Revealing huge potential for gas stations from Charleston - Savannah

Kalibrate’s latest market study collected data on all fuel retailers in the Charleston, Savannah, and Hilton Head greater area to reveal the areas of opportunity for gas stations and convenience stores looking to expand in the region.

Known for its golf courses, seafood, and rich history, this east coast region attracts a steady stream of tourists, with Charleston regularly ranking at the top of the Conde Nast Traveler’s list of top US cities.

With plenty of passing trade, the Charleston-Savannah region has a lot of potential for gas station entrepreneurs looking to expand their portfolio.

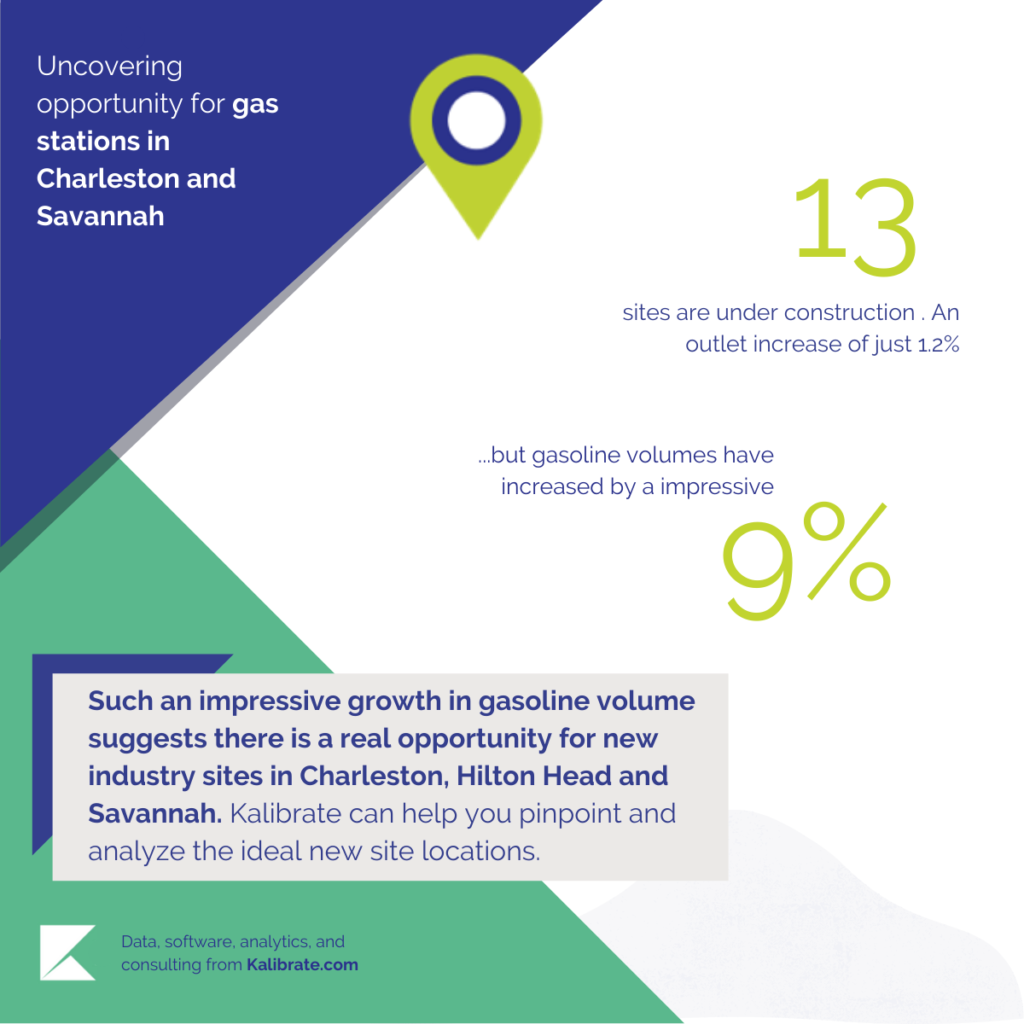

There were 13 sites under construction, joining the 1112 sites already active in the wider Charleston-Savannah greater area. This is an increase in outlets of just 1.2% vs. prior year — while the overall volume of gasoline sold has increased by an impressive 9% in just one year.

Like markets globally, gasoline volumes in the area waned in 2020 with the impact of the pandemic negatively affecting fuel demand, but these tourist hot spots have recovered quicker than most with this significant YoY increase.

With a level of anxiety still prevalent around overseas travel, we may see an increase in “staycations” and places like Charleston, Savannah, and Hilton Head could become more popular than ever.

Such a sizeable growth in gasoline volumes sold suggests there is a real opportunity for new to industry sites in the Charleston-Savannah greater area that could capture a good share of this growing fuel market. Optimizing the performance of existing sites will ensure they are performing to their full potential and achieving excellent revenue figures.

Assessing potential

Using Kalibrate’s performance potential quadrant (PPQ), 202 sites have been identified by our expert team with high potential but low performance. These sites present an opportunity for growth with the right investment into the right areas of the business — making them the ideal candidates for investment or acquisition. Most are concentrated in urban areas of Charleston.

If you’re considering acquisitions in the area, Kalibrate’s data can help you to pinpoint the existing sites that would thrive with investment, and the ideal locations for new build sites.

As well as the impressive increase in gasoline sales, c-store sales have also seen remarkable growth. Average monthly convenience store revenue is up 15% across these regions.

Gas stations in these areas that focus on strengthening their non-gas revenue streams are reaping the rewards. c-stores, QSRs and other ancillary offerings have immense potential for future growth in the Charleston-Savannah greater area.

Kalibrate’s 7 Elements of Fuel and Convenience Retail Success can help you to look at each aspect of your overall offering in isolation – and deepen your understanding of how they work in the context of your gas station network.

Each element can be optimized to attract more customers, bring in more revenue – and, ultimately, increase profitability.

Contact us to find out more about Kalibrate’s market study of Charleston, Savannah, and Hilton Head and generate actionable insights for your business.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...