What is a trade area?

Retail trade area analysis, in its simplest definition, is the study of the geographic area from which the vast majority of revenue (or customers) originates.

It is not at all unusual for retailers, restaurants, and service and healthcare providers to serve multiple disparate trade areas depending on the trip origin or destination associated with each customer. For example, most trade areas associated with retailers are residence-centric; that is, most retail shopping trips originate from each customer’s place of residence. Conversely, restaurants almost always serve multiple trade areas which typically reflect not only customers residing in the vicinity of a restaurant but also customers working or shopping near the restaurant.

Factors to consider when defining trade areas

It is important to not simply rely on generalizations when conducting trade area analysis. Retailers should consider numerous factors such as drive-time, the presence or absence of other units in the same brand, and urbanicity. They should also look at barriers that would naturally impede access to a location — natural barriers like rivers or lakes, or non-natural barriers like a major highway.

Ultimately, the significance of these factors is implicit in the actual sales or customer distributions associated with each location. Based on a rigorous analysis of individual existing locations, retailers can quantify the extent to which each of these factors “matter”.

Let’s consider three approaches to trade area definition and rank them in terms of how representative they’re likely to be of the reality of the location’s market.

- Good — concentric mile ring(s) around the location

- Better — concentric drive-time ring(s) around the location

- Best — uniquely modeled and defined trade areas for an individual location

If you have a location that is situated in a suburban area on the periphery of a major metro area, we’ll very often see the sales density (and trade area) for that location extend 20-30 minutes into the country, but only 10 minutes back into the city. That’s difficult to account for with concentric ring methodologies, and a big part of why retailers should follow the data and take the more rigorous approach.

Putting trade area analysis to practice

It is really critical to understand that not all consumers patronize a brand in the same way. Consumers who reside or work locally are those that have a convenient opportunity to utilize a brand’s services. Their convenience-driven visits are foundational to customer profiling, predicting future sales, and estimating cannibalization, and it is these consumers upon which trade area extents should be based.

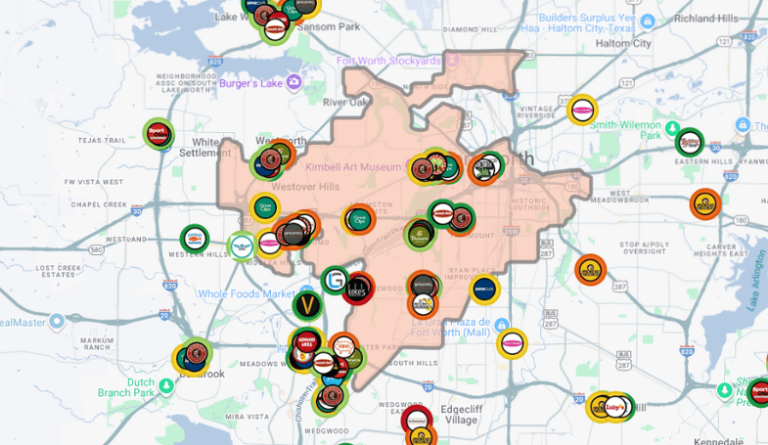

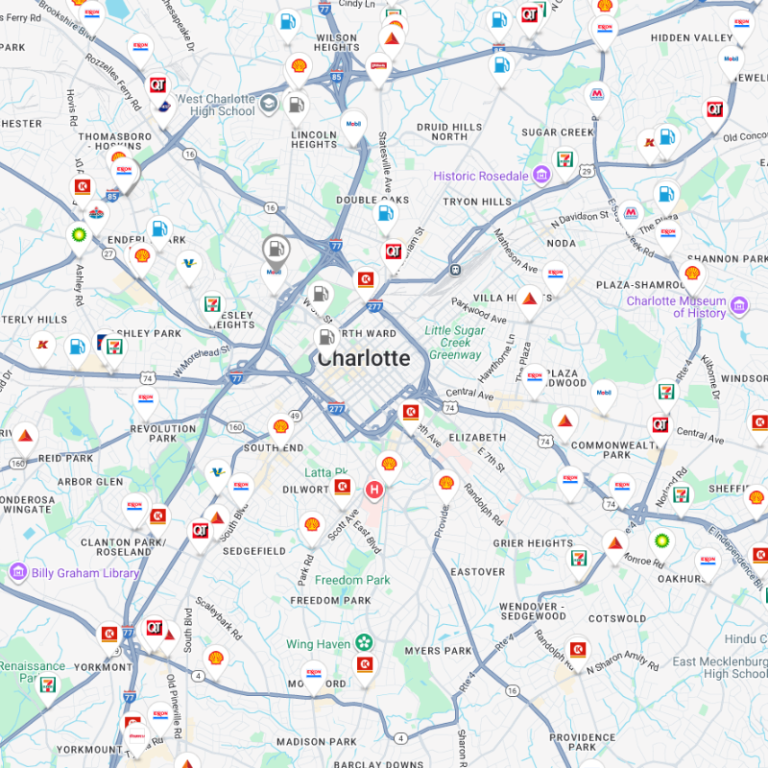

Consumers coming from some larger distance — travelers from out of town, visitors to a nearby attraction — defy those patterns of convenience. So, the trade area can be used as a “line of demarcation” to isolate individuals that patronize a location based on convenience versus those that had something else draw them to the area. Another practical benefit is that it provides an easy-to-use visual tool that market planners can use to identify infill opportunities and to visually approximate the impact of new unit openings.

Understanding the trade area extents of existing units and how they vary by market size, urbanicity, location type (mall/off-mall), prototype, etc. provides a means by which one can estimate the extent(s) of future locations.

Having defined trade areas for existing store (one of the first models Kalibrate develops) is a model that accurately predicts these known trade areas extents.

Knowing that we can accurately model the extent of existing trade areas provides us with confidence that we can accurately predict what the trade areas for future units will be. It is these models that are leveraged as a first step in generating a forecast for any future location.

Why are accurate trade areas so important?

Very simply, if trade areas for future locations are over defined — regardless of the rigor used to develop a forecasting model — you’ll over-forecast that location’s potential. Conversely, you’ll under-forecast if the trade area is under defined.

The gold standard approach considers both the characteristics of the location and the characteristics of surrounding neighborhoods when estimating extent, because this is likely to provide the most accurate results.

However, flexibility is important here — there are always going to be unique situations when applying a model, and being able to adjust on-the-fly for location market conditions is part of how we’ve built our forecasting platform. And with mobility data, it’s possible to study the sales distributions and trade areas for competitors or shopping centers near a unit under consideration to serve as a point of validation against the trade area you define.

Competitive Insights demo – retail trade areas

Interested in learning more?

Learn how we use white space analysis to conduct trade area definition