The challenge

The challenge

National deregulation of petroleum pricing created a new competitive landscape for established companies. Kalibrate’s

client needed to assess the effectiveness of their retail operations and pricing processes against new competitors, both domestic and global brands new to the country. With that competitive benchmark in place, the client needed to raise the level of sophistication on retail network planning and pricing processes.

They asked:

- k.

- How do I continue to succeed now that competitors are opening locations near mine?

- How do I keep them from luring my customers away?

- How do I know my outlets are performing as well as they should?

The solution

The solution

- Benchmark performance through a 7E assessment. This gave the client a benchmark for effectiveness in the 7 Elements of

Fuel Retail Success. Strengths and weaknesses were identified, pointing to areas where the retailer needed more capabilities and could gain advantage through capital investment. - Advance client capabilities with best practices training and workshop. Kalibrate conducted workshops to teach the client best practices in retail network planning and related disciplines aimed specifically at the client’s strategic priorities.

- Implement tools for ongoing assessment and strategic alignment. Kalibrate location solutions enabled the client to conduct an ongoing assessment of each retail location’s effectiveness. Underperforming locations could then be further analyzed, and improvements made. Overachieving sites could also be identified and analyzed for best practices that could be applied to other sites in the network.

The result

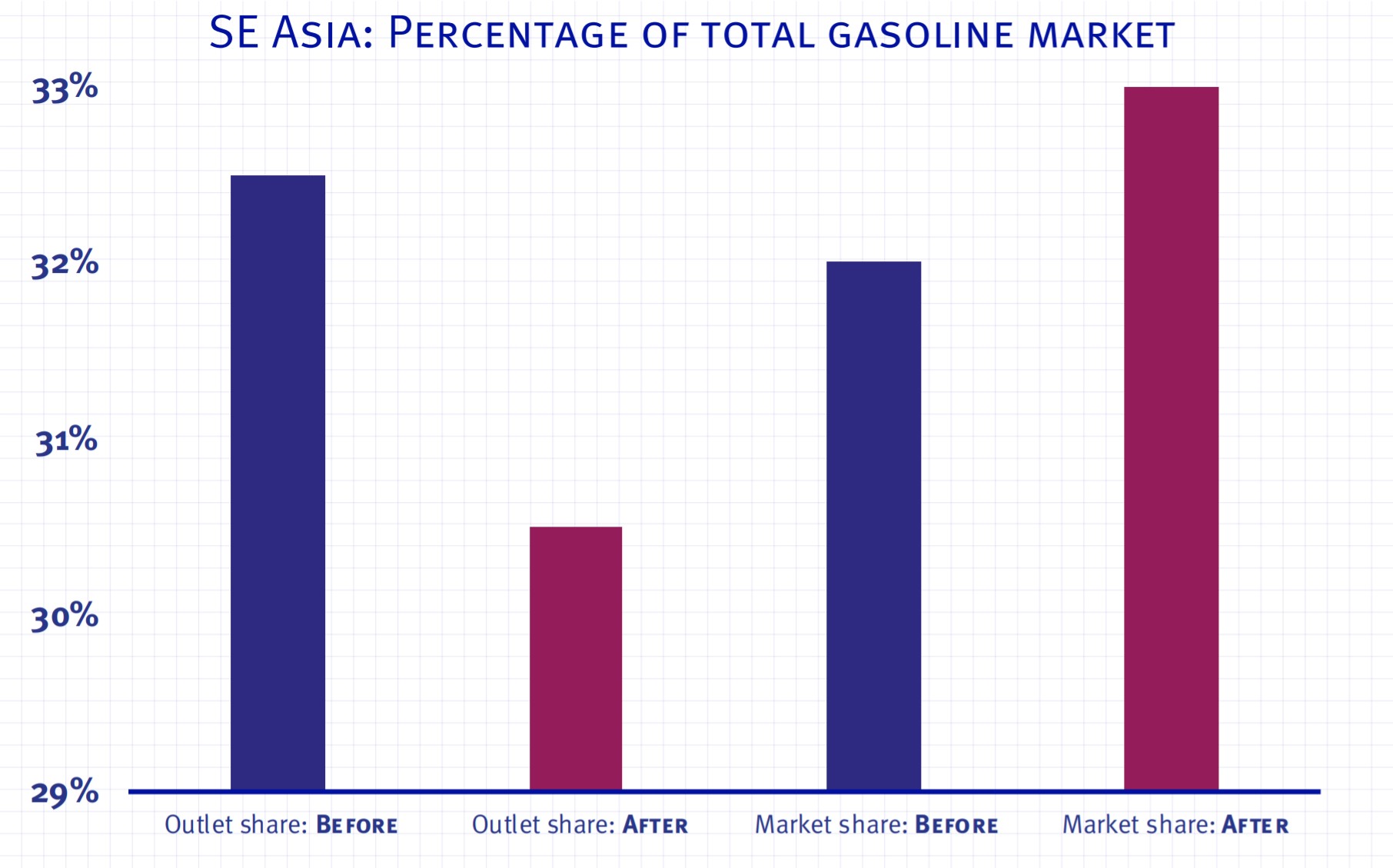

The company is now the leader in market effectiveness – the measure of how efficiently a retailer is running its network – and has the highest average gasoline volume per outlet.

Deregulation unleashed an evolution in the market that kept the client on a path of continuous assessment and adjustment of operations. In spite of the pace of change, the client has consistently improved its gasoline market share. The client has achieved volume performance above the market average and improved its gasoline market effectiveness ratio, even with fewer outlets than the market average. Overall the client’s market share increased 1.2%, while outlet share decreased 2.1%.