Private equity location intelligence from Kalibrate

Kalibrate has extensive experience in identifying whitespace potential, sales forecasting, and portfolio optimization for the world’s most successful brands.

- Leveraging the latest in mobility data to understand a brand’s core consumer

- Understand the quality of the existing portfolio as well as the runway for growth

- Utilizing analysis post-acquisition to provide ongoing strategy and insight

Want to speak to someone?

Private equity experts

Kalibrate understands the needs of PE firms, providing meaningful insights that inform investment theses and support and grow portfolios.

Due dilligence

Kalibrate’s due diligence delivers fact-based, independent assessments that de-risk acquisitions and guide investment decisions, providing confidence and clarity across diverse verticals to support smarter, more certain growth strategies.

Best practice analytics

Many site selection providers rely on outdated approaches to optimizations and runway analysis. Kalibrate leverages comprehensive datasets to help you get an accurate picture of market size and opportunity.

Multiple brands, one platform

Configure the Kalibrate Location Intelligence platform to provide brand-specific views of customer profiles, target markets, optimized network deployments, and growth strategies. On-demand dashboards provide reporting to your deal and portfolio support teams

Solutions for private equity

Our platforms and services are backed by the extensive industry expertise of the Kalibrate team

Ready to learn more?

Reach out to our team

Answer

Tell more more about Kalibrate Location Intelligence

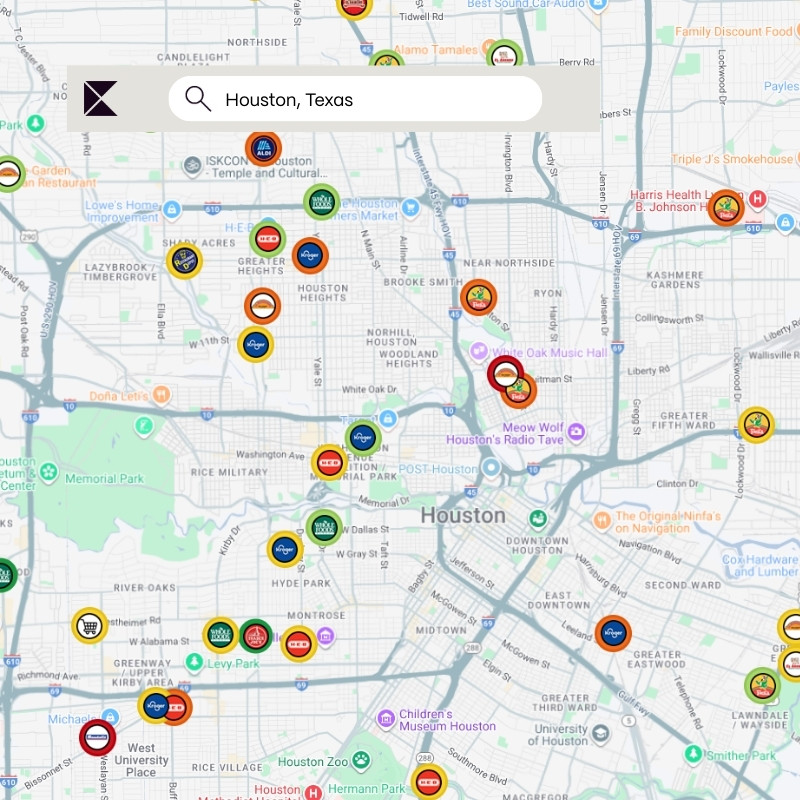

Kalibrate Location Intelligence allows users to view/edit/add data related to your locations and your competition, create trade areas, run demographic and competitor reports, and execute sales forecasts using models that are developed and integrated for your use.

Answer

Does the platform have mobile capabilities?

Yes, Kalibrate Location Intelligence is available as a fully native iOS and Android application. The mobile app gives users the same access to data and reporting as the desktop version, but in an interface that is designed to be touch friendly.

The app is designed to give you access in the field and serves as an excellent tool for capturing data such as store signage, store photos, competitor data, and other notes from the field. Site Tours planned in the desktop version of KLI can be excecuted in the mobile app.

Answer

Can data be imported directly into the platform?

Data can be imported in two ways:

1. End user drag and drop: Microsoft Excel data can be dragged and dropped into the software. As part of this process, data can be automatically geocoded. Once the data is on the map it can be shared with other people in the organization.

2. A secure API can be set up for ongoing uploading and downloading of data.

Answer

How does data visualization, analytics, and reporting work in the software?

Kalibrate Location Intelligence allows users to view/edit/add any first party data related to your customers, locations, or competitors. Users can run demographic and competitor reports, and create sales forecast reports using models that are developed and integrated for use.

In addition, users can visualize thematic maps, view and report on customer loyalty data, and view and report on mobile/foot traffic data. The platform supports bulk reporting/mapping and has an API for an ongoing transfer of data.

Answer

How does pricing work?

The pricing of Kalibrate Location Intelligence is driven by a few factors: the amount of third-party data you want to license, the number of users/seats your team needs, and if you want to include analytics into the platform.

Answer

What support is provided?

Kalibrate provides clients with a dedicated customer success manager that will engage with you during implementation of the platform and beyond. Your customer success manager will get to know your business goals to make sure you’re getting the most from the software.

There is a monthly virtual training session where all Kalibrate clients can join to learn about new features and tools, hear how other clients are utilizing the software, and is an open forum for questions.

Make every growth assumption defensible with industry-leading analytics