The principles of success in fuel pricing

At Kalibrate we often hear the saying “Pricing is a village” – meaning that a pricing team can’t work in a silo, they need to be working in synchronicity with the rest of the organization.

Determining fuel retail prices is one of very few business decisions that happens frequently – often on a daily basis. Having a coherent fuel pricing strategy that reflects many components of your offering – from brand image to product quality to location – is critically important. Having good processes in place can ensure the implementation of your strategy is as successful as possible.

Each department’s perspective needs to be reflected in the final pump price. For example – if there’s a marketing spend that needs to be accounted for – this needs to be considered in the fuel price decision, or if there’s an operational issue at one of your sites, or external factors like roadworks impacting parts of your network – this needs to be considered in the fuel price decision.

The fuel pricing team should be continuously looking at the performance of a site and will need input from all departments to understand if there’s anything happening that will affect site performance – or the elasticity of prices at any given site.

When it comes to understanding performance , the first question often posed is

How do you know what a successful outcome is?

It’s easy to set your KPIs as just volume and margin – but can you accurately measure whether it’s the pricing team that’s really affecting this?

Setting the right KPIs will help you to manage your efforts and better understand your performance. For a deeper understanding you need more to be measuring against other metrics such as difference to competition (DTC) and market share.

Difference to competition (DTC) has a big impact on consumer behavior. If you’re pricing cheaper — it’s easier for consumers to come to you. Measuring that in a triangle with volume and margin gives you the opportunity to measure the shift in those three components.

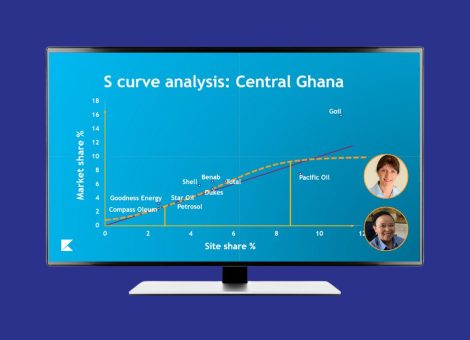

Market share reporting is a great way to measure successful performance. Maintaining market share is the baseline and you can then measure whether you’re gaining or losing market share because of your pricing decisions.

Once you’ve established your KPIs, ensure that reviews take place at frequent intervals and that you are reviewing the performances of your sites in tandem with the other business units – always implementing any changes into your automated pricing routines.

Teams that have effective sets of standard processes in place, strong lines of communication to the operational teams, and feeds in from marketing and other departments — have an increased understanding and a higher degree of automated pricing occurring. Once you’re at this stage, you can utilize AI and data science to make those decisions more efficiently.

How to make decisions in a smarter manner.

This is where data science and artificial intelligence (AI) come into play.

This article does not go into depth about AI and data science, but you can learn more about AI and data science and how it can help you optimize your fuel pricing in our ebook.

There are various ways of arriving at an optimized price. Regardless of the process, quality input leads to quality outcomes — and for pricing teams – that is the most critical component.

But AI is not a silver bullet

We need to be realistic about what AI can do – particularly in the realm of calculating fuel retail prices – or Price Optimization. If your station has never had any investment or focus on the 7 Elements, then there’s of course only so much that AI can do to increase profitability, and you may be well advised to consider investing in other areas of the site to generate a higher return on investment.

It’s important that you utilize AI with strong knowledge of both your customers and your competitors. But also, it’s critical to know your own history.

How has your pricing performance in the past affected your performance? Have you made price-level adjustments before? What happened to your performance as a result of it? How long did it last? And what happened afterwards?

Fuel price optimization is not right for everyone and there’s a certain level of maturity of operations that is required to successfully utilize AI in fuel pricing. You must ensure that your optimized pricing fits in with well-established processes and an understanding of what customers really want.

The great thing about AI however is that it’s uses are not limited to monitoring demand and optimizing prices, but it can also be utilized by pricing teams in other ways.

At Kalibrate we’ve brought to market a patent-pending methodology which can identify and fill in gaps in data. We call this Smart Imputation.

The system uses machine learning to look at your data, identify where there are gaps, and then populate those gaps with modeled data. This is beneficial in several ways.

Firstly, it helps to measure against those KPIs we discussed earlier. You can get a complete picture of historic performance to properly understand how you’re performing today. And it drives a higher degree of accuracy in the optimization algorithm too – so one component can make another data science component better.

Bad habits in fuel pricing

There are of course bad habits that fuel pricing teams adopt that could get in the way of their success, and here we’ll examine four of these.

- Focusing on the wrong data:

There are so many elements that can affect consumer behavior that focusing on the wrong data can often deflect from an ability to get a correct understanding.

- Basing decisions on incorrect models.

Data science and modeling can be a fantastic resource for fuel pricing teams – but only if they’re using the right data and the right formulas, to create the right results. It really is worth investing the effort in making sure that your models have all the data that they were built to require.

- Ignoring important information.

If a competitor site is closed, or there are roadworks affecting the traffic flow around your site then this is likely to be having a bigger impact than price and in such a scenario, changing your price position is likely to have minimal to no effect.

- Using bad correlation points

There are lots of ways that different data sets correlate – but correlation does not always imply causation. The chart below shows an example of a bad correlation.

The graph shows a strong correlation between Nicholas Cage movie releases and rainy days. This is correlation and not causation – as the rain does not cause movie releases. Using points that correlate but may not have a causal effect will impact the final price outcome.

To understand what goes into Kalibrate’s fuel price optimization algorithm and how you can utilize it to increase profitability, download Fuel price optimization 101

You can watch Tom’s entire presentation here

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...