Canadian gas prices explained

Kalibrate Canada publishes monthly price snapshots that report changes in gasoline and diesel prices on a month-by-month basis.

In July 2025, they reported that the highest recorded gasoline price, found in Vancouver, was 170.9 cents per liter (cpl), while the lowest, in Sarnia, was 124.9 cpl. During the same month, prices in some markets rose by as much as 24 cpl, while others dropped by 6 cpl — a significant range.

For fuel retailers operating across multiple regions, this level of volatility underscores the importance of a clearly defined pricing strategy.

These price variations aren’t random. Four key factors typically shape local fuel prices:

- Tax structures

- Regional supply logistics

- Competitive landscapes, and

- The unique characteristics of each station.

In this blog, we’ll explain these drivers, using real-world data from Kalibrate’s market insights to explain why fuel pricing in Canada is anything but uniform, and what retailers can do to navigate differences and effectively benchmark their own comparative performance.

1. Taxes and Regulations: Federal, provincial, and municipal layers

Taxes account for roughly one quarter of the gasoline pump price in Canada, and can vary not just by province, but sometimes even by city.

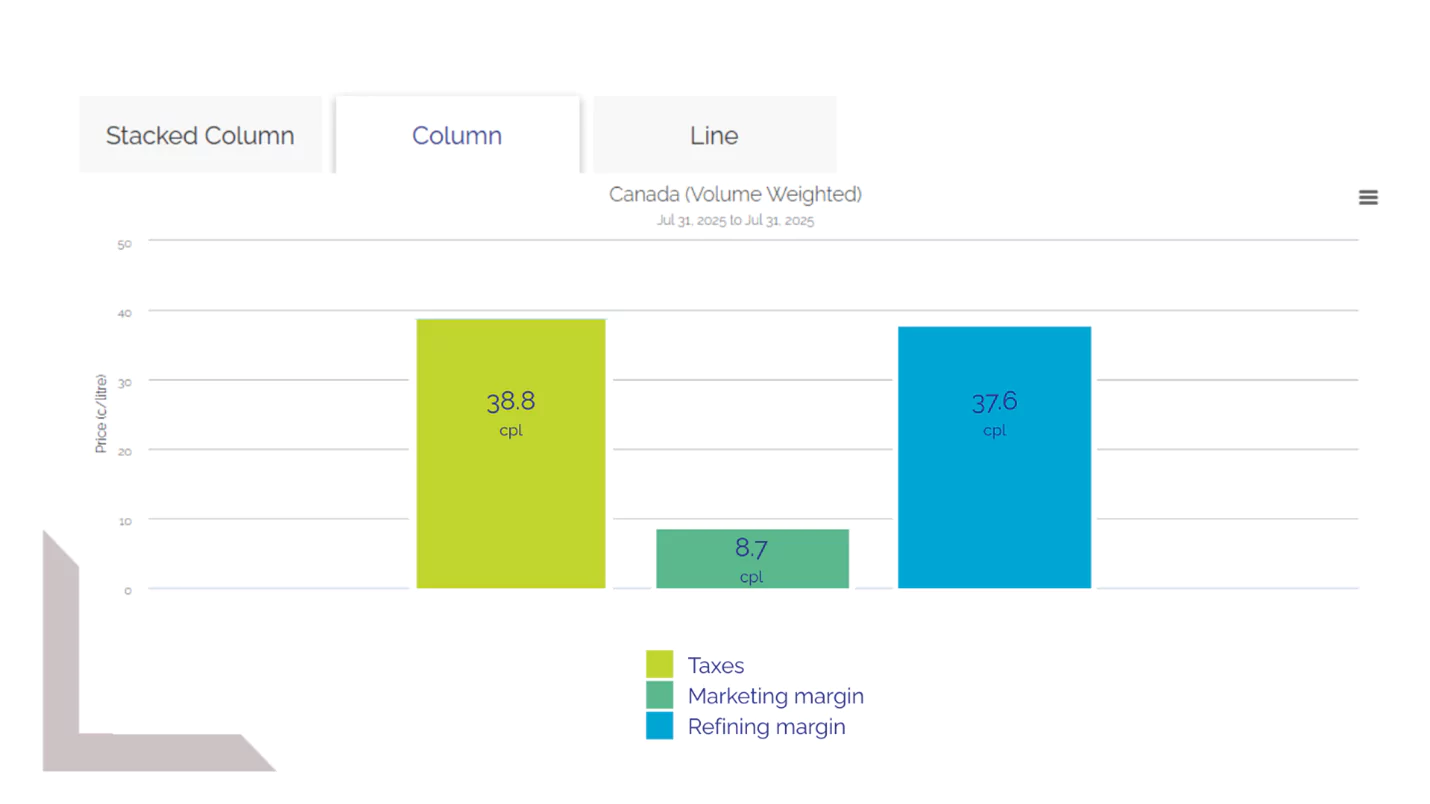

As of July 31 2025, taxes account for 38.8 cpl of the average gasoline pump price.

