The kids are alright – aren’t they? Examining U.S. birth rates

While population growth has been a near constant throughout recent history, in recent years the U.S. and other developed countries are seeing that once certainty thrown into doubt. For the purposes of this piece, our interest is in why this is happening and the potential impacts across retail concepts.

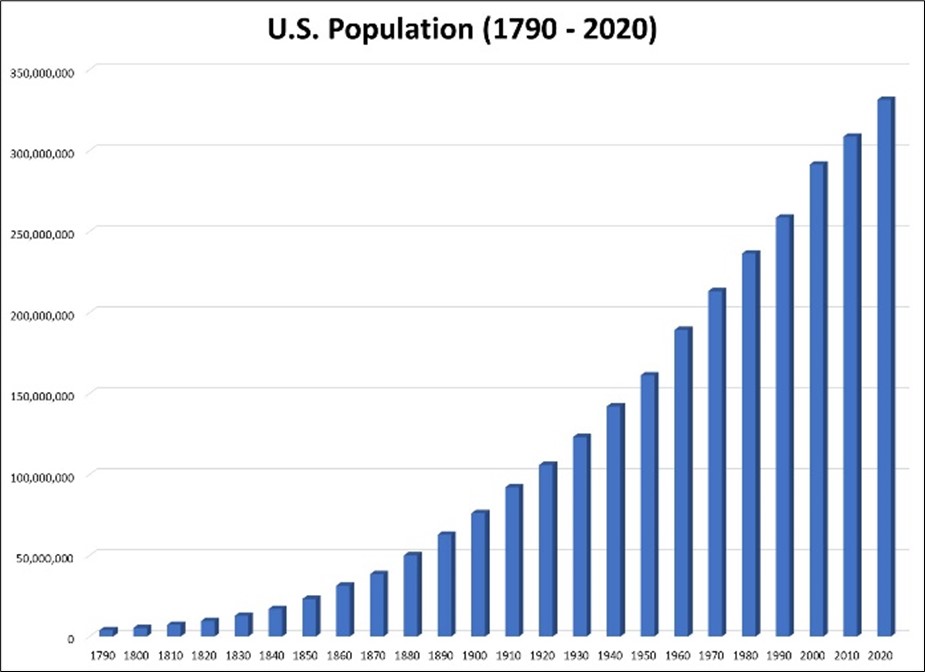

The United States has enjoyed steady population growth throughout its history, from the first Census of Population conducted in 1790 to the present. Ongoing population increases have been a constant for decades, which has been a major contributing factor in U.S. economic growth.

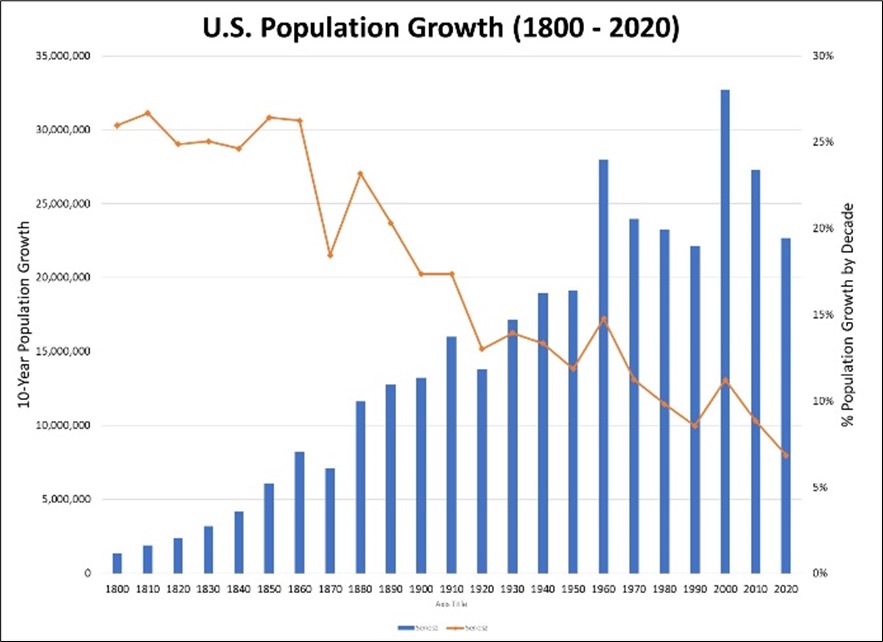

The rate of growth has slowed over time, from 20%+ every decade through the late 1800s to high single digits today. However, the absolute increase in the U.S. population base continues to be strong, accounting for at least 20 million new people every decade over the past 60 years.

