Fuel futures: Price optimization

How price optimization leads to fuel success

By pricing optimally, you’ll compete in your market regardless of its maturity stage, its current volatility, or your competitors’ tactics. You’ll achieve your fuel objectives by adapting whenever and however necessary, without compromising your overall profitability.

For example, you might be looking to increase margin while maintaining current volume, or perhaps you’re aiming for increased margin and increased volume. Price optimization will give you the flexibility to do either.

If you’re operating in an immature or stable market, price optimization may not apply to you at this very moment, but the need for flexibility will emerge once your market does start to mature and deregulate – especially the more volatile it gets.

Why pricing optimally is now more complicated than ever

We all recognize optimization as the process of continuous improvement, but in the context of fuel pricing, optimization is fundamentally a mathematical process, focused on making measured trade-offs within the parameters of your goals. Here are two example scenarios:

- Your target volume is X, but you aren’t selling as much fuel as you forecasted because your price is too high. However, you know that your minimum margin is Y, so you drop your price just above that. In plain terms, you’re trading off margin for volume.

- You need to achieve higher margin, so you raise your prices despite the potential decrease in volume. You’re trading off volume for margin.

Those are simple examples, though. Modern optimization scenarios are more nuanced than simply trading off volume for margin or vice versa.

Fuel pricing and modern technology

Fuel price optimization is a complex subject, both a science and an art, and the process is constantly evolving – partly due to market volatility and uncontrollable external factors, and partly due to the increasing sophistication of technology and its application across the fuel market.

Today’s proliferation of data, in particular, means that pricing your fuel optimally is now more important than ever before, because all of your competitors will be optimizing their prices to help them reach their goals. Surviving in such a market requires a competitive edge.

On top of that, fuel success is largely about capitalizing on short-term gains – identifying the opportunities and taking advantage of them while you can, often within just a few hours. But identifying those opportunities quickly enough, let alone grabbing them, is impossible without advanced fuel pricing software.

Modern fuel price optimization relies on artificial intelligence (AI) and the automation of certain processes, which we cover in more detail further down.

First, let’s outline the fundamentals of optimal pricing in today’s complex environment.

The 4 basic principles of fuel price optimization

Monitoring and reacting to competitors’ prices

Knowing your competitors and keeping an eye on their pricing activity is essential. In volatile markets, competitor prices can fluctuate dozens of times per day, so you must be able to keep up with the changes and adjust your own prices at the required speed – which is where automation and machine learning come in.

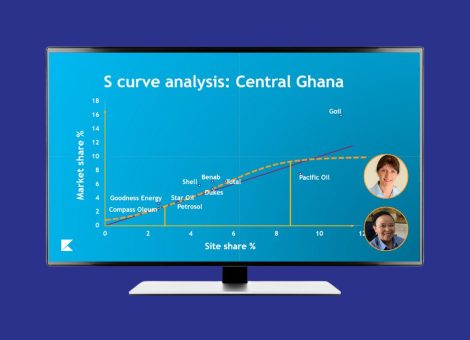

There’s an important point to be made here about also taking the time to consider and regularly re-evaluate who your true competitors are. Geographic proximity doesn’t necessarily make another site or retailer a direct competitor – at least not one that you should measure your own strategy against. Take time to analyze all of the fuel retailers in the given area, because this gives you a fuller, far more accurate view of which sites and brands you’re really competing against.

Crucially, however, delivering on your strategy means not only being in a position to react to external events – such as competitor price changes, market events, and demand disruptions – but also being able to proactively approach your pricing, using your market position or your brand strength to make changes that positively impact your performance.

Assessing your margin capabilities

Keeping an eye on each product’s potential for margin is fundamental to profitable pricing, especially as margins fluctuate all the time, often spiking and dipping at a moment’s notice, but sometimes following the same trajectory for a prolonged period of time.

Your margin potential will depend on your most recent product costs, so the latter must feed into your pricing strategy and be updated regularly.

Tracking your volume performance

Your forecasted volumes are calculated from the pricing rules you have in place, so when you compare those forecasts to your actual sales volumes, you see exactly how effective your current pricing rules are – and whether they ought to change.

The closer your track volume performance, the better informed you’ll be to make optimal adjustments at the right times.

Aligning your prices with brand image, product strategy, and site strategy

There is more to price optimization than meeting volume or margin targets and competing with rivals.

You should always ensure that the fuel prices you’re proposing are right for your overall brand and the position you’re striving for in the market. If you start to price too low or too high, consumers will notice and this may change their perception of your brand, which may affect brand loyalty.

On top of that, your prices must align with product strategy and individual site strategy.

So there is a lot to consider, and it’s a fine balancing act.

Why high-quality data is key to optimal pricing

Without current, clean, comprehensive data feeding into your pricing platform, you can’t make fully informed pricing decisions.

