Canadian 2023 National Retail Petroleum Site Census — Report for sale

Executive Summary

June, 2024

The 2023 National Retail Petroleum Site Census, researched and published by Kalibrate Canada, Inc., is a comprehensive enumeration of Canada’s petroleum retail outlet population. This is a unique study: no other single industry or governmental source of such information exists.

As of December 31st, 2023, 11,713 retail gasoline stations or 2.9 outlets for every 10,000 persons were operating in Canada. This is a decrease of 180 sites over last year’s survey result (a decrease of 1.5 percent from a year ago) and the lowest number of sites in Canada since tracking in the late 1980s. Although marginally lower this year, the number of retail sites in Canada has fluctuated little during the last decade, hovering near the 12,000 mark since 2008 after having contracted nearly forty percent during the prior two decades.

The Canadian Gas Station

Our census documented 97 distinct fuel brands in Canada, with the most common gas station being Esso branded, appearing at 2,100 sites or 18 percent of all sites. We identified 66 distinct companies marketing gasoline in Canada, with the most common station marketed by a company virtually unknown to the average Canadian consumer, Parkland Fuel Corporation, with roughly 2,000 sites in their fuel network or 17 percent of all sites.

Most commonly, a gas station in Canada was marketed by a non-refining traditional fuel marketer at roughly 4,400 sites or 38 percent of all sites. A traditional fuel marketer primarily offers petroleum and usually operates a chain of gas stations under their own brand. However, this is changing as the number of sites marketed by a non-traditional fuel marketer, one whose primary offering is something other than fuel, such as groceries or convenience store products, has increased and now makes up 27 percent of Canada’s sites (up from 15 percent of sites in 2004, our first survey year).

In addition, although most traditional fuel marketers use one of their own brands in their network, these marketers are increasingly using a branded supply agreement with another brand owner (often using a refiner’s brand such as Shell or Esso) to benefit from the established brand’s brand recognition, proprietary fuel additives, marketing support, and loyalty programs. In 2023, 42 percent of sites used such an arrangement, up from six percent in 2004, our first survey year.

Do big oil companies control the pump price at Canadian gas stations? Refined products sold in Canada originate primarily from just 13 gasoline-producing refineries, operated by eight refining organizations, of which only five are integrated refiner marketers – selling fuel to end-users at Canadian gas stations. In 2023, integrated refiner marketers set the pump price at nearly 2,600 gas stations or 22 percent of stations. Most stations have the pump price set by dealers or non-refiner marketers at 78 percent of sites.

Outlet Features and Offerings

The provision of goods or services other than gasoline is vital to the competitiveness and viability of retail gasoline outlets. Research has shown that the gross margin on gasoline itself is rarely sufficient to cover the operating costs and provide a reasonable return on the operation of these facilities. Accordingly, we also measured the market representation of several site features and offerings.

Our research shows that in 2023, 82 percent of Canadian gasoline stations had a convenience store larger than 500 square feet, with the most common size greater than 1,500 square feet. This marks a significant shift from 2004, our first survey year, when 45 percent of sites had a convenience smaller than 500 square feet. Fuel retailers increasingly depend on foot traffic from convenience stores to drive fuel sales.

Although most Canadian gasoline stations do not have a carwash or quick-serve restaurant, our research shows this is changing – likely also to drive traffic to gasoline stations and increase fuel sales. There is now a carwash at roughly one out of every four sites and a quick-serve restaurant at nearly every one in six gasoline stations. Compared to just a decade earlier, there are now over 600 more carwashes and almost 900 more quick-serve restaurants at Canadian gasoline stations.

In contrast, service bays appear at only one in every 18 gasoline stations, down from one in every seven sites in 2004, our first survey year. Another trend in decline is the availability of full-serve pumps. The number of sites offering full service has fallen to less than ten percent in 2023, down from over a third of stations in 2004. Although not declining, the number of Canadian sites offering diesel fuel appears to have plateaued, changing little in the last five years. In 2023, diesel fuel was available at roughly three-quarters of all gasoline stations.

Not only does the average gasoline station compete for fuel market share by enticing customers to their gasoline stations by offering a competitive price or by providing ancillary offerings such as a convenience store, a food offering, or a carwash, but many fuel marketers compete for market share using loyalty programs. New this year, we measured the number of gasoline stations offering a loyalty program. We found that 73 percent of gas stations provided a loyalty program – allowing customers to earn rewards or points towards future gasoline purchases or other incentives. In 2023, just three loyalty programs made up the vast majority of loyalty programs available: PC Points, Air Miles and Petro Points, which were available at nearly 50 percent of sites.

Average fuel volume site throughput at gasoline stations is often equated with profitability. The average site throughput in 2023 at Canadian gasoline stations improved from last year but still remains below peak throughputs achieved in 2019. After steadily climbing since tracking in the early 1990s, the average site throughput declined significantly in 2020 due to pandemic-related travel restrictions. Increased vehicle fuel efficiency, work-from-home habits, and electric vehicle penetration may limit future growth of average site throughputs, further emphasizing the use of ancillary offerings, loyalty programs, and competitive fuel pricing to increase profitability at Canadian gasoline stations.

For unrivaled insight into the Canadian petroleum retail market, purchase the full report.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

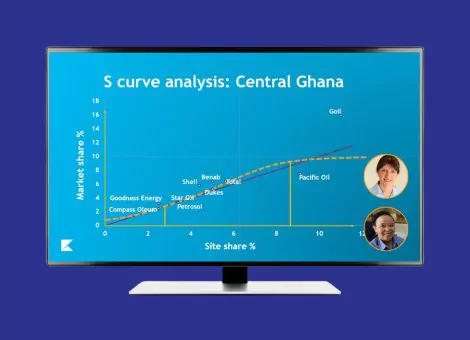

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...