Finding locations with the highest fuel volume potential in UAE

The UAE has the highest net migration rate in the world. Increasing developments and tourism has seen an influx of expats to the country in the past decade (a trend which is set to continue). So naturally, demand for fuel is high and is only likely to increase in the coming years. Demographically it’s very diverse with 157 different nationalities calling the UAE home, so fuel retailers have a hugely varied customer base whose requirements need to be considered.

In terms of fuel retail, the market is underserved. There are roughly 12,000 people for every fuel station in the UAE (6 times higher than anywhere in Europe). This means that the existing fuel stations achieve huge volume throughput, and there are often queues for petrol pumps. The cap ex required to build new fuel stations is not insignificant – and this poses a problem for fuel. retailers in the UAE. They are used to a certain level of throughput which may not be achieved when stepping into a new territory. It can be difficult to build a business case for a site in a location that hasn’t been built yet with no assurances of the level of volumes that can be achieved.

How do I select the locations that have the potential for the highest volumes?

Some locations have high potential for successful fuel stations. This is dependant on traffic levels, demographics, future growth projections, and the presence of competitors.

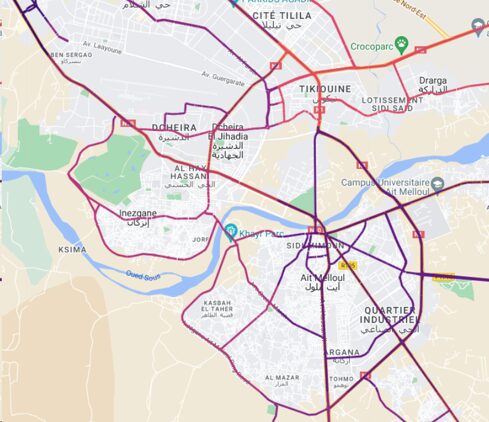

A hotspot analysis like this one, can be used to visualize ideal locations for new build sites that will meet your growth objectives.

The dark purple areas on this hotspot analysis are not ideal for new to industry sites. They either have limited potential or are already well served by competitors.

The area of orange at the top right of the image has far higher potential. It is not currently served by competitors, has high levels of passing traffic and has a high percentage of your ideal customers in the local demographic. This would be the ideal place for the real estate team to focus on for a new to industry fuel station.

In a country with so many new developments being built – if you don’t get a site in the ideal location – your competitor will. Data analysis like this can provide you with the insight you need to ensure you’re building in a smart way. In future proofed locations that will enhance your network and add to your profit.

Will a new site bring me new customers or cannibalize volume from existing sites?

Mobility data can provide insight into your customers, helping you to understand more about the demographics, travel patterns and locations of your actual customers.

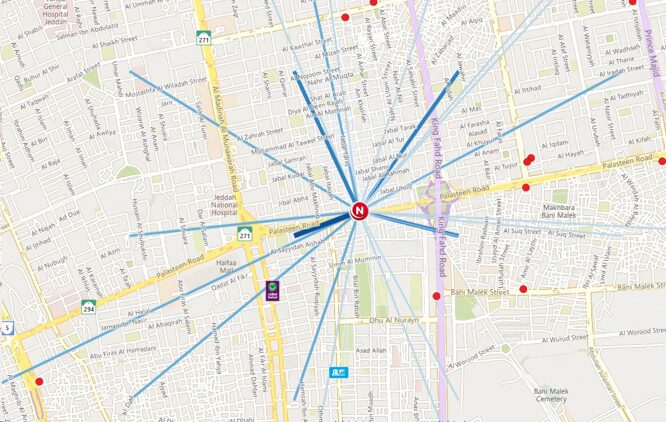

This image shows a fuel site, and where its customers are coming from. The thicker, dark blue lines show a high concentration of customers travelling in from the north and directly east and west. While the thin, light blue lines show that a low percentage of customers coming from the south of the site.

In this case, if a piece of real estate was available to the south of this site, it would complement your network, not cannibalize it.

In a country like the UAE where sites are often busy with long queues, fuel retailers might take the strategic decision to build a new site to ease the strain on existing sites, so they may choose to build to the north and take a share of the existing volume – before their competitors do. That way they will split customers evenly between their two owned sites, they’ll have satisfied customers and they’ll have retained 100% of their competitors rather than losing them to the competition.

In a rapidly growing market like the UAE, fuel retailers need to ensure they have a brand presence as new developments are built. But they can’t risk making bad decisions that don’t return investments.

Data and analytics can be used to analyze new locations, and the changing behaviour and movement of customers to identify the ideal targets for fuel network growth.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

12 tips for gas station owners this Christmas

Boost your gas station's holiday sales and customer loyalty with these 12 actionable tips.

Fuel pricing

November 2024. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....