The impact (and opportunities) of a global lockdown

The world has changed. The global economy has changed with it.

Business owners and leaders around the world are working incredibly hard to keep their companies alive. Fuel retailers are facing a dual-edged challenge — volume demand and gas prices crashed simultaneously. So, we brought together our expertise and knowledge to help you understand what you should expect in terms of a recovery in the future.

Never let a crisis go to waste

It’s difficult to accurately predict what will happen next, but even taking market nuances into consideration, the broad patterns remain the same across geographies. Restrictions are being lifted in some countries and states and not others, but the essential question of “how locked down are you?” still applies to almost everyone.

One thing is clear — decisive action is needed on the road to recovery. The landscape as we know it may never look the same, and that applies to fuel pricing processes, convenience retail, and QSR, too. Savvy businesses will see this as an opportunity for change, and will rise from the ashes of COVID-19. Others may simply take too little action, too late.

Kalibrate has a uniquely global and local perspective. Our experts have witnessed fuel and convenience retailers’ on-the-ground activity first hand. These professional insights, coupled with their own personal circumstances, and access to Kalibrate’s extensive, global data, provide a strong position to assess the current situation and make predictions on future outcomes, post-lockdown.

Modeling the path to recovery

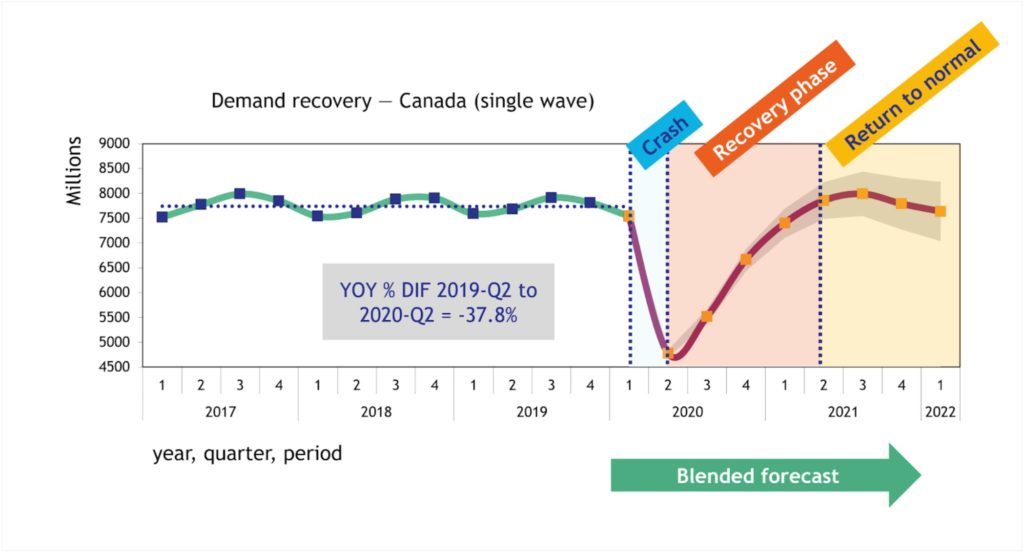

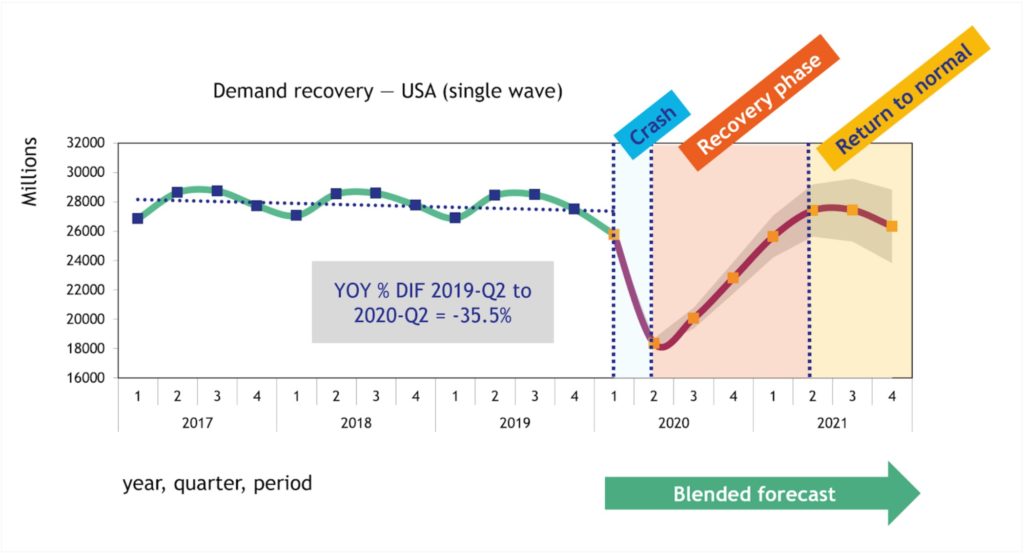

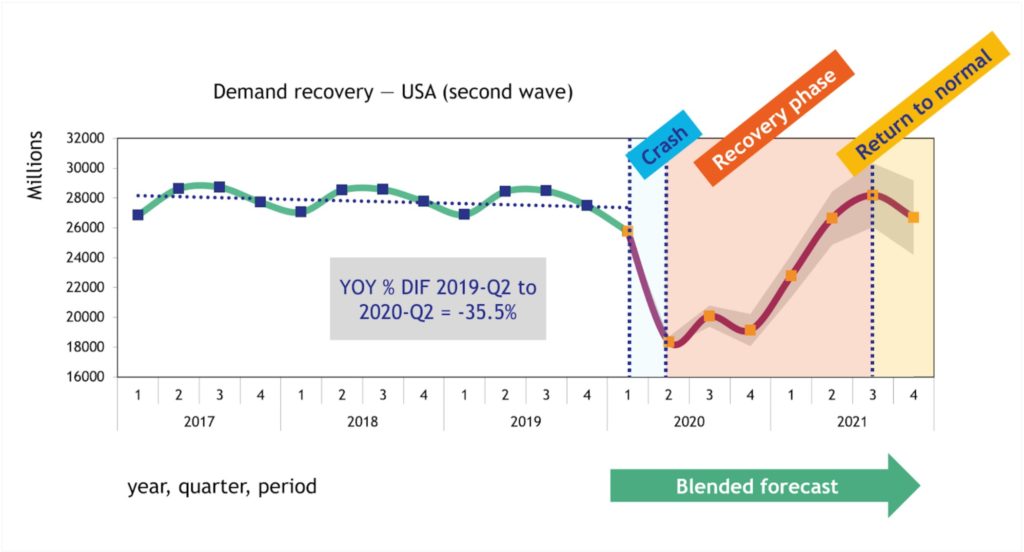

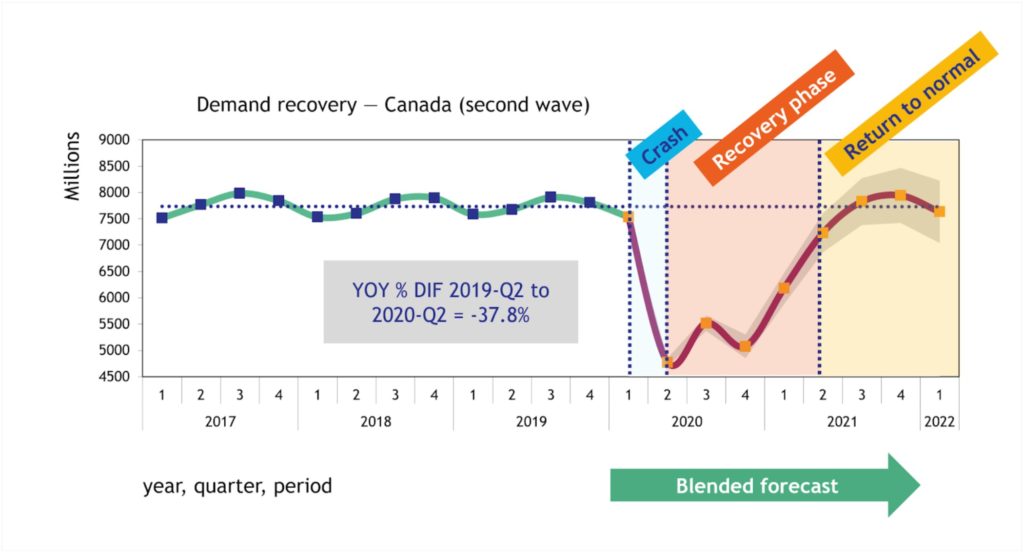

Using our proprietary modeling methodology, we developed a fuel demand forecast to model the impact of COVID-19 on fuel consumption in Canada and the US, and the likely timeline for recovery of demand up to “normal” levels. Our tried and tested methodology has been proven to achieve a high-level of accuracy, predicting next period demand to within 98% of actual.

