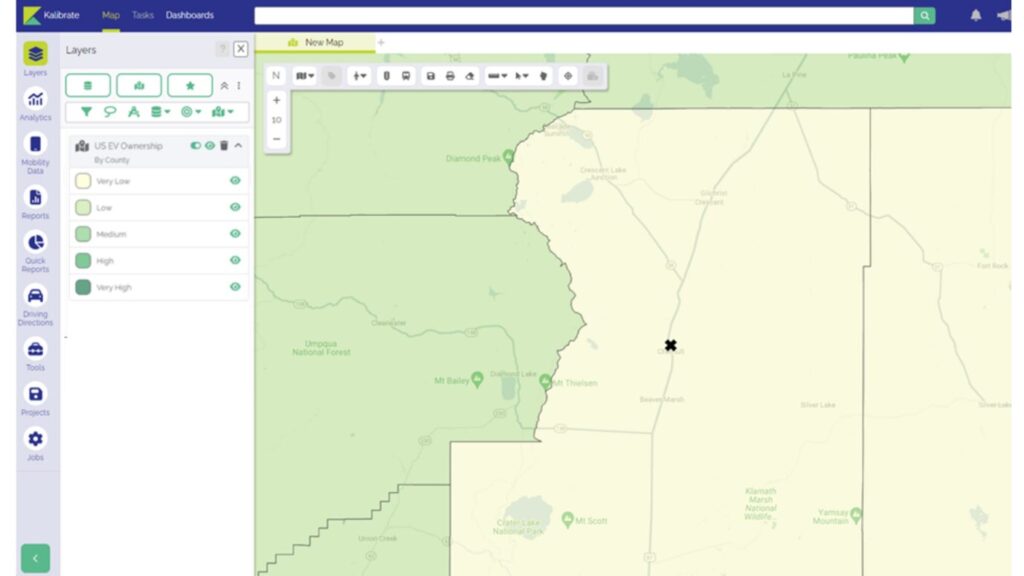

Let’s dive into a study of three gas stations in California and Oregon, utilizing Kalibrate’s data on EV adoption and fuel demand forecasts. We’ll explore how these stations, situated in various types of locations, will see different impacts on fuel demand.

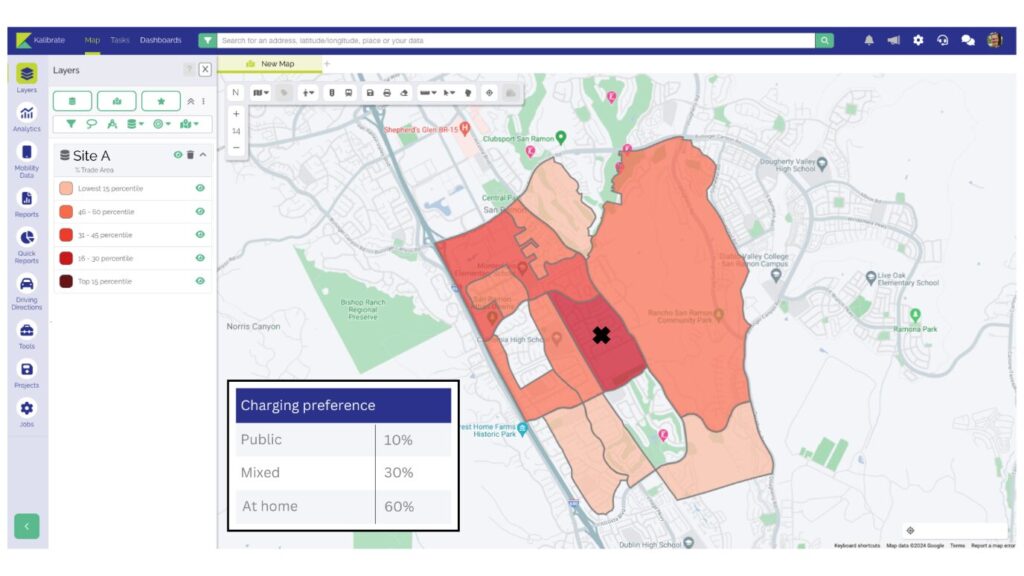

Site A: High EV Adoption in a Residential Area.

Located in central California, Site A is in a region with a high percentage of EV owners. This site might seem like an obvious candidate for adding EV charging stations. However, a closer look at the data reveals crucial insights.

