The challenge

A major oil company in Southeast Asia wanted to expand its network through acquisition. Seven different brands were being evaluated as acquisition candidates.

They asked:

- How can I tell which of the acquisition candidates will combine best with my current retail network?

- Which acquisition candidate will bring me the most market effectiveness for the least capital investment?

The solution

With the Acquisition Analysis from Kalibrate, 39 markets were consolidated into one database, representing 46% of the total outlets and 58% of the total volume for that country. The analysis consisted of three different phases: Pre-Consolidation, Overlap, and Post-Consolidation.

- Pre-Consolidation

Candidates for acquisition were prioritized so that the best candidates could be further investigated. Kalibrate’s proprietary statistical formulations were used to simulate the rebranding of the seven different brands to that of the client brand. Each scenario resulted in a report of projected impact on the client’s market share. Each brand was ranked in terms of its acquisition attractiveness to the client, based on the new total volume. The overall purpose of this phase was to prioritize the brands so that the best candidates could be further evaluated in subsequent phases.

- Overlap

This phase determined the number of acquisition-candidate outlets located within ½ mile, 1 mile, 2 miles, and 3 miles of existing client outlets. Brands that interfered least with the client’s existing network and that also provided an attractive incremental volume gain were identified.

- Post-consolidation

Kalibrate identified the “look” of the retail environment after the industry closed low-volume, small-lot outlets, and the client eliminated outlets that would be interfering with one another if the proposed acquisition occurred. A set of rules was developed that were applied to the marketplace through a proprietary spatial interaction model. The rules identified the site characteristics for the industry closure scenario and for determining which overlap sites to divest.

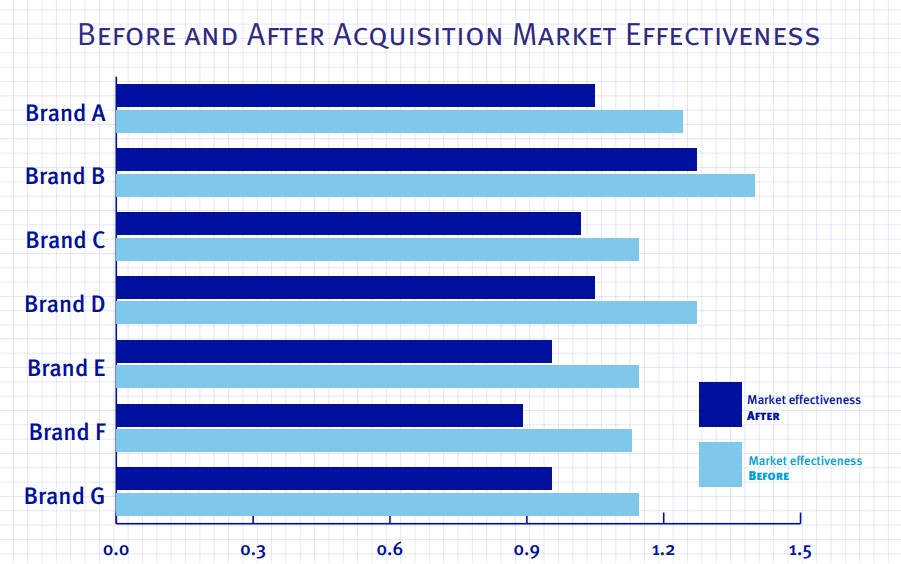

The rule base was also used to simulate changes to facilities, pricing postures, and merchandising practices for those acquisition candidates. The results provided the client with before and after acquisition data on total volume, market share, outlet share, and market effectiveness.

The results

Kalibrate’s Acquisition Analysis identified Brand B as the candidate that would yield the optimal market share and market effectiveness when combined with the client’s existing network. The client completed its due diligence and completed a multi-country acquisition of the recommended best candidate.

With the Acquisition Analysis, the client was able to:

- Identify the acquisition that would provide the best synergy with its existing network.

- Evaluate volume projections for the proposed acquisition scenarios, supporting a more thorough due diligence economic analysis.

- Gain insight into which acquired outlets to divest and which refurbish, making it possible to determine the economic impact of the required changes.