How should fuel retail businesses manage high profit margins?

So how should you deal with it when you do have those spikes? What is the best way to handle your high profit margins? Should you reinvest? Or should you revel in the glory of success, if only for a moment? There’s a simple answer, really: best-in-class retailers know that high margins aren’t forever, and they make investment decisions that reflect the temporal nature of this success.

What it’s like to win

When your site or retail network is performing especially well, it can be tempting to spend the money you’re making on a celebration of your success. You might see your margins rise for a time — sometimes a prolonged period — and feel confident that they’ll stay high for the near future, as long as you do not make any major alterations to the way you address fuel pricing or run your business.

But that confidence, though gratifying, is false. The strongest retailers understand that high profit margins are temporary, and when they inevitably drop, the exposure they create can be significant. After all, every retailer has process inefficiencies and under investment that margin hides.

These inefficiencies are like rocks at high tide. They’re still there. They’re still…rocks. But the high margin (the swelling tide) stops them from being exposed. When the margin starts to reduce, those inefficiency rocks start to become exposed — and can harm the retailer’s business.

Intelligent retailers do their best to remove those rocks even when margins are their highest — perhaps especially when margins are their highest. Eliminating inefficiencies and concentrating on investing in the right areas during high tide shows awareness that the tides do change. Those retailers exhibiting this awareness are those with a smooth, walkable beachfront when the tide recedes.

Where can you use high profit margins effectively?

The story around how to use your profit margin effectively to invest is a story about intimacy. You have to know and understand accurate, detailed, current data about your market and your sites in order to choose the right investments and capitalize on the moment.

Spending incremental margin in the right places means investing in areas of your sites that drive volume, so you can gain the pricing power to price correctly for margin when you need to. The margin generated by pricing correctly for the volume you can draw is directly linked to how well you perform in these six key volume magnet areas: market, location, facilities, operations, merchandising, and brand. Because there are so many contributing factors, you must think granularly.

How can you analyze data about your business such that you always put your extra margin in the right places — those that will keep you afloat when the price of crude shifts? Look at comparisons with competitors, focus on your additional offerings, and consider how the market of convenience and the business of driving is changing around you.

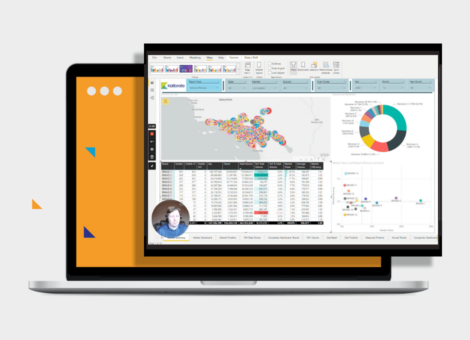

If you want to be a long-term player in the fuel retail arena, you must continue to be a destination for your customers. We’d advise you to invest there, but that’s not quite granular enough. That’s why we created a way to better analyze highly detailed data about your market and your locations. You need to know exactly where to place your incremental margin. And we can show you.

Get in touch with a Kalibrate today.

Read more articles about:

UncategorizedSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Uncategorized

On-demand demo of Kalibrate Market Intelligence

For fuel retailers that want to gain market share, KMI provides granular detail on competitor performance allowing...

Location intelligence

Kalibrate Planning: hints and tips

Your monthly Kalibrate Planning hints and tips.