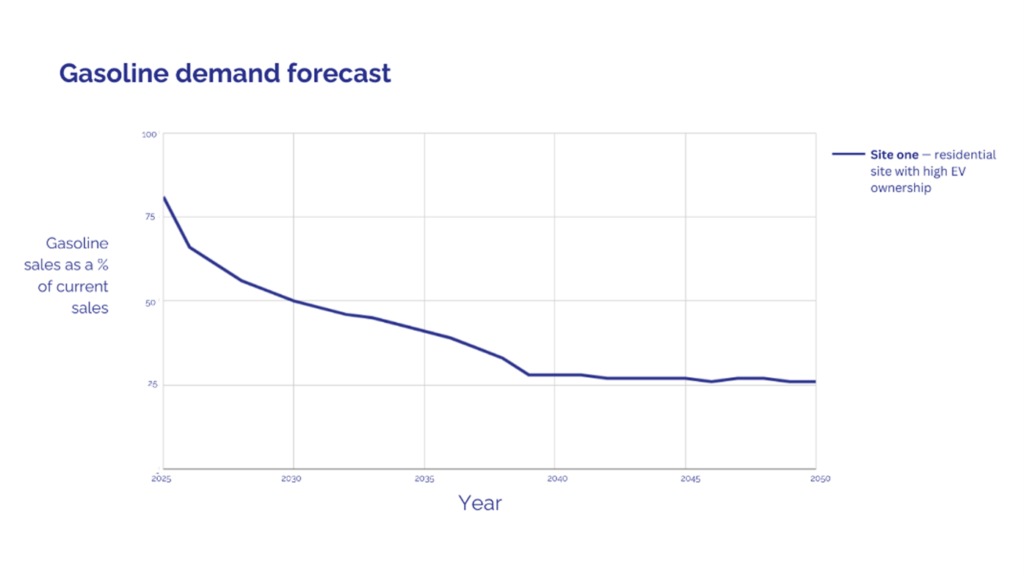

Most customers here are local, living in single-family homes with driveways, allowing them to charge their EVs at home. In fact, 60% of consumers prefer home charging, with only 10% opting for public chargers. Given this, demand for public EV charging at Site A may not be sufficient to sustain the gas station. Gasoline sales are projected to drop to 25-30% of current levels by 2040.

In just 15 years, this site could lose 75% of its fuel volume.

Gas stations are normally on prime real estate, in convenient locations with easy access and high passing traffic. Consider the demographics of your local population and what would best serve their needs to make the most of your real estate. Convenience stores, QSRs, and coffee shops have long been the go-to auxiliary services for gas stations. Could they take over to become the main attraction? Or will we see alternative services take the lead with options like pharmacies, gyms, and beauty offerings gaining in popularity?

