Where to invest, and where to divest for fuel retailers in North Africa

There is huge variation in the fuel retail market across North Africa. Across the region there are many fuel stations that were built back in the ‘50s, that are very small and don’t have the services we’re used to seeing at fuel stations today. But as populations across the region continue to grow and new suburbs and towns are developed, larger purpose-built sites have been introduced with fantastic facilities that serve different consumer needs.

There are multiple international brands with a footprint in North Africa, and many have a combination of small, older, fuel only sites, and large, shiny, fuel, restaurant, car wash, and lube bay locations. Managing both, and understanding where to prioritize investment can be difficult.

In order to improve overall network quality, fuel retailers need to understand which of their sites would improve with investment, and which should be sold off.

Notably, some of the small sites have excellent locations. They’re often in prime spots in busy cities with high traffic levels – and real estate like this isn’t easy to come by. By thinking creatively, and tweaking their offer to meet the ever changing needs of their consumers, many of these sites could see increased returns from their small locations.

How do I work out which sites I should invest in – and which sites should be divested?

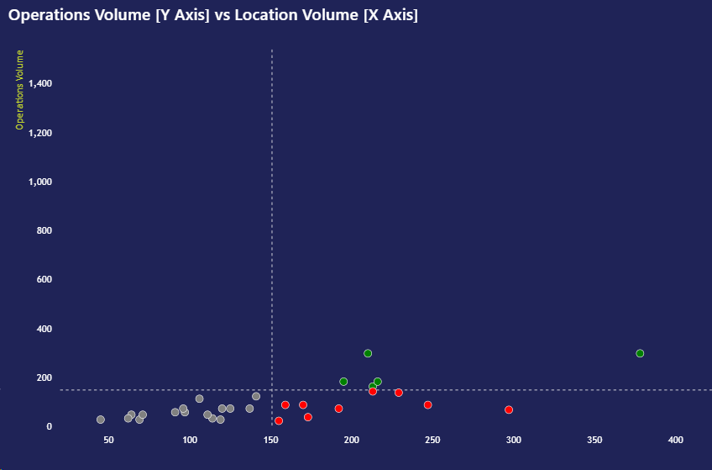

Data analysis like this Performance Potential Quadrant (PPQ) analysis can help you to visualize your sites in terms of both their potential – and their performance.

Sites that fall in the bottom quadrants of the chart have low performance based on their actual volume performance.

The sites shown in red have high potential – they are in great locations – but they are underperforming their potential. These sites represent big opportunities for your network. Investment in these sites will improve performance and positively impact your profitability.

The sites in grey, however, have low performance and low potential. They aren’t in great locations and the data suggests that they are unlikely to increase fuel volumes significantly even with cap ex investment. These are the sites that should be considered for divestment. Selling these will free up op ex and protect the quality of your overall network.

It’s so important to understand the potential of your sites – because from a performance perspective, the red and grey dots here look the same. They are achieving similar turnover numbers. But one group has potential and the other doesn’t. Without this view it’s not possible to make a confident decision on where to divest and where to invest.

In a region like North Africa, where fuel retailers are looking to protect and optimize their existing sites, it’s vital to make sure any cap ex invested yields a return – wasted investment is not an option.

Data and analytics can be used to analyze a fuel retail network and pinpoint opportunities so that fuel retailers can target growth – even if they aren’t adding sites.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

Improved performance for fuel retailers in the Middle East and North Africa.

Significant growth is taking place in the Middle East and North Africa (MENA), but we recognize that the region is...

Location intelligence

Why performance is key to unearthing site potential and unlocking network value

There are many factors to consider in optimizing network performance, and individual site volume and convenience...