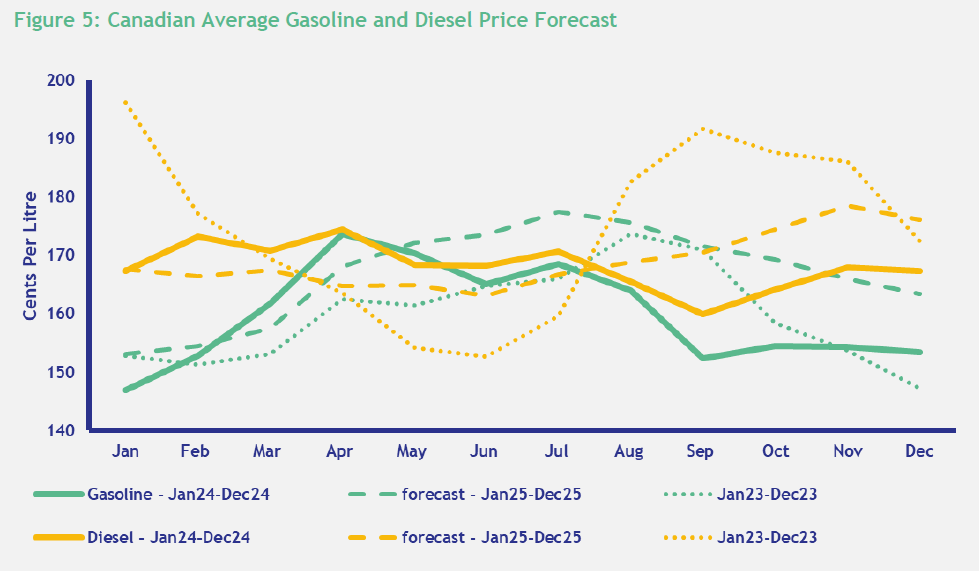

A modest increase in crude oil prices and stable gasoline margins led to a slight increase in retail gasoline prices in the fourth quarter. However, expanding diesel margins contributed to higher diesel prices, which reached a four-month high in November.

After experiencing significant price volatility in early October, crude oil prices moderated, trading within a narrow six $US/BBL range during the remainder of the quarter.

The price of Brent crude (a global benchmark) climbed 7.92 $US/BBL in early October to 80.27 $US/BBL before reducing gains during the remainder of the quarter to end at 74.58 $US/BBL. This was 2.23 $US/BBL higher from the end of last quarter and an overall increase of 3.1%.

Retail gasoline prices in Canada changed little in the fourth quarter, peaking in October at 154.5 cents per litre before declining to 153.5 in December, just a 1.2 cents per litre increase from the end of last quarter. Despite declining North American gasoline inventories in the fourth quarter, strong refinery utilization this fall enabled refiners to meet lower seasonal demand for gasoline, keeping gasoline margins stable in the fourth quarter.

Canadian regional gasoline and diesel market overview

Retail gasoline prices experienced regional variation in price movement this past quarter, with prices declining in western parts of the country and rising in central and eastern regions. Prices generally declined in the fourth quarter in British Columbia, possibly due to lower LCFS credit market prices, which fell 26.3 percent from last quarter and reached the lowest quarterly credit price since Q4 2020.

Canadian fuel market outlook

Looking ahead to 2025, retail gasoline prices will likely increase from current prices in the spring, peak in the summer, then decline until the end of the year. In contrast, diesel prices are expected to remain near current levels during the winter months, then decline to the lowest level of the year in the summer before beginning to rise again in the fall.