Medtail’s march to a multi-unit future hits a snag

Keen observers of the healthcare industry will have spotted two significant trends over the past ten years.

One has been the blurring of formerly traditional lines between retail and healthcare operators. This trend has been particularly true of providers who interact directly with consumers without the need for a referral from another medical professional, leading to the coining of the phrase “medtail”. It is not uncommon today to see dental practices and optical offices located in strip centers next to hair salons and fast food restaurants, engaging in direct marketing outreach to consumers not unlike the customer acquisition strategies employed by their retail counterparts.

The other trend that we have observed relates to the “roll up” strategy that investors and private equity firms have been engaged in to take healthcare sectors that have historically been highly fragmented and creating larger entities through the acquisition of individual practices. The resultant scale ensures that the larger network can realize purchasing, marketing, and operational efficiencies.

The trend setter: Veterinary

This phenomenon has been most pronounced in the veterinary space, where several large players have been active in acquiring independent operators. Depending on the business model, the acquired practice often continues to operate under their original names and consumers are unaware of any change in ownership.

Developments in primary care

The most recent healthcare sector to be impacted by these trends is primary care. Walgreens made a $5.2 billion investment in VillageMD in 2021 which had been acquiring primary care providers and developing greenfield facilities inside of or adjacent to Walgreens’ drugstores. At the same time, Walmart was developing their own network of primary care facilities (in yet another foray into healthcare, a strategy that Walmart has pursued through numerous consumer health offerings and varying operational models for the better part of two decades).

Headwinds to further primary care growth/consolidation have emerged within the past six months. Walgreens announced in October 2023 that they would close 60 VillageMD clinics and exit five geographic markets entirely, followed by an announcement of another 100 closures in early April. Walmart also announced last month that they would be closing all 51 existing Walmart Health clinics – this only one month after stating that they would be opening 22 additional clinics in 2024.

What’s the diagnosis, doc?

Why have these attempts to develop a network of primary care providers failed? First and foremost, primary care is a challenging sector from a profitability standpoint – both Walgreens and Walmart have cited ongoing losses as reasons for scaling back. There are many factors impacting profitability, ranging from payment/reimbursement models to physician shortages. Outside of concierge care, where the membership model provides primary care physicians with both a profitable and a reasonably-sized patient panel, traditional primary care providers are increasingly squeezed by payers while experiencing higher rates of burnout (relative to other physician specialties) due in part to the underlying size of the panel of patients that they are treating.

While physician shortages are adversely impacting the medical, dental, and veterinary sectors broadly, shortages in primary care are particularly acute – the proportion of physicians practicing primary care has declined to 25% as medical school graduates pursue more lucrative specialties and sub-specialties. Primary care providers have also proven to be a bit more resistant to working in a “retail chain store” environment. Unlike the pharmacy space, where an estimated 58% of pharmacists are employed in a retail setting, primary care physicians are much more likely to work within a physician network or for a larger healthcare system.

While the race to realizing scale across the healthcare spectrum is ongoing and feels like an inevitable eventuality, winners and losers are emerging along the way. It is too soon to say with certainty that specific strategies will or won’t work. That said, one must wonder how many more cautionary tales are needed to give pause to established brick-and-mortar retail operators when contemplating pairing their existing store networks with seemingly complementary healthcare offerings.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

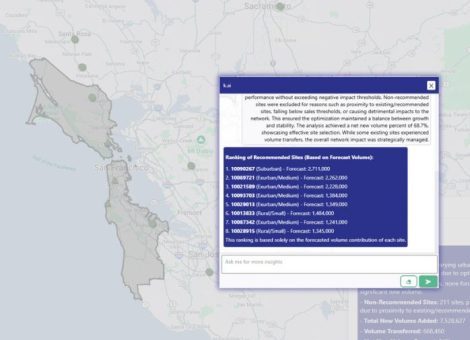

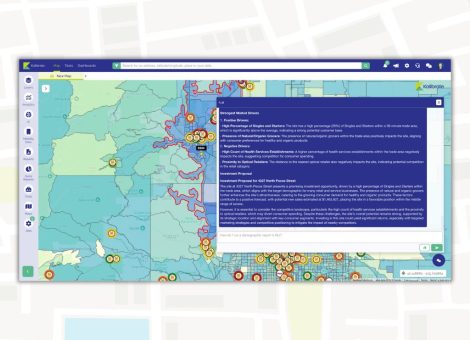

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.

Fuel pricing

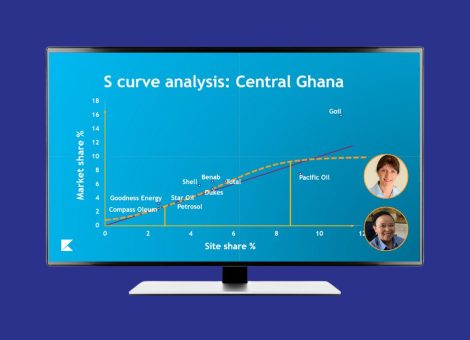

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...