What is retail cannibalization and how can you avoid it?

During expansion of a network or lead up to an expansion, concerns and questions come in all shapes and sizes. Which locations make the most sense based on your market and your strategy? Do you keep your same product offering at every new site and reach your volume targets, or do you make changes? And then there’s the big question: What should you do about retail cannibalization within your own network?

That last one might be the most unwieldy concern of all. Retail cannibalization can hurt your sites and suppliers. Then again, it depends on your goals; if you are expanding to gain market share, cannibalization will not be the primary concern. If you are expanding to grow volume and margin, it should be at the forefront of your worries.

Fortunately, you can ease this worry with information. Your retail network doesn’t have to suffer due to ill-planned expansions.

When does retail cannibalization occur?

Whenever there is a certain number of similar sites in a geographic area, all drawing on the same demand, retail cannibalization can become a concern. Multiple sites in one geographic area is only an issue when the market cannot bear them. In other words, enough demand must be present for suppliers and retailers to succeed.

What can be somewhat confusing about cannibalization, though, is that your network generally gains overall volume with the addition of another site. Initial reports could indicate an increase and you may be inclined to believe this is a positive trend. But where is the volume coming from? Is it being taken from one of your other sites, or is it all new customers? In certain geographic proximities, the former is more likely.

What can you do to prevent cannibalization?

Best-practice retailers ensure their site strategies are consistent with their market objectives. If you already have stores in a market that is being considered for expansion, each store will need to be evaluated while identifying new sites to ensure the plan considers what is best for your entire retail network. A plan may appear to be strong when viewed for a single outlet; however, when evaluated with respect to the impact on your entire retail network, the opposite could be true. You could literally be stealing volume from one of your other sites if you aren’t careful.

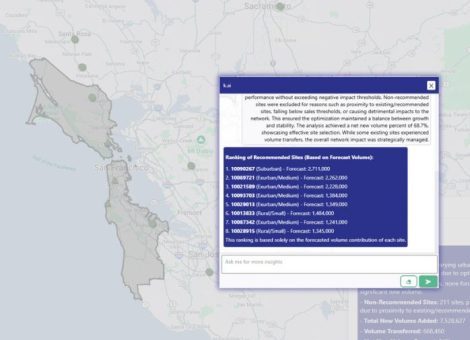

Finding the correct positioning for each site you build must be your ultimate goal (unless, as mentioned, you are only trying to capture market share in a particular geographic area). The most important step you can take toward this goal is gaining information about the proposed expansions and running what-if scenarios. Taking into account data points like the number of parking spaces, number of pumps, lot size, merchandise offerings, average sales estimates, etc. can help you gain an understanding of what the overall volume gain will be at this new site and whether or not that detracts from the success of your existing sites.

Because of the massive complexities of understanding how a change at one site will impact another (or multiple other) sites, modeling these what-if scenarios is a job for a predictive model.

- What will happen if you build a new large-format store or what if you only build a medium-sized store?

- What if you open a new store and close one (that seems to be underperforming) in the same vicinity?

- What if you open five new stores vs. two?

Predictive capabilities allow for careful planning. Careful planning ensures you position your sites correctly — not only to avoid retail cannibalization but also to make sure you can survive against future competitive threats.

See how white space analysis can help you avoid cannibalization

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...

Fuel pricing

June 2025. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....