Fuel futures: Mastering fuel site investment through data insight

Data, data, everywhere

You probably hear a lot about why you need to use data, how it can help you manage your existing investments, and how it can inform your strategy going forward.

When deciding where to invest to get the most return on your real estate, you need to understand what is going on at a site-specific level. The characteristics of each site, its traffic volume, and demographic make-up. You can only truly realize investment potential when armed with detailed market intelligence.

With data available from as granular a level as local competitor pricing, to as high-level as industry trends, the issue is often managing the wealth of information available. It can be difficult to know where to start.

For independent retailers, time is tight and finding the resources to analyze data is near impossible. Often, “gut-feel” provides a quicker and time-tested approach to more informed decision making. However, to get the most return on real estate, this “gut-feel”, instinctive knowledge should be complemented by data. But where should you begin?

Information exists on a spectrum: from raw data to insight. If you feel like you have enough data to drown in, the trick is getting the right data — and the right level of data — to inform your decision making. You need more than raw data, you need insights. You need data that has been standardized and made sense of. No matter what data you use or how complex the statistical model, untreated data could have serious implications on the accuracy of your retail network decisions.

Fortunately, this doesn’t have to be an overwhelmingly complex task. Market and traffic count data is readily available and readily analyzed, but it’s important to choose the right provider. Finding data experts that won’t baffle you with jargon, but will take the time to recognize the exact information you need, and present it back to you in an understandable way is key.

Blending data with human expertise

Maturity in business teaches us that there isn’t only one way to solve problems and make the tough choices. Science matters when your investments are at stake. Combining emotion, experience and data insight to create a decision-making triangle will help to drive your strategy towards success.

Anila Siraj, Senior VP and Head of Kalibrate Data Strategy

You may baulk a little at the idea of letting data alone drive decisions that are so important to you. It’s true that it’s critically important to know when to let the machine do the analysis, and when to get human insight too.

Artificial intelligence (AI) and machine learning do much of the work that humans can do, often more effectively and certainly with more speed. As sophisticated as these algorithms are though, there always remains pieces of work which would be better carried out by people. These tasks, usually “microwork,” require some kind of human intervention, because they generally involve illogical, emotional, or ethical elements that can’t be made sense of by a machine. Your “gut-feel” is there for a reason: it’s built on experience. You should work with data providers and data experts that understand this, appreciate the importance of having a human element to complement machine learning and can guide you through a process that combines the best of both approaches.

Painting a fuller picture

Whether you’re trying to make your site a destination, make investment decisions around buying or building, or trying to ward off competitive pressure, accurate, up-to-date data about your market and competitors is the only way to understand your environment.

Assessing a fuel site effectively relies on more than just fuel site data. To understand the bigger picture, there are a number of elements to consider. This is not unique to fuel retail, it’s the same kind of data out-of-home (OOH) advertisers, real estate investors, quick service restaurants and convenience stores need — it’s insights into traffic flow, movement patterns, and demographics.

Seeing the total picture of your site will help you make the most informed investment decisions. Retail market data is key to decision-making around real estate, investment, and site selection.

But retail market data is vast and a lack of standardization across providers can make it complicated to read. It’s important to work with a provider that will find and use complementary datasets, above and beyond what the provider itself owns. This saves you time and resource — and the headache — of determining which data you need to inform your decisions, sourcing it and trying to cross-reference it.

Where to start when considering fuel site investment

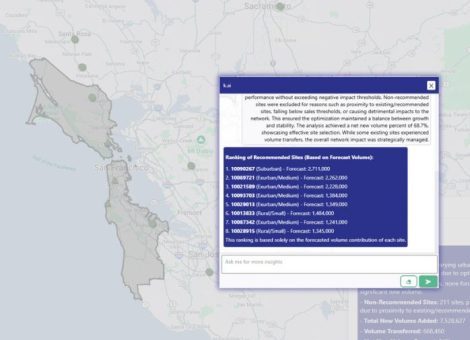

When making specific real-estate decisions, you need to maintain a big-picture view of the market, your place within that market, and the performance of individual sites. How do you ensure you make decisions that will maximize your return on investment?

There are five steps you need to take to make the best use of capital spend on a site by site basis, to improve investment decisions overall:

- Forecast outcomes with a market planning tool

- Identify opportunities for growth

- Determine your goals

- Consider market restrictions

- Avoid cannibalization

You need to understand what the micro-market — or locality — of the site you’re assessing on two levels. You need a bird’s eye view of your volume and sales potential, and you need to understand your competition in more granular detail.