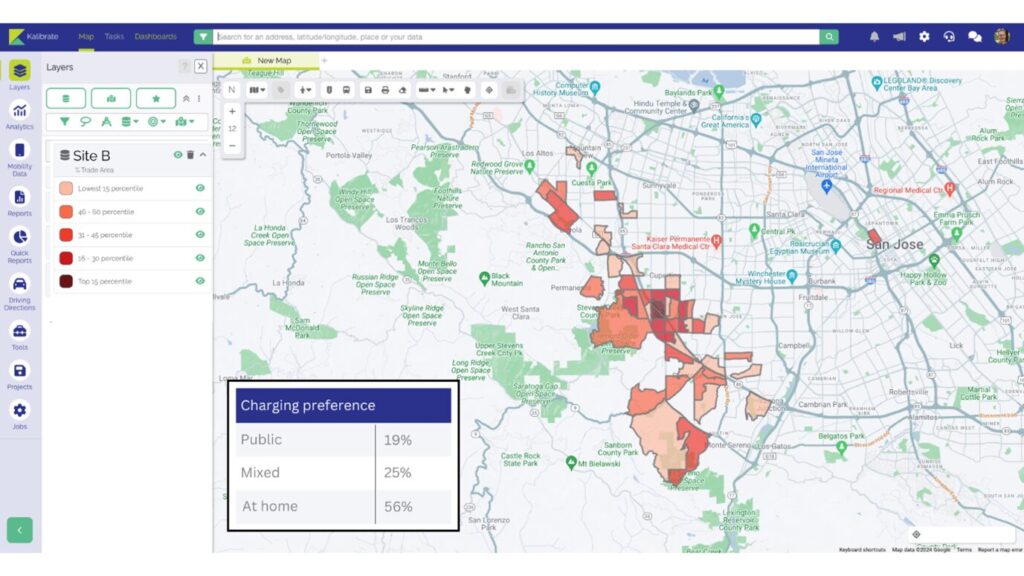

Site B: High EV Adoption in a Transient Area

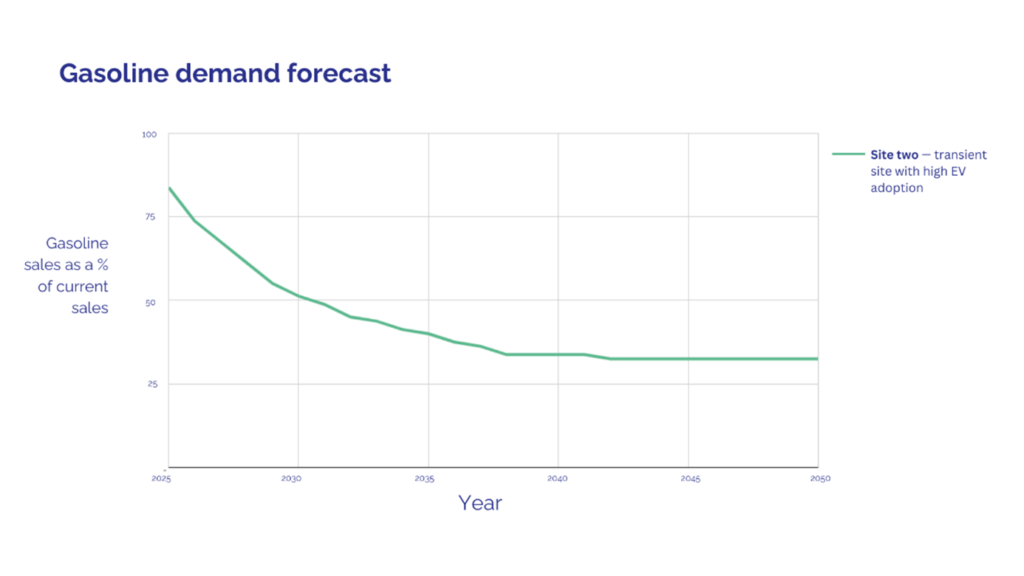

Site B is located on a major highway, serving a transient customer base. While local residents also have a high rate of EV adoption, the majority of customers are stopping by on longer journeys. The area has many early adopters and innovators of EVs, and adoption is expected to grow steadily.

Though many locals prefer home charging, about 30% of the population in the trade area favors public charging. This site, well-placed for those on long journeys needing a charging stop, is forecasted to see gasoline demand drop to 50% by 2030 and 30% by 2037.

Because this site serves a transient population, it remains strategically positioned to cater to passing traffic, whether gasoline or EVs. Maintaining both fuel pumps and EV charging stations while optimizing space for maximum return per square foot is advisable for such locations.

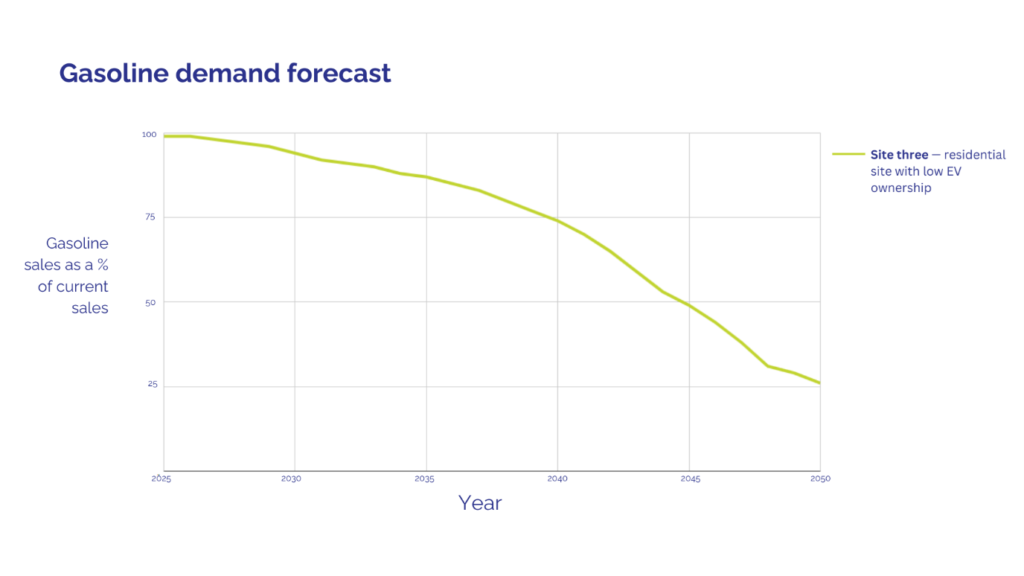

Site C: Low EV Adoption in a Residential Area

The third site is in a region with low EV ownership levels. Despite its proximity to a highway, 70% of its customers are locals. The area is categorized as “late majority” for EV adoption, meaning the transition to EVs will be slow. Gasoline demand is expected to remain high for the next decade, dropping to 75% of current levels by 2040.

Given these characteristics, this gas station will likely remain viable as a traditional fueling station for at least the next 15 years.

Strategic Insights for Gas Station Owners

The future of gas stations varies significantly based on location and customer demographics. Some will continue operating traditionally, some will transition to hybrid models offering both gasoline and EV charging, and others may need to repurpose their prime real estate for different services altogether.

Understanding and analyzing customer behavior and its evolution is crucial for securing a successful future for today’s gas stations.

Want to learn more about using data to drive an effective EV strategy?