Models were run to assess the relative impacts of a sustained single recovery (v-shaped recovery) following a single wave of lockdown, as well as a “second wave” of virus and lockdown in the fall of 2020 (w-shaped recovery). In reality, we have actually already started seeing a second wave in many states across the US – however, this is not modeled here given that lockdown restrictions have not changed drastically.

All models showed demand bottomed out in Q2 2020, with over a 30% drop compared to the same period last year. This stood at -37.8% YOY for Canada and -35.5% YOY for the US.

In the v-shaped recovery scenario (one wave of lockdown with sustained recovery) demand returns to relatively normal levels by late-Q1 / early-Q2 2021.

In the w-shaped recovery scenario (a second wave and lockdown), in both the US and Canada, demand recovers slightly into Q3 2020, then dips again in Q4 2020 to a level just above the lowest point in Q2 2020. The same level of demand destruction is not seen in the second wave as the second lockdown is anticipated to be gradual and planned.

The second wave pushes the complete recovery to relatively normal demand levels out to Q3 2021.

In all scenarios, the return to normal is within a few percentage points of demand levels in 2019 (either slightly above or below), this indicates that none of the models are showing permanent demand destruction.

Strategic self-reflection for success

So what does the decline in demand and the slow road to recovery mean for fuel retailers?

Fuel and convenience retailers will need to take a hard look at their existing strategies and understand that what worked pre-COVID may not necessarily work after.

Take fuel pricing, for example. With drops in demand the cost of product sitting in tanks means fuel retailers are faced with complex pricing strategy decisions; whether to focus on retaining higher margin and sell less, or concentrate on shifting product. Manual processes simply won’t function in future because of market volatility and widespread disruption in fuel prices. There will be more rigorous compliance expectations, risk of perceived price gouging, and room for human error. Kalibrate can help you understand the scope of this problem, and streamline your volume and demand mix. You’ll need a clear, robust strategy and more reliance on automation. How you implement this will be vital.

We are not looking at “demand destruction”, what we’re seeing is “demand shock”; fuel demand will rebound. But we expect patterns to change. We are in a new normal, but our “new normal” may never be the same again.

Many people are growing used to working from home and shopping online. Before lockdown, people were going to smaller supermarkets, specialist suppliers and “artisan” coffee shops. These evolving habits have expressed themselves on the forecourt, too ― fueling your car, selecting higher-quality convenience food, and picking up essential groceries all at the same location.

Fuel demand will return, but it’s essential to also consider which of your site’s facilities are more appropriate to these more long-term changing habits, and which are becoming obsolete. Network locations that were high-performing may no longer be profitable. Locations that weren’t attractive before might be your most successful sites in future. This means the elements you need to focus on in your strategy will be entirely different. Those businesses that move fast will be at the front of the queue, and Kalibrate can help facilitate and validate those opportunities.

Overall, fuel demand may be altered for the foreseeable future, so retailers will need to focus their attention on other areas to drive profits.

We’re not going to settle into stagnated demand for a while. We don’t yet know what adoption trends will be. It will take months for the world to settle into new habits. Until then, it’s essential to review your fuel and convenience retail strategy, assess your network’s potential as well as performance, and identify areas of opportunity.

Individually, the hypothesis of how we do business has been rattled for many of us, we are more focused during office hours, and our previous commute time is now used for personal activities.

Similarly, fuel purchasing will be fundamentally altered. It’s absolutely critical to spend time assessing the scope of the change in your markets and your wider network, because micro market changes are likely to happen incredibly quickly. Half of your previous customers may no longer be driving every day, post lockdown. That means your existing strategy might not be the right strategy on the forecourt.

As local market experts, we can ensure you identify these gaps early, and deliver the most positive changes for the future.

Read more from our experts about understanding the impact of COVID-19 on fuel retail using mobility data, how to manage your pricing during a state of emergency, or how to react to an unprecedented climate. Get in touch with one of our consultants to discuss the future of your fuel retail network.

Read more articles about:

UncategorizedSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

How we're supporting our clients (COVID-19)

We want to reassure our clients that, since our teams began working remotely, we have not experienced any disruption to the service we provide.

Related posts

Uncategorized

On-demand demo of Kalibrate Market Intelligence

For fuel retailers that want to gain market share, KMI provides granular detail on competitor performance allowing...

Location intelligence

Kalibrate Planning: hints and tips

Your monthly Kalibrate Planning hints and tips.