Visibility on competitors’ pricing is vital, but you also need a full record of your own prices:

- Current and historical

- Volumes sold at those prices

- Product costs

Those are the bare minimum data points.

If possible, you should also have the following information for each site:

- Forecasted volumes

- Sales volumes

- Delivery volumes

- Historical price requests and approvals

- Wet stock volume

Deep geographic understanding across your network is equally invaluable, because it gives you the context needed to truly understand the strengths, weaknesses, opportunities, and threats of every single site in your network. Start with the following data points:

- Location

- Local demographics

- Traffic

- Nearby competitor sites

- Market share

- Recurring events in the area

- One-off events in the area

All of that said, data isn’t automatically useful to you, especially if it’s raw. Focusing too much on some data points – and not focusing enough on others – can be counterproductive, resulting in fogginess rather than clarity.

You need to establish which data points are most relevant and useful (across your network and on an individual site basis), and concentrate on those. Your aim should be to find the sweet spot.

Data missingness and smart imputation

The data-driven approach requires you to gather and monitor information both internally (your own historical and network data) and externally (competitor and market data). Ideally, you’ll repeat the data-gathering process several times each day, depending on your market’s maturity phase and general volatility. Unfortunately, external data can be inconsistent in its depth and freshness – resulting in what we call data missingness.

Data missingness makes price optimization more difficult and can’t guarantee accuracy. There’s also no way around it – unless you have the right software.

A worthwhile pricing platform will gauge data missingness, let you know, and then plug the gaps for you via smart imputation – inferring certain values based on the local market, seasonal trends, market volatility, and other historical data.

The role of machine learning and deep learning in price optimization

The uprooting of manual pricing

Technological innovation and data abundance have put an end to manual pricing – by which we mean the process of creating and using internal spreadsheets, updating them manually, and using them to price by instinct.

It’s true that modern price optimization does still require human input, but the mathematical processes, the recommendations, and some of the actions are now automated for the analysts by sophisticated software, i.e. artificial intelligence. This fast automation means that there are now more types of data available than ever before – giving retailers a fuller view of the market and their place in it.

AI is here to stay in fuel pricing, and there are two key types of AI that apply to the practice:

- Machine learning

- Deep learning

They might sound like the same thing, and they are directly linked, but they need to be understood separately. Deep learning is a labyrinthine facet of machine learning, providing a distinct benefit, as we explain below.

Machine learning

Broadly speaking, machine learning is the processing of data to make mathematical connections and take certain actions as a result of them. A mathematician would be able to visualize these connections if they were to sit down and take the time to do so. The beauty of machine learning, of course, is that it does the number-crunching infinitely more quickly than people can, enabling faster, sharper decision-making. As time goes on, it learns from the results you achieve, comparing your predicted outcomes against the actual outcomes, and then modifies future predictions accordingly – continuously striving to further refine them.

This is why machine learning has become an essential part of fuel pricing. Retailers can apply it to continually review and adjust pricing at the required speed, according to whatever relevant criteria (data points) they choose.

The more relevant data points you have feeding into your pricing strategy – such as weather, local traffic patterns, and nearby sports venues – the more context you’ll have to respond correctly. Put simply, you’ll know whether or not changing price is the right course of action in any given situation.

Deep learning

Where most of machine learning is about quantitative logic, deep learning is more about qualitative understanding.

Machine learning understands the intrinsic relationships between the common factors that influence short-term demand (chiefly prices, volumes, and costs). Deep learning, on the other hand, takes into account the far more nuanced factors that affect longer-term demand changes, such as weather conditions, traffic patterns, and economic situations.

As such, deep learning mimics the complexity of the human brain, creating artificial neural networks that can interpret the relationships between different data points – and then making accurate predictions off the back of those. It makes connections that humans cannot define or label.

This inexplicable complexity is what makes deep learning such an exciting prospect for fuel retailers.

When the two combine

Machine learning and deep learning are most effective when they work in tandem, with the right balance between the two.

This balance will depend largely on your market maturity phase. For example, if you’re operating in a highly volatile, deregulated market, you’ll see constant pricing fluctuations day to day, sometimes hour to hour.

Crucially, successful use of machine learning and deep learning also requires human-based computation. Algorithms provide dynamic predictive intelligence, and they’re forever evolving in complexity, but AI doesn’t yet have the industry context and intricate understanding that an experienced pricing professional has. There are certain emotional and ethical decisions that the machines will still need to outsource to humans for some time yet.

Market volatility and how it affects pricing strategy

For retailers in mature or maturing markets, market volatility presents a significant, unavoidable challenge. The more volatile a market is, the more often its fuel prices tend to change, so all retailers need to keep up.

If you can’t react quickly enough to the market’s price changes – or you aren’t equipped to react wisely to them – you risk being left behind, losing out on volume and failing to maximize margin.

