Your fuel market has been newly deregulated - what now?

Your fuel market has deregulated. Now what? It’s a time of great uncertainty for incumbent fuel retailers, and opportunity for those retailers with ample network planning experience, processes and solutions. Whatever drives deregulation, whether it’s partial or complete, there are a vast number of variables and considerations to take into account when devising a strategy to compete in a changing and often unpredictable landscape.

Taking it to the extreme: deregulation in Mexico

Let’s take a look at an extreme example, to examine what could happen. The market in Mexico fully deregulated in 2016 as part of Mexico’s broader energy reform strategy, intended to stimulate private investment. It certainly seems to be working.

Previously, Pemex was the only retail fuel brand in Mexico. While this national oil company didn’t own or operate retail fuel sites in Mexico, all fuel retailers had supply agreements with Pemex and therefore had to display the Pemex brand on their canopy, pumps, employee uniforms, etc.. With deregulation, multiple foreign majors entered the market. As the government had expected, of course.

But what does this mean for incumbent sites? The independent retailers flying the Pemex flag? These less sophisticated retailers would struggle to compete against the highly developed marketing and sheer financial strength of major foreign fuel. The level of competition has shifted.

And while it’s impossible to pinpoint just one thing that incumbent retailers should do or consider when their market deregulates – understanding the sophistication of the new competition is possibly the most important thing.

In Mexico, convenience retail has transformed. One of the key strengths of the foreign brands investing in the region lies in their brand and convenience offerings, and sites still carrying the Pemex brand are struggling to compete with the new-to-Mexico fuel brands.

Since Mexico deregulated, more than 2,000 of its 13,000 sites have rebranded from Pemex to well known foreign players. That’s often the first step in a newly deregulated market – foreign acquisition, testing the water to understand demand.

In the early stages of deregulation, foreign retailers took notice of how well BP’s first rebranded site in Mexico City was performing. That likely accelerated their rebranding, acquisition and market entry plans. With more aggressive plans in place, these foreign retailers formed agreements with local suppliers in order to expand cookie cutter-style.

Incumbent fuel retailers, lacking experience in this relatively sophisticated environment, have limited choices. Either divest, or associate and operate as a franchisee, aligning to the big player’s SOPs, expected volume thresholds and all the other elements that come with operating under a big brand name. Or struggle to mitigate losses by lowering fuel prices or improving service.

Consider how aggressively foreign firms are entering the market. Whether they allow franchisees to retain elements of control, how much equity they offer. Incumbent retailers need to think carefully about how they could obtain maximum value.

This rapid expansion of foreign firms within the Mexican market is rare. Perhaps unique. Since it deregulated, about 15% of sites have been rebranded. Most countries deregulate more slowly, or with restrictions in place, and without the same aggression.

A less aggressive approach: deregulation in India

The Indian government took a more conservative approach to deregulation. Necessarily so. Clearly, deregulation has huge political and economic implications, and a big concern in India was protecting employment among government run energy companies. As is more typical, foreign investment has been slower to come in and things are changing more gradually.

Establishing a strategy to compete

So, how do relatively inexperienced local retailers compete with the sophistication of an international oil company?

You have to understand their strengths. Kalibrate’s 7 Elements model quantifies and qualifies brands and sites by market, location, facilities, operations, merchandising, brand, and price. Big players tend to perform well in merchandising and facilities. Less sophisticated or smaller retailers end up needing to develop a unique value proposition that sets their brand apart: fuel messaging, deciding which c-store brand to fly.

Understanding the competition is key. If they’re strong in facilities, change your facility investment strategy. If they’re keeping the same facilities but pricing aggressively, address your pricing strategy. Reassess your strategy wherever you find yourself at a disadvantage. Most likely, brand strength will be the first area to consider. Followed by facilities, then merchandising, then operations.

Avoiding a race to the bottom of the barrel

When a market deregulates, price is often the easiest thing to alter. Building a convenience store is costly, dropping the forecourt price is quick and dirty. We strongly counsel against this. If you simply lower price, you are essentially buying volume but wasting your margin. If you don’t have another source of revenue on site – you lose fuel margin without gaining it elsewhere. It’s not sustainable. Depending on the composition of the market, sites start to close as fuel margins become too small.

In a price war nobody wins. Everyone loses margin. Retailers should seek alternative routes to differentiation: develop a better offering to attract consumers to their locations.

Final thoughts

In a newly deregulated market, there are a lot of new things to understand, which can vary according to the type and speed of deregulation and the aggression of foreign investors. A lot to think about, certainly, but the most important thing is understanding the tsunami of competition changes coming your way. If you understand your competition, you understand how to react and build a more sensible strategy for these changing environment.

_ _ _ _

To learn more about competing in a newly deregulated fuel market, download Kalibrate’s Deregulation Playbook.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

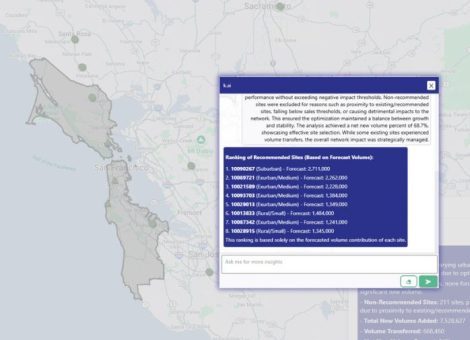

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...

Location intelligence

Five burger companies, five problems

These burger brands had challenges from international growth to understanding franchise locations cannibalization,...