I've implemented a new fuel pricing strategy - how do I know it's working?

Of all the elements that contribute to the success of a retail fuel network, pricing may be the most difficult to understand the impact — but with the right fuel pricing strategy and enough data to support that strategy, pricing managers can maintain a greater sense of control in their role and make decisions with a higher level of confidence.

The most important thing to remember about a fuel pricing strategy is: It’s not you, it’s me. An effective pricing strategist takes into account not only what their competitors and the greater market are doing, but also what’s happening within their own network as well. There are many factors that can influence pricing, so both developing and measuring the effectiveness of a new pricing strategy requires a high-level view of all these factors.

Let’s discuss how to develop, implement and measure an effective pricing strategy from beginning to end.

1. Identify a site or group of sites to target

Before you begin, identify where a new strategy needs to take place. Not every location will be in need of a strategy change at the same time, and you should never just change for the sake of changing. Focus in on a subset of your network, whether it’s one site or a group of sites, and identify those that are under-performing.

It’s important not to lose sight of the value of the human eye when identifying sites to target. You need to be deeply familiar with your sites before you can be sure that a pricing change will impact overall performance. In other words, you can overcook the equation at any store. If you push too far for volume in a location that’s not built for speed, you can find yourself in an unprofitable situation very quickly. Consider the location, brand value, facilities, market, and more to understand what the reasonable volume performance for each site should be.

2. Be intentional

Your fuel pricing strategy, without a targeted objective, is a blind and misguided effort. Once you’ve identified the sites for making changes, then articulate your strategic goals for each. Remember, a strategic goal is not “to reduce the price at this site by two cents.” A strategic goal could be to increase market share in this local market or to grow margin dollars with minimal loss of volume. Whatever your goal, it needs to look beyond the price change itself and consider the desired effect of that price change.

When you’re developing a new fuel pricing strategy, it’s important to remember that everything you do can have an effect on all of the other elements in your store. If you’re trying to improve your fresh food business or your overall c-store category, you have to be sure that those areas of the business aren’t going to be affected; don’t overhaul your fresh food offering at the same time as your pricing strategy, because it will be difficult to tease out the true cause and effect of each change.

3. To minimize volatility, set a limit to your fuel pricing strategy

This is extremely important. To control the volatility within your market, you need to have a limit to the price changes you make. If your strategy is to decrease price to improve volume, set a limit to the number of price changes you make in a day or the percentage of price changes each day. Once you’ve reached that limit, stop and revisit your plan tomorrow.

As a rule, you should never change prices more than 5 percent in one day — at a $2 price point, that’s about 10 cents a day. However, we don’t recommend ever making moves more than 2-3 cents at a time, because anything greater than that can have a serious impact on profitability and the overall margin availability in the micro-market.

4. Define metrics for success (and a plan B in case something goes wrong)

Now that you know your intentions for the price change, ask yourself: What does success look like? How is it defined and managed? And what if my plans are wrong? Key metrics you may want to pay attention to are volume performance, margin performance, unit margin, and total gross margin dollars. You should also keep track of your delta to competition to understand your price position in the greater market.

These are some obvious areas that pricing strategists consider, but don’t forget about other, more subtle areas of your business as well; price changes can have an effect on both c-store and fuel sales. In addition to defining your success metrics, develop an adjustment strategy in case your price changes have an unintended consequence on some other part of your business.

5. Be patient

The biggest mistake that a fuel pricing strategist can make is being short-sighted and undoing the new strategy if they don’t see an immediate response. A new pricing strategy often won’t have a significant effect in a short period of time; generally, consumers only buy fuel once or twice per week, so it may take some time before consumers even realize that you’ve implemented a change. Hold the strategy for at least four weeks before you draw any conclusions.

While you’re holding the test, monitor your sites’ performance both daily and weekly. At the end of the four-week test, it will be time to bring the rest of your team together to analyze the results.

6. Measure the effects of your strategy on your fuel network

Using the metrics you defined early on in the process, test the effects of your price changes. You may also have unintended consequences on things like your c-store sales or your ability to accomplish other goals that you have at specific locations. Bring together a cross-functional team that includes people from pricing, operations, marketing, and the supply team to review the goals and results of your pricing test.

One of the main challenges pricing strategists run into is taking on too micro of a view when testing their strategy. If you look at the performance of just one site, the volume-margin equation might look relatively linear. However, a price change at one site can have an effect on the entire market; you may have lost some volume at one site but made up for it in gross margin contribution. Analyze the combined performance of all of your stores to understand whether there’s been a noticeable shift in profitability or total volume in the marketplace.

7. Measure the effects of your strategy on your micro-market

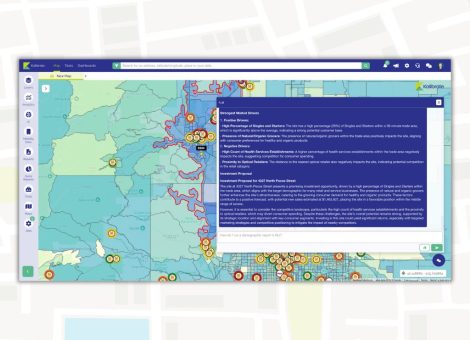

Use an analytics tool to understand the effect of your price strategy on local market trends. Remember, when you price, you’re not pricing in a vacuum. Your competitors are going to notice the change, so it’s important to constantly monitor their reactions to understand if the new strategy is going to work in your micro-market.

Juggling data about individual sites, the network as a whole, competitors, and the local market may seem overwhelming, but any pricing analytics tool worth its weight in salt will have all of this information — including the day’s price, the margin position, competitive intelligence, current volume run rate, c-store sales and more — available in an easily-accessible dashboard for the pricing team to review while making their decisions.

8. Adjust your fuel pricing strategy according to your results

Once you understand the effect your strategy has had on individual sites in your network, your fuel network as a whole, your competitors, and the local market, it’s time to make an informed and strategic decision about where to go next. Should you develop a new, more ambitious goal? Should you implement a new strategy?

If your strategy had a negative impact, you have a couple of options. If your competition was overly responsive to the changes you made, you could go back to the original strategy and try again. You could also revise the strategy in some other way; for example, if your strategy was to decrease price by two cents, you could try one cent this time. Or, you could go in the other direction and raise your price one cent above your competitors’ prices. This will give you a good idea of the limits of each store.

A good pricing tool will allow you to do some of this what-if analysis upfront. Using a tool that helps you understand the sensitivities of each individual site, you can define specific parameters and know what to expect with a strategy change. That way, you’re not entering the test completely blind — and you don’t want to exit the test completely blind, either. Timeliness is a critical component of effective fuel pricing, so you need to have a centralized analytics tool that’s collating comprehensive data for you. With the right pricing process, you can make smarter decisions before, during, and after you implement a new pricing strategy.

Make Optimal Pricing Changes with a Data-Enabled Strategy

Pricing is often the most controversial of the 7 Elements for fuel and convenience retail success. Luckily, with the right analytics tool informing your strategy, automatically compiling a massive amount of market intelligence and measuring the effects of your strategy, you can make smarter, more informed decisions about your pricing. Use the data to support your strategy, and you can ensure you’re moving the needle in the right direction.

Download Free eBook:

Fuel pricing optimization 101

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.

Fuel pricing

Fuel pricing by exception: When do analysts actually analyze?

Managing fuel prices can be time-consuming, especially when analysts spend much of their day on routine tasks....