A challenge all retail and restaurant chains face is the desire to maximize profitability and company valuation. Numerous factors contribute to the value of a company, including gross profit margins, cost controls, distribution efficiencies, and comp sales growth. However, one of the most important considerations is the build-out potential for a retail or restaurant chain – how many more profitable units can be supported? Kalibrate has conducted hundreds of white space analyses on behalf of retailers, restaurants, and private equity firms, with a primary concern: the desire to quantify a chain’s growth potential.

This blog highlights the importance of white space analysis and how it can benefit your business strategy and future growth plans.

What is a white space analysis?

All retailers interested in growing their store footprint need to assess the sales and profitability associated with a proposed location. Conducting an optimal white space analysis, however, involves a more sophisticated approach – in addition to quantifying sales and profit potential for individual locations, a retailer must also determine the combination of additional sites that will maximize the total supportable store count.

For example, deploying a new store in one location in a small market may inadvertently preclude the deployment of a second store in the same market.

How do you conduct successful white space analysis?

Successful white space analysis is dependent on the development of an accurate sales forecasting model that can be used to project sales for proposed locations. Sales forecasting models are calibrated using data from existing store performance and quantify how factors such as population, consumer demographic and psychographic characteristics, road accessibility, competition, and site characteristics influence sales. Depending on the concept and type of business, other factors may be relevant (for example, home improvement stores may be as reliant on trade customers as on household consumers).

1. Develop an accurate sales forecasting model

A sales forecasting model can be applied to estimate sales for every potential future deployment opportunity. This does not mean evaluating all ~150 million real estate parcels in the U.S., but it does mean that every reasonable deployment opportunity is considered. For some tenants, this might include all shopping centers and all competitive retailers in the U.S.; for others, such as convenience stores which are not reliant on retail synergy, this might focus on competitors and all major road intersections in the U.S.

Once the appropriate set of potential deployment opportunities has been identified, the forecasting model can be used to generate a top-line sales forecast for each. Kalibrate believes that it is critical to identify opportunities that truly reflect where a retailer could operate. Using the center of ZIP codes or census tracts as potential deployment opportunities will not be of much use to a retail estate director if those points fall in a cemetery or housing subdivision. Furthermore, considering freestanding locations for concepts that rely on retail synergy to drive sales is also unhelpful.

2. Set minimum sales revenue targets

Each retailer must then determine the minimum sales or net new sales required to support a profitable store. This is a critical component of any white space analysis, since opening an unprofitable store can reduce the value of the company. Obviously, retailers will not be able to factor in the specific lease or land acquisition terms associated with each potential deployment opportunity, but existing operational experience can be used to establish minimum sales parameters.

For example, higher rents and wages in urban areas may mean an urban store must generate at least $2,000,000 to be viable, compared with $1,600,000 for a suburban location or $1,400,000 for a rural one. In addition, if certain markets have higher operating costs than others, then the minimum sales threshold can be further refined by market.

Once these minimum sales parameters have been established, the retailer can identify those future deployment opportunities that exceed the minimum threshold and therefore merit consideration.

3. Consider the impact of cannibalization

The next step is to account for cannibalization, or the sales transfer impact that the proposed store is projected to have on all existing and planned stores. Acceptable levels of cannibalization can vary – a retailer might be more willing to subject a higher volume store to a given impact than a lower volume store, lest the lower volume store be driven into unprofitability.

Cannibalization impacts can be accounted for in one of two ways:

- Establishing both minimum sales and maximum cannibalization levels

- Calculating the net new sales associated with every potential site (projected sales less projected cannibalization impacts).

When it comes to white space analysis, the focus on cannibalization is different for corporate-owned stores vs. franchisees. Corporations opening and operating their own stores focus on the aggregate impact to company profitability and valuation – if a proposed store has a 25% cannibalization impact on a nearby unit but nonetheless results in an increase in corporate profitability, it can likely be supported. Conversely, individual franchisees are only concerned with the cannibalization impact on their specific store – the aggregate impact on corporate profitability is of little or no relevance to them.

Once the universe of potential deployment opportunities that meet the minimum sales and maximum cannibalization thresholds have been established, a retailer must identify the combination of those opportunities that will maximize overall profitability. In addition to accounting for the impact of those opportunities on existing and planned stores, their impact on one another must also be considered – two high-volume opportunities located across the street from one another likely cannot be both supported. The algorithms required to conducted optimization analyses are very complex.

How does white space analysis benefit retailers?

The result of a successful white space analysis has two primary benefits for a retailer:

- Build-out potential and valuation: A white space analysis offers valuable insight into the ultimate sales and profitability for a retail chain. This information is of benefit to the retailers themselves and helps plan for future growth, such as understanding how much capital they’ll need for future expansion, and the scale of a retail estate department or brokerage network they’ll require. It also benefits investors, as the chain’s build-out potential will help determine how much they should pay for or invest in the business.

- Store deployment roadmap: A white space analysis will provide the real estate team with specific guidance concerning where to focus on future real estate deployment opportunities. Rather than simply reacting to whatever opportunities are thrown at them by real estate brokers, they can proactively guide brokers to areas with real potential. While this may initially label the white space analysis results as “deal-killers” (“They automatically turn down 80% of the sites I bring to them”), the process ultimately becomes more productive and efficient for internal real estate teams avoid wasting time on unsuitable locations, and third-party real estate brokers benefit from a higher approval rate on opportunities they bring to their clients.

