Location-based marketing: How marketers can capture value from location analytics

Marketers should pay attention when their firms have contracted for a real estate site selection model. There are multiple benefits to the savvy marketer that flow naturally from site selection analytics. Let’s take a quick look at some of the best practices for leveraging location-based marketing across two key components—the trade area and the customer profile:

Trade area insights

A key element of site selection analytics in location-based marketing is defining trade areas. While there is no universal standard for defining trade areas, they represent the geographic area that accounts for the majority of a store’s sales, and within which a store achieves its highest market share levels. (We have used the term “store” for convenience purposes, although this applies equally well to restaurants, clinics, practices, and all other consumer-facing brick-and-mortar locations). Trade areas enable the modeler to quantify the impact of locational convenience, urbanicity, demographic and psychographic characteristics, competition, and other relevant factors on that geographic area most significant to a store’s performance.

When marketers think about trade areas (if they do at all), they generally think in terms of a pre-determined radius around any given brick and mortar location. While a trade area defined on a radius is better than no trade area at all, there are inherent pitfalls in this way of thinking:

- A radius based trade area may overlook geographies that disproportionately contribute to sales, and likewise, may include geographies that don’t impact sales

- Radii are often based on a simple analysis of customer ZIP Codes, which if not statistically validated, may produce a “false positive” trade area—one that seems to capture customer draw, but which either over-or under-estimates the size of the trade area

Let’s take an example:

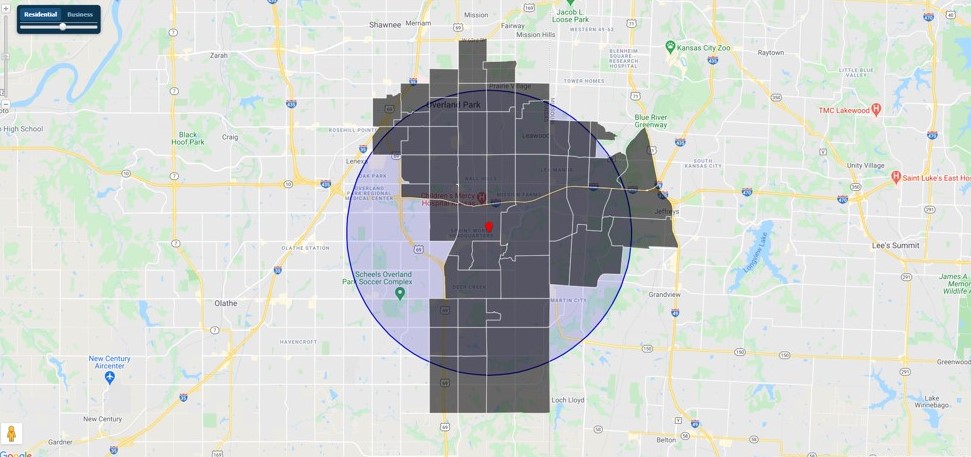

Compare the hand-drawn, statistically derived trade area (the gray shaded block groups) to the radius (the blue circle). It’s clear that important areas of customer density identified in the hand-drawn trade area are found outside this radius-based trade area, to the north, south, and east. Also clear is the fact that the radius includes significant geography from which this location (the red point) does not draw customers, whether because of the presence of a sister store, a large number of competitive substitutes, a different consumer demographic, or natural boundaries.

Marketers using a radius-based approach will end up investing scarce promotional resources in areas unlikely to yield a satisfactory return, and will miss other areas of high potential.

Location-based marketing best practices for leveraging trade area insights:

- Concentrate marketing investment on households that fall within your organization’s defined trade areas, and particularly those areas most proximate to the store. Customer proximity to your locations is a key driver of marketing success

- Use addressable media (household level digital, direct mail, etc.) that can be distributed within trade areas

- Avoid saturation strategies, which might sound efficient, but which often end up costing more when measured on a cost-to-acquire (CTA) basis (keep reading for more on this topic)

- Keep in mind that trade areas vary from location to location. Urban trade areas are generally much smaller than rural trade areas. Locations with high degrees of competitive intensity can be smaller than those where competition is sparse. Trade areas are not “one size fits all”

Profile insights

Another key element of site selection analytics in location-based marketing is the customer profile. The profile identifies those household-level characteristics of customers based on their relative contribution to revenue and/or foot traffic. With a deep understanding of the customer profile and access to the right data, marketers are able to make a wide variety of fact-based decisions:

- Improve targeting strategies, and deliver marketing messages to those households most likely to respond to the brand’s value proposition

- Position their messages in ways most likely to resonate with the target audience

- Quantify the addressable universe of prospective households

- With known customer data, analyze brand penetration and market share at discrete levels of geography

- Inform media buys, optimizing reach and frequency

- Invest marketing resources as a function of the identified customer potential

Profiles include detail on a variety of household characteristics—demographic, financial, behavioral, attitudinal, and lifestyle. For an example brand, the table below shows the customer contribution based on a sample of twelve MOSAIC lifestyle groups.

These twelve segments represent 78.4% of the brands customers, but 62.4% of total US households, for an overall index of 126. A customer acquisition campaign targeting only those households that fall within these twelve segments can be expected to be 26% more effective compared to a mass or saturation campaign targeting the general population. Put another way, forecasted return on ad spend (ROAS) would improve by 26%.

We can further leverage this insight with an even more targeted approach. Let’s take just the top five segments for this brand:

This more tightly targeted approach would be expected to yield an ROAS improvement of 97%, for all practical purposes double that of a mass campaign.

While many brands have proprietary segmentation schemas—or personas—in place, most of these share a common flaw—they’re built from “the top down” and cannot be applied at the household level. The advantage of leveraging a profile based on household level datasets is a “bottom up” approach, where every single US household can be evaluated based on its unique characteristics and assigned to marketing segments or target audience groups.

Location-based marketing best practices for leveraging customer profile insights:

- Focus marketing efforts on only those highest that have the tightest fit with the identified customer profile

- Move from “saturation targeting” to household level addressable targeting, particularly in digital and direct marketing channels

- If you have a proprietary customer segmentation or persona schema, map it back to discrete household level variables so your segments can be applied and analyzed at the household level

- Use MOSAIC profile descriptions to inform media buys, particularly mass media

Read more articles about:

Location-based marketing contentSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

Market Optimizer: Demo video

Market Optimizer allows users to strategically grow their network in existing markets while balancing revenue...

Fuel pricing

The Kalibrate news round-up: June 2025

In this monthly feature, we look across the industry and mainstream news to uncover stories of note that we think are...