Petroleum pricing in Canada — the Q4 report

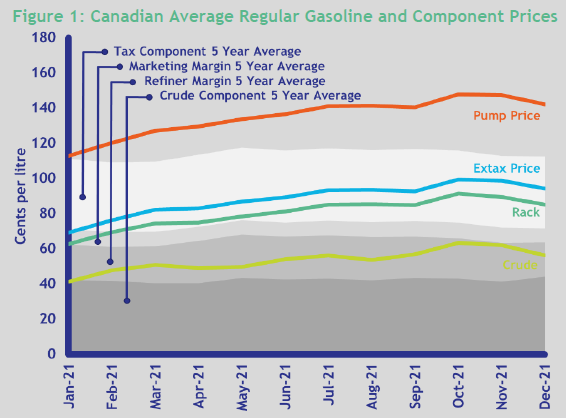

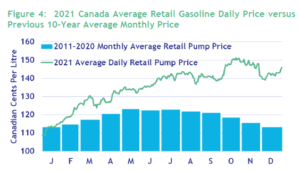

Canadian crude prices reached a seven-year high in October and, along with strong refining margins for both gasoline and diesel, led to record-high retail prices in the fourth quarter.

In quarter three, the effects of Hurricane Ida severely affected North American crude oil production in the Gulf of Mexico, which lead to lower crude oil supplies coming into quarter four 2021. At the same time, the Organization of Petroleum Exporting Countries and allied countries (OPEC+) continued to stick to curb their monthly crude oil production — despite increasing global crude oil demand.

Despite a drop of over $14 per barrel in late November — spurred by the new Omicron COVID-19 variant and the potential impact it could have on oil demand — it quickly became apparent that the new variant produced milder cases, and oil prices quickly recovered and then continued to trend upwards for the rest of the quarter.

Each of these factors impacted North American gasoline inventories, keeping levels low.

Contrary to normal seasonal patterns, gasoline demand remained uncharacteristically strong throughout the fourth quarter of 2021. So with slowed production, low inventories and strong demand — gasoline refining margins soared throughout the end of the 2021.

The result of this?

In quarter four 2021, crude prices reached a seven-year high and wholesale gasoline prices a thirteen-year high, sending Canadian pump prices to an all-time high in October.

Read the full report to get detailed insight on Canadian petroleum pricing in the last quarter, including:

- A gasoline and diesel market overview

Find out how prices have changed across the nation — with an explanation of demand, supply, and other influencing factors

- The market outlook for Q1 2022

Read Kalibrate’s analysis on how production rates, global factors, and changing demand will impact the market — and Canadian pump prices in 2022

- 2021 Gasoline Prices: A Year of Recovery

We look back across the previous year to investigate the impact of COVID-19 and the recovery of gasoline pump prices in Canada

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

November 2024. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....

Fuel pricing

The Kalibrate news round-up: November 2024

In this monthly feature, we look across the industry and mainstream news to uncover some stories of note that we...