A macro view of your micro-market

There are so many questions that demand answers when considering fuel site investment. Whether you’re building a new site or updating an existing one, you need to make informed decisions around issues like store size, number of pumps, which brand you will fly, fuel pricing strategies, and your convenience offer.

There’s a lot to think about, but arguably the most important consideration is understanding your volume potential and the margins you can expect. To take this first step, you need to assess the demand in the area you’re serving and consider it against the number of sites within that area. Is the market underserved? In which case, you can predict you’ll enjoy a high volume. Or is it already saturated? In which case you may want to rethink your investment strategy.

A closer look at the competition

Once you have established that your micro-market can tolerate and will utilize another site, you can dive into more granular detail around competitive offerings and start to understand where to set your value proposition.

Every site offers unique possibilities. A large part of understanding the potential of your site is understanding the possibilities available to you thanks to your competitors’ weaknesses. Gather information on competitor fuel and convenience store offerings and overall value propositions. If there are very similar value propositions to yours out there, you need to rethink your strategy and reassess where your competitive edge might come from. In this day and age, you should aspire to make the convenience store a destination, and there are an increasing number of possibilities to make your offer stand out, from laundry services, to branded fast food.

To carry out a thorough competitor assessment, you should obtain a market share overview to understand how you are positioned against competing brands in terms of market share, site share, and market effectiveness. You should then obtain a competitive landscape overview and benchmark for your site, to provide you with an indication of performance potential.

This might sound complicated, but by working with a provider that has expertise in both fuel and convenience retail, and data science — it is very achievable. It’s a process that an experienced provider will be able to guide you through, and one that can create a very digestible, easy to read output, when the information is presented to you properly. Don’t let your data provider blind you with data science, look for a partner that will make things clear.

Buy or build? Understanding site strengths

A potential new location will fall into one of two categories:

- New to industry opportunities — or green-field opportunities — are locations where a service station has never existed before. Ideally, locations that have high traffic, high demographic demand, and low competitor activity.

- New to business opportunities are sites that already exist in the market but are owned or leased by another company. There are clearly advantages to acquiring sites that are already operating, such as circumventing the delays to obtain the necessary planning approvals and licensing.

Fuel site analysis: if you buy…

If you decide to pursue a new to business opportunity, you should first understand the site’s performance, and its potential. You need to understand the gap between where the site is now, and where it could be. A site can typically be categorized in one of four ways:

- High Potential/High Performance: star sites. Those that are performing as expected. This doesn’t mean they can’t improve — there is always room for improvement.

- High Potential/Low Performance: sites that are under-performing their potential and offer opportunities to increase volumes/revenues through various capital and non-capital interventions.

- Low Potential/High Performance: sites that are over-achieving their potential, possibly because they have no competitors nearby or have a far superior offer.

- Low potential/Low Performance: sites that are situated on poor real estate, with poor prospects for volume growth without significant investment.

Once you’ve determined the category your site falls into, you can test out different scenarios, based on the unique characteristics, traffic flows, and demographics of that site, to understand the best way forward. This is where data-based decision making becomes not only incredibly important, but really the only feasible route.

Fuel site analysis: if you build…

It’s important to look ahead. Successful retailers ask themselves “what if?” and consider everything that might happen, as well as the situation as it stands.

You need to be able to anticipate how different scenarios would impact the site. For example, what if a competitor opened up around the corner? How would that impact traffic volume?

In the absence of a crystal ball, considering the impact on your own site needs to be driven by data to ensure true accuracy and avoid cannibalization. Processing the data needed to test multiple “what if” scenarios requires purpose built algorithms, machine learning, and AI techniques to forecast potential performance accurately.

The role of fuel market intelligence

While experienced retailers often develop a sense for such things, with so much at stake, relying on your gut alone doesn’t make good business sense. And with such robust, accurate data available today, it makes no sense not to consult the market intelligence.

If your focus is wrong, you could be limiting performance, or even giving up margin. Accurate, up-to-date data about your market is the only way to understand your environment and realize your potential.

You need robust input to generate the most informed output and educated decisions. The type of information that is most useful is quantitative data about your site’s strengths and weaknesses, and how they compare to those of the competition.

Considering the forecourt alone, you need to know how many pumps or fueling positions are needed, how many parking spaces you need, and how big the store should be — and all these questions need to be answered with competitor comparison in mind.

