Whether you call it sales transfer or cannibalization, understanding how new openings affect existing unit sales is a vital skill.

And it’s especially critical in franchised restaurant concepts.

For a franchisor, you need to assure your franchisees that new openings won’t have a significant negative impact on their bottom line – or, at the very least, provide an analysis of the potential impact on their sales.

From the franchisees’ perspective, independently quantifying how your sales will be impacted by proposed openings allows you to respond and plan appropriately.

In either instance, the process of evaluating sales transfer should be objective, robust, and transparent. Let’s consider each in turn:

Objective

A third party’s analysis gives the franchisor and franchisees the confidence that there’s no commercial interest to whether a proposed deployment goes ahead or not. The analysis process should be based purely on data and on a validated methodology, without manual interventions.

Robust

The methodology employed to quantify sales transfer between units should have been tested and refined based on real world outcomes. Most transfer analysis is iterative; as demographics, consumer behaviors, and competitive environments shift, so will the thresholds and parameters used to quantify the likelihood of sales transfer between units.

Transparent

Giving all parties visibility into the data points, assumptions, and methodology employed gives greater confidence in outputs. Business-critical decisions shouldn’t rely on outputs of a ‘black box’ model that stakeholders cannot see or interrogate.

The approach we’d recommend

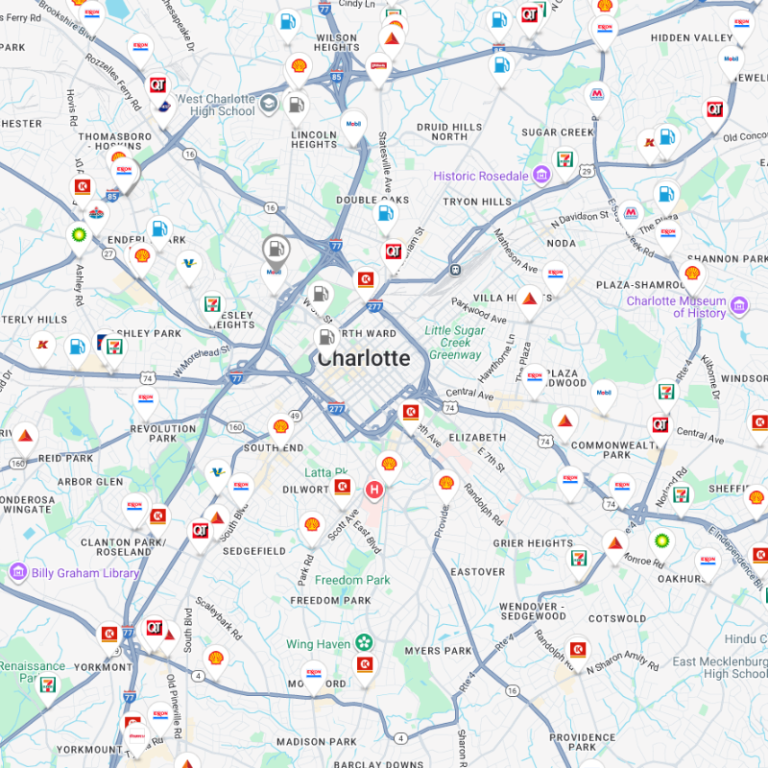

When Kalibrate conducts transfer analysis, we leverage Massive Mobile Data (MMD) to determine the distribution of customers around the impacted unit. This involves creating a geofence, virtual boundary around a location. Data is collected from devices that enter this area within a specific time frame, typically 12 months.

This provides a capture rate – the total percentage of customers entering the unit’s boundary and their point of origin – this can be rationalized into US Census Block Groups. A good analysis should utilize additional algorithms to filter out employees to ensure outputs are not distorted by non-customers.

Analyzing customers’ points of origin can help identify the locations they are traveling from and to. This could be residential, non-residential, or a neighboring shopping node.

We consider customers from outside the area as travelers. They are unlikely to visit the unit regularly. You should also determine the visit frequency by time of day, weekday, and weekend distribution.

You can estimate the impact of the proposed unit for each US Census Block Group. The transfer estimate would be based on factors including the Block Group’s proximity to the proposed unit vs the existing unit, journey complexity, physical barriers, retailer orientation, and the presence of other sister units.

The overall transfer score should be a weighted sum, taking into consideration the impact percentages and the Census Block Group capture rates. Micro or situation specific impacts will add unknowns that no solely data-led analysis could capture. As such, transfer impact values typically deliver as percentage ranges to show a higher, lower, and central estimate.

Learn more

Kalibrate regularly conducts transfer studies to help our clients quantify the impact of new openings. Use cases include franchised concepts, retailers conducting optimization exercises, or as a component of a market entry strategy.