Fuel Pricing strategies - one size doesn't fit all

In today’s fuel industry, a number of retailers work hard to define their market position, establish their most effective pricing strategy, and apply it generically across all their markets. While this cookie-cutter approach helps influence how a brand is perceived across the board, a one-size-fits-all approach rarely drives maximum return. The problem is, granular micromanagement of thousands of sites is also unrealistic.

To make things more complicated, the frequency of price changes varies, and typically increases as the market matures. Depending on the local competitive mix in a highly competitive market, price changes can occur up to fifteen times a day.

That’s where segmentation really comes into its own. It delivers genuine insight into common factors your different sites share, and how they can be identified to be handled together to deliver the greatest benefit overall. And while your pricing has to be aligned with the overall business strategy, it should also have the scope to consider the opportunities on a site-by-site basis.

In the performance segmentation process, a site can be assessed and categorized into one of four quadrants based on actual volume output versus potential volume output. However, there are other inputs for segmentation analysis which are necessary when looking at pricing strategy. Here are three questions fuel retailers should ask when segmenting their sites and devising a pricing strategy:

- Why avoid the cookie-cutter?

What’s the problem with rolling out the same fuel pricing strategy, without taking market nuances and local competition into account? Firstly, there’s a danger you’re either losing opportunity for improved profitability, or devaluing what you have.

It is almost impossible for fuel retailers to occupy exactly the same strength and position in every market. There is almost always an exception, or multiple subtle exceptions!

For example, is your business a leader or a follower? Are your individual fuel markets aggressive or not? Do you have a location advantage or offer an ancillary service that is specific to your site? These factors can all impact pricing in different ways.

Also, consider whether local consumer needs have changed. Perhaps customers want something different; cleaner facilities, or a good quality restaurant. There might always be someone doing things differently, impacting your market position.

Ultimately, if you apply the same pricing across your network, then you’re missing the opportunity to differentiate between your different segments of sites.

- Is fuel site segmentation complex?

Segmentation isn’t complex if you have access to the right information and expertise. With the tools to spot different environments and nuances that drive a service station’s volume, it can be straightforward to apply optimum pricing to those sites.

A common barrier to segmentation is objectivity. Internally, it can be hard to recognize that competitor sites might be more compelling to your consumer, and your own sites could be improved.

For segmentation to work, however, fuel retailers need access to reliable and up-to-date data for their markets, reliable and timely information about competitor offers and pricing activities, and a robust and flexible pricing tool. For many retailers, these are the largest hurdles.

Fuel retailers need to be prepared to dedicate time to segmentation and their pricing strategy overall. Without an appetite for change, to scratch beneath the surface and to flex their muscles, segmentation can feel like a bigger barrier than it truly is.

- How can I recognize opportunities?

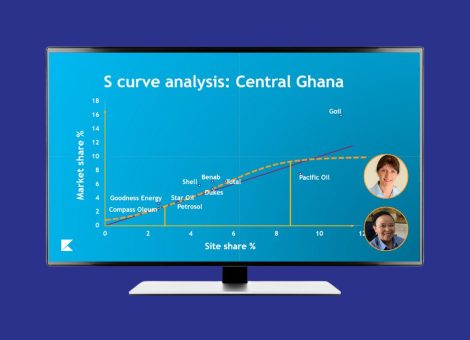

To effectively segment your fuel retail sites, it’s important to understand where sites fall on a performance potential quadrant chart. This insight unlocks key knowledge about volume potential in the network.

The relative strength of a site is scored on demand generated by the site’s trade area demographics (population statistics, number of houses, average number of vehicles per household, and average household income), as well as by the number of vehicles that pass the site daily. Further analysis, using Kalibrate’s 7 Elements framework approach, gives quantified insight into the opportunities which exist in your network.

A fuel retailer working with an industry expert like Kalibrate to identify the risks and opportunities in their network can then apply a strategic approach to pricing, to maximize performance. If objectivity is a common barrier, working with an external party with extensive market and data knowledge can hugely benefit the process.

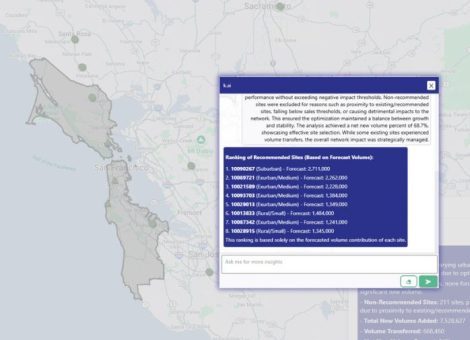

Finally, a fuel retailer needs to be agile. Building a successful fuel pricing strategy should be a curious, data-driven process rather than a one-size-fits-all model. By working with Kalibrate to tap into data analysis, perform quadrant analysis and use predictive technology, a retailer is ideally positioned to segment their sites and maximize their profitability.

Learn more about the benefits fuel pricing can have on your company, by reading about other success stories here.

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...