At the same time, you should avoid becoming a price follower who blindly responds to everybody else’s changes just to be doing something. You can only achieve this vantage point if you have deep understanding of demand and how it feeds into market volatility.

Fuel market volatility is influenced by several key factors – both microeconomic and macroeconomic – and any or all of them can be at work simultaneously.

Microeconomic influences

First, let’s take a look at the causes that stem from people and retailers within the fuel industry.

Competitors’ pricing activity and strategy

When one retailer changes their prices, its competitors tend to follow instinctively in order to avoid differentiation.

Now, why would that first retailer decide to change price to begin with? It’s often triggered by the idea of daily demand periods – the perceived spikes and dips in fuel demand over the course of a given day – and capitalizing on them by either raising or lowering prices.

Although it is true that demand fluctuates throughout the day, many retailers change their prices simply based on intuition rather than fact-based analysis, often creating and leading a needless volatility cycle that everyone else instinctively follows.

This is, again, why it’s so important to know who your true competitors are at any given time – while also identifying the red herrings. By adjusting your pricing strategy in accordance to irrelevant retailers, you may end up sacrificing margin needlessly.

Your own pricing activity

Just like all other retailers, your actions can also make the market more volatile.

But there is nothing to be gained from purposely stimulating volatility in your market, apart from very short-term gain (if any).

For example, if you decide to drop your prices in an effort to drive high volume over a short space of time, you might enjoy a momentary uplift while the rest of the market catches up – but that would be it.

Similarly, pushing your prices up would have a similar effect but in reverse: you might capitalize on margin while everybody else’s prices are still low, but that won’t be for very long, and then the whole market will be left inflated.

In the age of AI and the automatic price changes it enables, volatility opportunism is largely a waste of time.

Macroeconomic influences

Then there are factors that are out of retailers’ control, some of which cause mild inconvenience, whereas others can lead to temporary industry standstill.

- Unfortunate industry events such as refinery outages and oil spills, the latter of which might prompt a brand to lower its prices for PR purposes, resulting in the rest of the market then lowering theirs in order to remain competitive

- Geopolitical crises and any supply disruptions that come as a result

- States of emergency initiating protectionist measures that restrict or prohibit price changes to prevent consumers from being exploited

- Disruptive weather – but only if it leads to one or all of the following:

- A state of emergency

- Disruption in the oil supply chain

- Increased consumer demand

Evaluating your own contribution to market volatility

To measure how your pricing activity is impacting market volatility, look at what you’re achieving when you adjust your fuel prices.

Is it resulting in better overall performance?

Whenever you drop your prices, does this tend to increase volumes to the levels you expect? Maybe you’ve actually experienced a drop in volume, or triggered a downward pricing spiral among yourself and your competitors. Or perhaps there’s been no perceivable change whatsoever.

When you raise your prices, does margin enjoy a comparative boost? How much volume does it lose you? Do you gain as much margin as your competitors?

Regular self-evaluation will keep you focused on what’s important: making measured adjustments that have positive impacts.

The need for agility

High-quality data is an essential ingredient for shrewd price optimization, but if you can’t act on it quickly enough, you’ll be limited in what you can achieve.

To capitalize on pricing opportunities in today’s fast, ever-evolving fuel market, you need a dynamic predictive modeling system that automatically generates the pricing insights required to make the right decisions at the right times.

In highly volatile markets such as Australia and Germany, and in mature markets such as the US, Canada, and the majority of European countries, agile pricing is already a prerequisite for fuel success. In maturing markets such as India, China, Mexico, Brazil, and Argentina, the need for agility is becoming increasingly apparent as the leading retailers are investing in AI-powered pricing platforms.

Agility isn’t wholly reliant on technology, however. Experienced, knowledgeable pricing staff can ensure consistency and stability across your pricing operations.

The recipe for optimal fuel pricing

Be clear on your overall strategy

Price optimization is a way to meet your business goals – which should always come first – so bear that in mind.

Capitalize on all of the available relevant data

Not all data points relevant to your strategy, and not all data is of sufficient quality. Find the relevant data points, and use smart imputation to fill the gaps.

Try out new strategies

If you don’t dip your toe in the water, you’ll never find new, better approaches to pricing.

Have patience, and always measure

Success isn’t always immediate, so given each new tactic time, and make sure you measure everything.

Continuously monitor and evaluate performance to learn and adapt

Once you’ve tweaked your pricing strategy, or implemented a new strategy altogether, here’s how to gauge how well it’s working.

Ultimately, you have to view price optimization as a never-ending process. It’ll never be done, and there will always be ways to improve further.

Read more articles about:

Fuel pricingHow much is your fuel pricing costing?

If you’ve not examined your company's pricing processes for a while, it’s critical to do so now — because the fight for volume is about to get harder.

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...