Conducting a competitive analysis before expanding your retail network

When analyzing your competitors, certain categories of data are most important to research and take into consideration. This effort, underpinned by objective science, will help prove the potential for longevity and success of your new locations or market expansion.

The three key areas to consider in a competitive analysis

Volume

Monitoring your competition is important, but you need a frame of reference. Making decisions about your retail network based on your competitors’ general volume requires first knowing your own sites very well.

Each of your sites is unique. An individualized approach to determining strategy and tactics for each site, and the factors that contribute to overall volume, is important. You can certainly measure the number of cars that pass your location (and you should), but that measurement alone will not tell the whole story. It’s critical to evaluate all factors that influence your volume, from the pumps to the store. Once you have, you can develop a strategy with specific tactics to increase overall profitability — not just for fuel, but for convenience store sales and unique site offerings (a car wash, for example).

Designing a clear strategy and communicating that to your team will make it easier to implement a more proactive approach when dealing with competitor influence. Your team will have a framework to move forward to stay competitive in your current market, or any new markets being considered for expansion. Filtering your decisions through the 7 Elements for Fuel and Convenience Retail Success will ensure that every possible area of value is being leveraged to help drive volume and profitability at your sites, instead of your competitors’.

Value

The context of the volume your competitors are selling really lies in the unique value their sites provide to the customer. Understanding how that value differs from what you offer, or from what other competitors in the market offer, is the basis for knowing where your weaknesses and strengths might lie should you expand. How your competitors are attracting customers and what their value proposition focuses on will give insight into where your business can fill the gaps in the market or where you can double down.

Previously, companies encouraged people to pay for their gas inside the store so that the added inside purchases would be made. With the growing focus on adding value from small grocery stores and QSRs, the model of newer convenience stores tends to be focused on creating a separate experience between the fuel outside and the store inside.

Ultimately, if your value proposition in any of the 7 Elements is weaker than competitors in your market, you will eventually lose ground. Areas of differentiation could exist anywhere — from discounted price to more parking spots that encourage customers to linger a little longer in the store with better merchandising to bolster the results.

Gauging the strength of your competitor’s volume and value are two key elements of conducting a competitor analysis.

Market perspective

Having a balanced perspective of your market requires understanding both its potential and its limitations. This will give you well-defined and actionable insights into whether expansion in certain areas will create “over pumping” or excessive volume cannibalization. Utilizing a GIS map of the surrounding areas will provide a clearer picture into the makeup of a larger urban mass and its satellite cities. Try to segment where your customers are coming from and where other customers frequent. If your customers are commuting from a larger city, consider nearby smaller cities where other potential customers live and commute. Research what fuel brands are currently occupying those markets and if your value proposition would be able to compare with their brand strength and offerings.

Researching opportunities for market expansion might, in some cases, create a situation where emotion takes over. You might see an opportunity for expansion and be absolutely sure you will succeed there. But it’s important to use a scientific approach to support your emotion. Having more granular data about your competitors’ locations and volume will benefit your research and end speculation about competitor performance. Will your site have the lasting power to be successful over a long period of time? Answering with certainty is something that emotion alone won’t allow.

Conducting a competitive analysis before solidifying any decisions to grow or expand your retail network is critical. Before making any investments, you must know if these sites will have the power to generate revenue over a long period of time and continue to stack up against competitors as they, too, change and grow.

Read more articles about:

UncategorizedSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Uncategorized

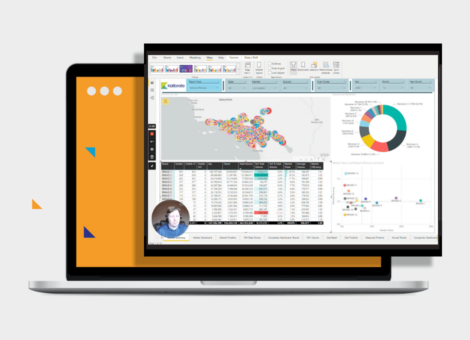

On-demand demo of Kalibrate Market Intelligence

For fuel retailers that want to gain market share, KMI provides granular detail on competitor performance allowing...

Location intelligence

Kalibrate Planning: hints and tips

Your monthly Kalibrate Planning hints and tips.