What does an omnichannel real estate strategy look like?

In the not-too-distant past, many viewed e-commerce and brick-and-mortar sales as distinct channels. Today, the story is different. Retailers with physical presences in markets often see a positive impact on e-comm sales around their locations. Where there are limited or no brick-and-mortar stores, for some, online sales in the market will trend lower than comparable geographies with a physical presence. But each concept’s omnichannel sales relationship will be different.

The challenge for decision makers is quantifying the interaction between channels to make decisions. With the proliferation of data and the sophistication of analytical approaches, we can gain greater insight into the relationship between ‘clicks and bricks’. That’s where a truly unified omnichannel real estate strategy emerges.

A practical example

Let’s consider this in practice. Our client, a retailer in the home goods space, wanted to understand the potential impact on online sales as locations opened or closed in a market. The goal was to optimize their cross-channel sales through strategic real estate portfolio management.

Key questions:

- To what degree can e-comm sales be associated with new store openings?

- Do store closures impact e-comm penetration in the market?

- How does e-comm penetration change over time after a new store has opened or closed?

- How can we maximize sales across channels, managing costs of store deployments, to have the greatest impact on profitability?

Data-driven approaches

Our starting point for this type of analysis is collecting sales data from both physical and online channels, including the geographic information associated with customers.

To quantify the difference between naturally occurring annual e-comm sales growth and the impact that a change in the physical store portfolio can produce, we measured the annual change in e-comm sales around the store’s location, relative to a much larger area, where customers are not likely to frequent the physical store.

The idea was to measure e-comm sales when the presence of a physical store allows the customer to either shop in-person or online versus shopping online only. To do this, trade areas were developed where customers were likely to shop both channels, versus a larger geographic area where customers would likely only shop online. To help visualize this, imagine a donut where the inside hole is the area of cross-shop opportunity, and the ring is the online only shopping area.

Using three years’ monthly e-comm data, we measured the difference in annual e-comm growth between these two geographic areas. This approach allowed us to measure multiple new store openings and closings, over multiple years to determine the impact of physical store changes on e-comm sales over time.

Analytics to insights

All retail concepts have different interactions between their online and physical channels. For this home goods retailer, we found e-comm sales increased in the 12 months after a store opening and there was an additional acceleration in the second year. We also discovered that the first physical store to deploy in a market produced the biggest impact on e-comm sales. Subsequent openings showed a smaller positive impact – but significantly lower than the first store’s ‘pop’.

Alternately, when a physical store was closed, there was an initial increase in e-comm sales, as customers needed to shift online to continue shopping the brand, but as time moved on, e-comm growth began to soften. The initial increase that occurred with a store closure was not as strong as the increase in e-comm sales associated with a new store opening.

To help the customer quantify the growth in e-comm with a store opening, we added a line item to the store sales forecast that shows the projected growth in e-comm sales after the store opens. Effectively, we achieved an omnichannel sales forecast model. The retailer can now plan store deployments and portfolio optimizations thinking about the full mix of channel sales.

Lessons learned

Seeing brick-and-mortar and online as distinct sales channels is a recipe for missed opportunities. Fortunately, a typical retailer generates huge amounts of data that supports insight-driven decisions. For many, the transition from data to insight can be overwhelming – that’s why we recommend partnering with specialists with a track record of conducting comparable analyses.

Brands that understand how brick-and-mortar assets impact e-comm will often outperform their competition simply because they will be operating from a more efficient cost basis. They know how to serve markets optimally, retaining and growing their market share while managing overheads and improving profitability.

Learn more

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Fuel pricing

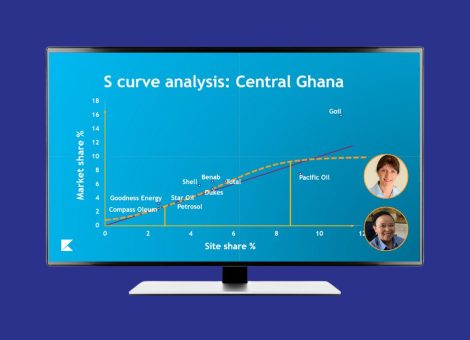

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...

Location intelligence

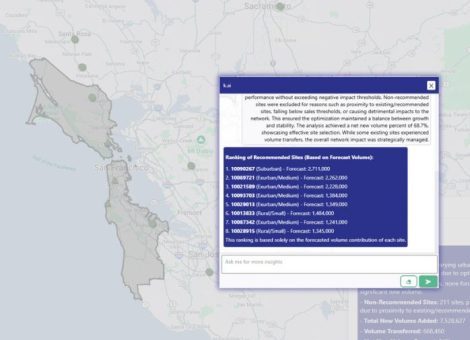

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...