Using mobility data to understand market share

The retail market is dynamic. With much disruption in recent years and consumer behavior shifting at an accelerating place, understanding your market can be challenging. One powerful tool at your disposal is mobility data and its power to conduct market share analysis, which offers valuable insights into your position relative to the competition. In this blog, we’ll briefly explore how businesses can use Kalibrate Location Intelligence and Competitive Insights to gain a comprehensive understanding of their market position.

Analyzing market share in Competitive Insights

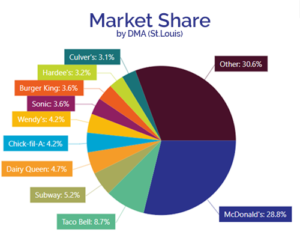

Competitive Insights, our mobility-based analytics solution, provides a market share dashboard to get a detailed view of how selected sites perform vs competitors, as well as reporting to see exactly how your business stacks up against the competition.

When retailers conduct this analysis, they might find some markets overperform expected benchmarks. In others, competitors may be taking a larger share than hoped. The critical question — and the value in understanding market share — is ‘why?’.

Competitive Insights allows users to analyze market share by US counties, Designated Market Area, or by state.

Learning from above average market share

Markets where a chain has above-average market share should be analyzed to gain insight to apply across the wider portfolio. It’s possible that a particular co-tenant may be positively driving visitation counts or a main competitor may be absent or underinvesting. A lack of investment in signage or accessibility could have a negative impact.

Elsewhere, the pricing strategy, or the merchandising offer in the market, could be other contributory factors. Consider the possibility that marketing efforts could be stronger in these areas — either because of more resources or by better targeting of potential customers. Ultimately, understanding why certain markets excel can inform broader real estate and customer acquisition strategies, and improve overall performance.

Understanding underperformance

For locations experiencing underperformance, it’s crucial to determine the root causes. This could range from facing a strong regional competitor or simply being in a market with too many competitors. It could be that the market is saturated with your own locations and a portfolio optimization exercise could improve profitability.

Other factors such as inconvenient locations for your customer, tired signage cold be impacting share, or the local store portfolio may need an upgrade.

Limited marketing resources or even issues like inadequate parking can further compound these challenges. Markets where locations experience particularly strong regional competition may need additional resources or competitive pricing strategies to thrive.

Tracking market changes over time

It’s essential to track changes in the market over time to understand fluctuations in market share. Ask questions: What changed? Did a new competitor enter the market? Did a competitor offer significant discounts or revamp their store? Was there a marketing effort that impacted consumer behavior? By closely monitoring these factors, businesses can better understand how dynamic their market is. If a new competitor entered the market and share fell, what action could be taken elsewhere when the competitor expands further?

Market share analysis is indispensable in today’s dynamic retail environment. Tools like Kalibrate Location Intelligence and Competitive Insights can help decision makers gain insights into their performance, capitalize on strengths, and address weaknesses. And by understanding the drivers behind both high and low market share, brands can refine their strategies, allocate resources effectively, and maintain their competitive edge. In a constantly evolving market, staying vigilant and adaptable is key to sustained success.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

Five burger companies, five problems

These burger brands had challenges from international growth to understanding franchise locations cannibalization,...

Location intelligence

Market Optimizer: Demo video

Market Optimizer allows users to strategically grow their network in existing markets while balancing revenue...