Why agility is the key to a successful fuel pricing strategy in 2019 and beyond

In the ever-evolving fuel industry, pricing analysts must remain both vigilant and responsive — especially in the coming years.

Though the oil and gas industry saw a slightly uncharacteristic lull in 2018, the stage has been set for a more mercurial market in 2019 and beyond. Mergers and acquisitions will continue at a robust pace, automated and electric vehicles will remain a player in fuel demand, and new technology will give pricing managers and location planners the ability to make more complex and strategic decisions.

For all these reasons, agility is — and will continue to be — key to maintaining a successful fuel pricing strategy and sustainable business model in the future. But before we get into the tools and tactics required for a more agile fuel pricing strategy, let’s dive into some of the forces driving this need in the first place.

The Fuel Market in Flux: Disruptive Tech & Major Mergers

The ongoing evolution of the fuel market is twofold:

- Advanced technology is changing the way we price, plan, and make predictions for the future.

- Merger and acquisition activity is shaking up markets we thought we’d already mastered.

Less than a decade ago, the ability to get your hands-on competitive information was limited. Now, however, competitor data is available in much larger quantities on a more regular basis. Obviously, the faster you can consume this data — whether it’s through a government-regulated source in Europe or via OPIS in the United States — the faster you can react to that information.

And when you plug the immense amount of up-to-date market information into a dynamic, predictive modeling tool, you have the catalyst for a highly competitive, fast-moving market. Pricing managers and analysts no longer have to rely on slow, manual data collection in the field. They now have tools at their disposal to quickly access that information, draw on various reporting functionalities to gain a bird’s-eye view of the market landscape, and build mature, proactive fuel pricing strategies around it.

Simultaneously, as fuel retail companies continue to grow through mergers and acquisitions, they’re growing into adjacent markets that they may not have operated in previously. Pricing analysts who have decades of experience in a specific market now have to learn the trends and triggers of entirely new markets. With new leaders driving competitor moves, you now have to reassess everything you thought you knew about your market.

That’s a pretty massive challenge if you’ve been basing your entire pricing model on the past decade or so of competitive pricing data.

To make things more complicated, the frequency of pricing changes has increased as well. In some deregulating markets, price change frequency has increased from once a week to once a day, which is a drastic change for some operators. Depending on the local competitive mix in a mature market, price changes can occur up to four or five times a day.

So not only are fuel prices becoming more volatile, but competitors are completely uprooting their old strategies — and they now have access to technology that allows them to make savvier pricing decisions in general.

The good news is: You have access to that technology, too.

In Increasingly Competitive Markets, Agility is a Tool for Survival

These changes are causing fuel pricing strategists to rethink everything. To succeed in the coming years, pricing strategists need to learn to be more flexible, to build proactive strategies while still accounting for the need to react quickly to unexpected market turns, to keep a pulse on what’s happening in the marketplace, and to analyze massive amounts of data during the decision-making process.

But how?

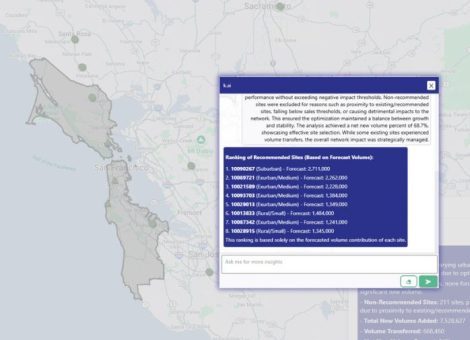

Using automated intelligence, machine learning, dynamic predictive modeling and mobile pricing tools —as well as the ability to integrate to the POS — pricing strategists can collect, consume, aggregate, and analyze the competitive landscape in more complex and holistic ways. And they can react quicker. Rather than blindly reacting to day-to-day competitor moves and pushing a price for the sake of it, you can now use data to optimize your pricing strategy and, ultimately, win in your marketplace.

The maturity of your pricing team, then, will become crucial in the coming years. If you have a revolving door of pricing analysts and you’re constantly training them on how to price, what to expect in the market, and why certain market events occur, you could quickly fall behind. On the other hand, companies with a robust, stable and forward-looking pricing team will be able to take advantage of the experience and knowledge base that comes with this kind of maturity.

Building a successful fuel pricing strategy must become a curious, data-driven process at the individual level. Soon enough, every pricing analyst will be using advanced predictive technology to make decisions about their networks — but the most mature teams will continue to dig deeper, to ask those “why” questions and to strengthen their ability to move forward with agility and confidence.

Get Ready, Get Automated, Get Agile

The fuel industry leaders of tomorrow need to adopt a new mindset — one that embraces change, learns from the past, and makes every decision with consideration for the future.

You need the data, analytics tools, and experiential knowledge to understand the changes coming up in your market and formulate a solid strategy that will carry you through this unstable landscape. Rather than remaining fixated on the fuel market within your specific geography, take the time to learn about the markets and competitive landscape outside of your area to help broaden your skill set.

Armed with a greater breadth of knowledge, a more complex set of data and dynamic predictive technology, you’ll be able to take the future market changes in stride and always remain one step ahead of the competition.

Start preparing today. For more information on building a proactive, future-facing fuel pricing strategy, download our free eBook, “Understanding How to Achieve Fuel Pricing Mastery.”

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

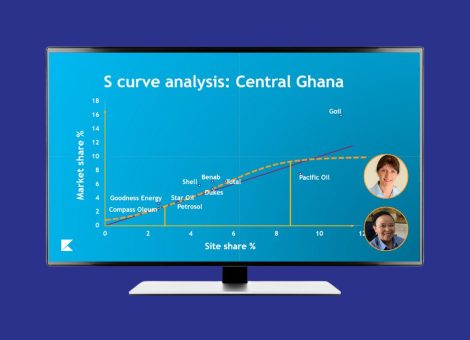

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...