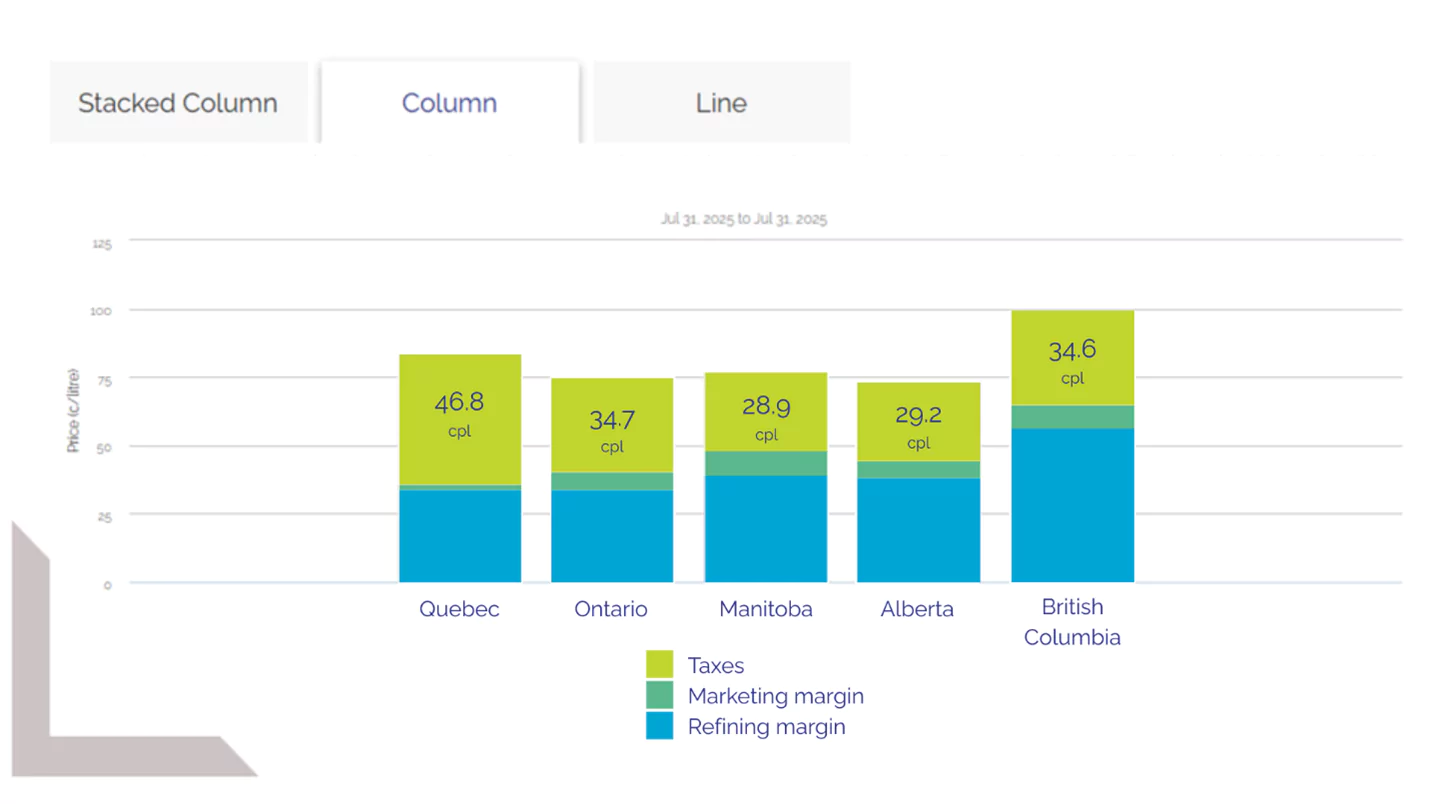

The tax component of the price of gas can differ widely due to differing provincial petroleum and sales tax rates, and in some cases, municipal petroleum taxes. For example, as of July 31 2025, the average pump price in the province of Quebec had among the highest total tax component, above 45 cpl, while Manitoba was among the lowest at 28.9 cpl.

In Kalibrate’s Q1 2025 report, it was noted that fuel tax changes had a profound impact on retail prices. For example, the removal of the federal carbon tax in every province except Quebec on April 1, 2025, led to an immediate and notable dip in average gasoline prices. By the end of Q2 2025, the average retail gasoline price had dropped by 15.8 cpl from the end of Q1.

The provinces of British Columbia and Quebec each have established programs to reduce greenhouse gas emissions through market-based mechanisms that put a price on carbon.

British Columbia has the Low Carbon Fuel Standard (LCFS), and Quebec has a Cap & Trade System. Although the exact amount these programs add to retail pump prices is unknown, it can be assumed that some, if not a significant portion, of the cost for these programs on suppliers and producers of petroleum products is passed on to consumers, as shown by these provinces’ higher wholesale prices compared to provinces without carbon reduction programs.

Besides taxes and carbon pricing programs, some Canadian provinces have fuel price regulations that set a cap, and in some cases, a floor, on retail pump prices. These regulations are used in the Atlantic provinces: New Brunswick, Nova Scotia, Newfoundland, and Prince Edward Island.

While they generally do not result in lower pump prices compared to other provinces, fuel price regulation helps provide stability in fuel markets — addressing a common concern among consumers.