How do you develop an optimal built-out strategy?

White space analyses are most straightforward when the format and geographic focus for future expansion is consistent with past deployments. However, certain situations require more experience and deeper expertise to determine an optimal build-out strategy.

Any restaurants are dependent on nearby employees to help drive lunch traffic. Locational convenience is particularly important for this customer segment – most employees have a limited amount of time for lunch and can’t afford to spend a lot of time getting to and from a restaurant.

New store formats

Retailers continually refine their store formats to enhance the customer experience. While minor adjustments will generally not have a measurable impact on a white space analysis, significant changes can do so. Many retailers have experimented with smaller-format concepts, with the goal of deploying in-fill stores in existing markets, or opening stores in markets previously considered too small to support a store. In these cases, care must be taken to ensure that sales assumptions for a new format are reasonable and realistic. For example, shrinking a store’s footprint by 30% but keeping the same sales projection is unlikely to be achievable. Conversely, doubling a store’s size won’t usually double sales, although there are exceptions, such as Walmart discount department stores adding food to their Supercenter concept.

Urban/rural deployments

Many retailers who have traditionally focused on suburban locations often consider expanding into either rural and/or urban markets in an attempt to increase their growth footprint. However, most concepts perform differently by urbanicity, with rural locations typically having larger trade areas and higher market share, and urban locations tend to serve smaller trade areas with lower market share due to denser competition and limited space. The key to adjusting a white space analysis to accurately assess deployment opportunities in new urbanicities is to be realistic in estimating how much performance will vary by urbanicity.

Regional variations

Some restaurants can be highly sensitive to regional tastes and preferences. Certain items like buffalo wings have broad national appeal – Buffalo Wild Wings units are deployed across the U.S. However, others remain tightly rooted in local tastes. For example, in the case of Cincinnati-style chili, Skyline Chili and Gold Star Chili are the dominant chains serving 3-ways and 4-ways. Gold Star units are almost all clustered in the greater Cincinnati market, while Skyline has been a bit more geographically adventuresome, with units in Columbus, Indianapolis, Fort Wayne, and even half-a-dozen locations in Florida. On the extreme end, concepts like Runza, built around a distinctive Nebraska sandwich, remain almost exclusively within their home state with all but four of their units located in Nebraska.

International expansion

Perhaps the most difficult use for a white space analysis is to estimate how many units can be supported in other countries. This is because the factors that influence store performance – demographics, psychographics, competition, site characteristics – can vary significantly from one country to another.

Is white space mapping the same as white space analysis?

No, white space analysis and white space mapping are not the same, though they are closely related and the terms are often used interchangeably.

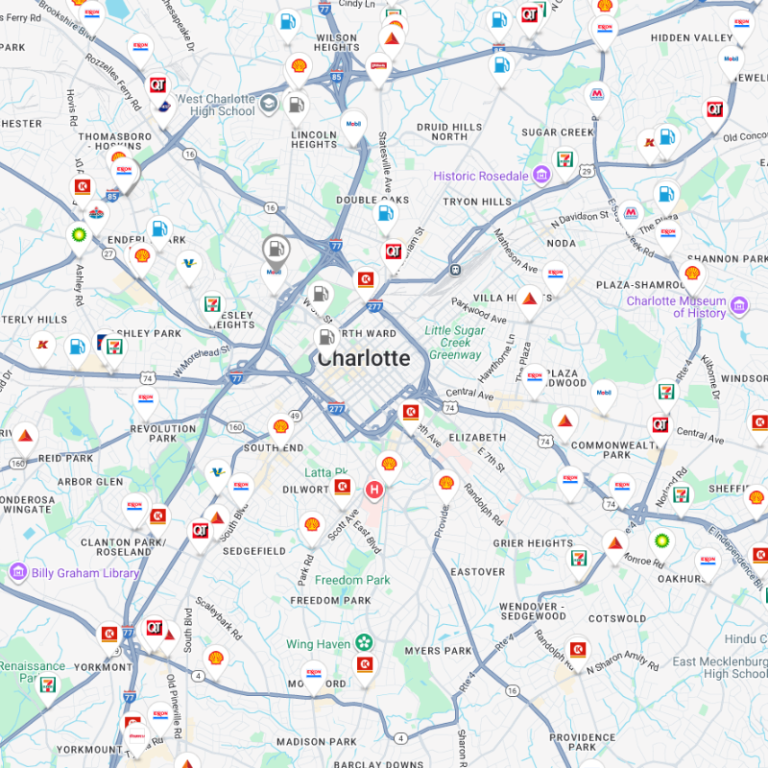

White space analysis is the broader process of identifying opportunities by looking for gaps in the market or between a company’s products and customer needs. On the other hand, white space mapping is a specific technique, or a part of the analysis, where these identified opportunities are visually represented, often on a location map or dashboard, to show areas of potential growth.

By combining both approaches, businesses can gain a clear, actionable view of market opportunities plus areas and locations for growth, while helping them prioritize initiatives, optimize product offerings, and strengthen customer relationships.

Looking for expert white space analysis?

At Kalibrate, we conduct expert white space analysis to help your business make strategic location decisions, target resources more effectively, and support your growth ambitions. Contact us today.