When it comes to proving the projections and value of a given site, data is more important than ever. Perhaps your investors are asking for a feasibility study before agreeing to a loan, or a major wants to see the volume the site will yield before agreeing to brand the site. In these cases, data over gut is critical: you need to be able to provide facts.

Taking a holistic approach

There is, of course, much more to site optimization than footfall. You need to consider the 7 Elements for Fuel and Convenience Retail Success to make sure your investment — whether in a new or existing site — is spent as well as it could be.

These comprise of location, market, brand, facilities, merchandising, price, and operations. Within each of these elements, there is more information to be found that can be processed to predict your site’s outcome, and a number of questions you should seek to answer in order to draw that information out.

Look closely in particular at the market — are you in tune with the competitive environment in your locality? Are you aware of and prepared for any changes that might impact the market? Is your price position at the right level? Look at your operations, is everything running as smoothly as it can? Are there efficiencies to be gained?

Understanding the opportunity: Traffic data

There are many reasons you might need to understand traffic volume and movement patterns in a local area. You might want to evaluate the percentage of traffic you’re pulling off the road at an existing site, or you might want to understand the available volume at a new site.

Traffic volume and movement patterns are obviously a major factor in a site’s success and reliable projections can only be made using current, comprehensive data. Gone are the days of relying on city, state, and national organizations to pull together information — a lengthy process that often led to businesses making decisions based on out of date or incomplete data. Now, retailers can access field-verified average annual daily traffic (AADT) counts that take data from multiple sources, standardize it, and present it comprehensively.

In areas where current traffic count information is not available, artificial intelligence and machine learning methodologies can be applied to forecasting techniques to enrich data and create accurate projections. Research indicates that different factors influence traffic volume on different types of roads — urban or rural — so data should be classified with this in mind too. Again, this sophistication of site analysis and forecasting is critical to mastering fuel site investment and is only achieved through the application of data science.

Understanding the customer: Demographic data

Of course, it’s not all about your fuel retail offer, you need to go beyond the gasoline and select your adjacent offerings to ensure your site is reaching its true potential. Once you understand the broader picture in terms of traffic patterns and movement, you need to start to drill into more specific data on your customer. This is especially useful in informing your convenience store strategy.

Today, you can — and should — get to know your customer intimately. Demographic data should play heavily into your convenience retail strategy.

The basis of a robust, successful convenience offer comes down to… well, convenience. Your convenience offering needs to be tailored to the unique needs of your demographic. Convenience is constantly changing and subject to wider consumer trends. Take for example the move towards healthier foods, “traditional” forecourt offerings just don’t cut it any more. It’s all about creating a destination. Fuel sites no longer have to be simply functional.

Best-practice retailers use technology to sharpen customer-focused marketing and pricing tactics, and to gather and analyze data to better understand potential. Purchase data has revitalized the loyalty programs of many retailers, creating intimate customer knowledge and enabling tailored promotions, higher conversion rates, and increased profits.

It’s important to periodically check whether you are still offering what your customer wants. Convenience is about what’s convenient for them, which changes over time.

Data-powered decision making

Ultimately, what data does for fuel site investment is minimize risk. It ensures decision making is grounded in reality so that projections that can be relied on. There are a huge amount of variables to consider when assessing a fuel site for investment.

Fortunately, there is a huge amount of data available to base your assessment on, and proven artificial intelligence and machine learning techniques that will forecast fuel volume and retail convenience store revenue precisely — and human expertise that can translate data into insights that are useful to your specific situation.

To generate accurate volume projections, the micro market around your site should be analyzed in the context of traffic data, consumer buying patterns, neighborhood demographics, and local competitor strengths and weaknesses.

Basing decisions on data and gleaning insights from robust information is the only way to ensure truly unbiased, valid forecasting of fuel volume and convenience store revenue, to really propel your ROI and improve performance across your real estate.

Finding the right provider is important. What can seem like a daunting task doesn’t have to be. There might be vast amounts of data out there, but a good provider will distill it to what’s right for your site and your situation, and present clear information back in an easy to understand report. This turnkey approach makes sure you make the most of your investments – informed by your instinct and their data insights.

Read more articles about:

Location intelligenceYour fuel market has been newly deregulated - what now?

It’s a time of great uncertainty for incumbent fuel retailers, and opportunity for those retailers with ample network planning experience, processes and solutions.

Related posts

Location intelligence

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...

Location intelligence

Five burger companies, five problems

These burger brands had challenges from international growth to understanding franchise locations cannibalization,...