2. Location and logistics: Proximity to supply

Geography and infrastructure play major roles in shaping local fuel prices.

Cities closer to refineries, like in Alberta or Southern Ontario, often benefit from lower transport costs due to proximity to primary distribution terminals with direct access to refined product pipelines.

While, rural or remote stations, typically face higher delivery expenses due to a larger distance to primary distribution terminals or bulk plants that are supplied by rail or transport truck rather than pipeline, which translates into higher retail prices.

Refinery capacity and regional demand play a role in pump prices. Canada’s coastal markets are a great example. The East Coast is home to Canada’s largest refinery, with the region consuming less refined products than it produces, exporting the surplus to the U.S. East Coast.

In contrast, Canada’s West Coast’s refinery capacity is lower than consumption. They rely on imports, and compete with markets along the U.S. West Coast for supply. As a result, gasoline prices on the West Coast are often higher than on the East Coast, with refinery capacity being one factor behind this difference.

3. Competition and station characteristics: Consumer choice matters

The presence of nearby competitors and the nature of a site’s amenities, like convenience stores, restaurants, or EV chargers, can influence fuel pricing strategy and customer value perception.

Stations in dense, competitive areas often use fuel pricing to attract customers and drive in-store sales, while stations in lower-traffic or isolated locations may need to maintain higher margins.

Kalibrate’s 2024 Canadian National Retail Petroleum Site Census highlighted the growth in the number of stations with convenience stores, car wash, and quick service restaurants.

Stations with strong ancillary offers have more pricing flexibility, using promotions or loyalty programs to increase volumes while protecting overall profitability.

Average site throughput is a crucial factor explaining differences in pump prices at gas stations in nearby markets, and sometimes even on the same street. If all other factors, such as fixed costs, are equal, a gas station with higher annual throughput can support a narrower retail margin and lower retail prices. Additionally, stations selling more gasoline can often secure larger purchase discounts, further lowering retail prices.

4. Market forces: Crude, currency, and seasonal trends

Like all countries, Canada’s fuel prices are influenced by global and regional macroeconomic factors. Global crude oil prices, exchange rates (especially CAD/USD), and seasonal demand patterns all play a part.

Crude oil prices make up a significant part of the retail pump price, accounting for about 40% of the pump price in 2025. Oil price movements are mainly influenced by global factors, such as supply and demand fundamentals, and often by geopolitical concerns that threaten oil supplies or production.

The value of the Canadian dollar can also affect pump prices, since wholesale gasoline prices between Canada and the U.S. generally remain at par after accounting for exchange rates. During the first quarter of 2025, the Canadian dollar’s value against the U.S. dollar dropped to its lowest level in two decades. A weak Canadian dollar leads to higher pump prices.

Retail gasoline prices follow a distinctive seasonal pattern in Canada: Rising in spring and summer and falling in fall and winter. In spring, Canadians emerge from hibernation and start driving more. At the same time, many refineries tend to carry out seasonal maintenance during spring and fall.

When refinery capacity is reduced while demand begins to increase, retail prices are pressured higher. There are also seasonal differences in gasoline blends between summer and winter. Summer-blended fuel, which contains more additives to reduce evaporation in hotter temperatures, also contributes to higher gasoline prices during the summer months.

How Kalibrate helps retailers react with speed and precision

Understanding what drives fuel price variation is one thing, acting on it is another. That’s where Kalibrate’s data-driven fuel pricing and market insights solutions come in.

Stations using Kalibrate’s solutions can:

- Adapt instantly to tax changes or global price shifts, ensuring they remain competitive while maximizing margins.

- Benchmark against local competitors using Kalibrate’s granular market data to make smart pricing decisions tailored to hyperlocal conditions.

- Leverage station strengths such as retail or foodservice offerings by adjustng fuel pricing strategies that drive more visits and higher total revenue.

- Track performance over time using Kalibrate’s in depth market data to track performance against competition.

Turning price variation into a winning strategy

Gasoline and diesel prices in Canada will always be shaped by a complex mix of taxes, geography, infrastructure, market forces, and local competition.

For fuel retailers to remain competitive, protect margins, and uphold your brand promise, you must have a pricing approach that balances local market expectations with your overall brand position.

Customers associate your brand with a certain price point and value proposition — especially in regions where price sensitivity varies dramatically. A well-defined pricing strategy that is aligned with your brand and supported by robust insight, processes, and tools, allows you to respond to market shifts quickly and consistently — ensuring you attract volume, maintain customer trust, and protect profitability across every market.

To stay competitive, protect margins, and deliver on your brand promise, fuel retailers need a pricing strategy that strikes the right balance between local market dynamics and overall brand positioning. Customers connect your brand with a specific price point and value, particularly in markets where price sensitivity can vary widely.

A clear, consistent pricing approach, backed by strong insights, efficient processes, and the right tools, helps you react quickly to market changes. This consistency builds customer trust, drives volume, and safeguards profitability across every location.

With Kalibrate’s robust pricing intelligence and real-time insights, retailers can respond faster, price smarter, and deliver more value.

Want to see how your station compares or how you can optimize your pricing strategy?

Learn more about:

or contact Kalibrate today

Read more articles about:

Fuel pricingSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

Kalibrate Canada: 2025 half year data available now

Data collected by Kalibrate Canada from roughly 7,000 gasoline stations across Canada shows that the average...

Fuel pricing

April 2025. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....