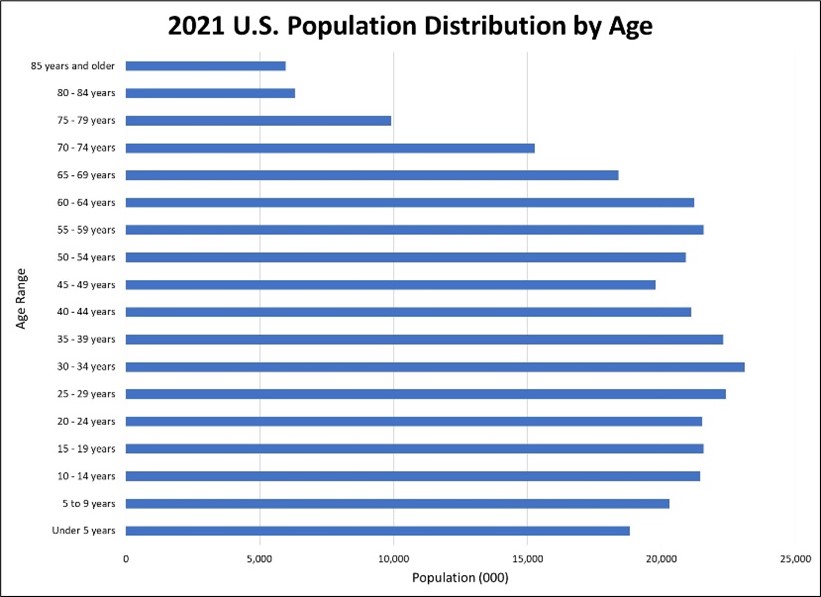

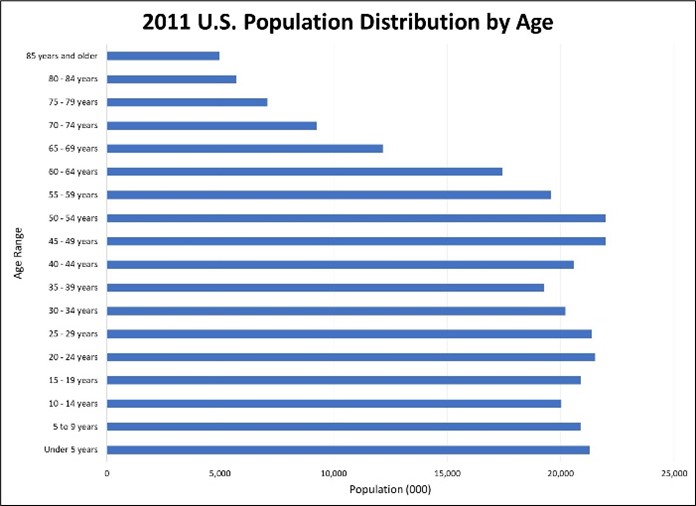

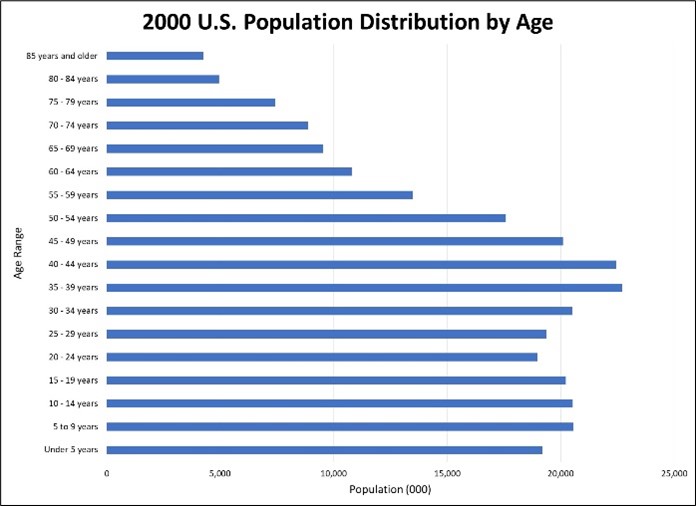

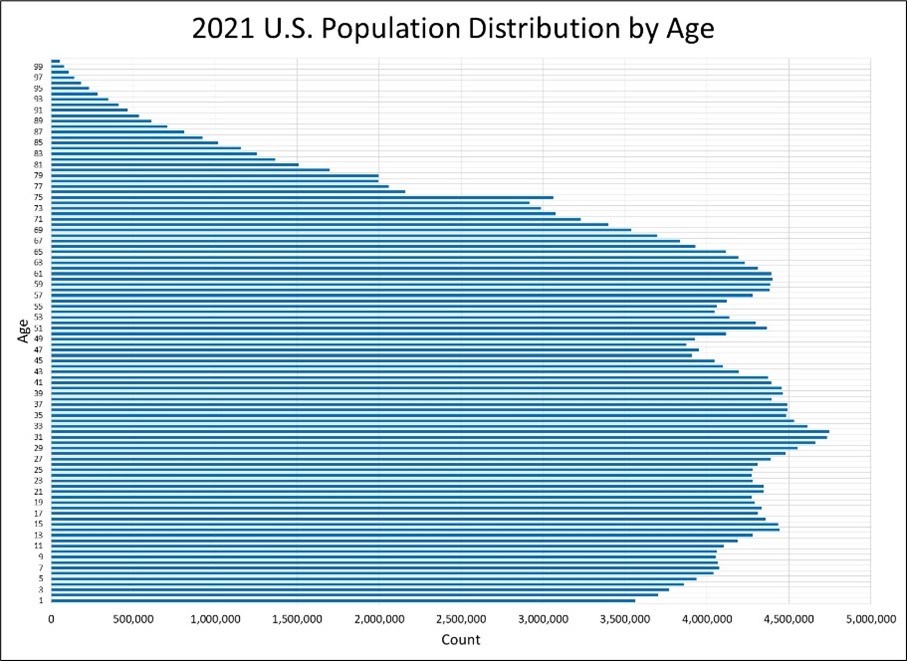

There is, however, one major change that has taken place in recent years – the decline in the number of newborns. The following graph shows the proportion of total U.S. population by age range in 2021:

The population aged 0-4 years (18.8 million persons) is lower than any other age cohort younger than 65-69 years. This was definitely not the case in earlier decades – in 2011, the U.S. had 21.3 million persons aged 0-4, and in 2000 the U.S. had 19.2 million.

In fact, the last decade in which the U.S. had fewer than 18.8 million kids was in 1980 (16.3 million persons aged 0-4 years) – over 40 years ago, when the aggregate U.S. population was 226 million, almost one-third lower than today.

The results are even more extreme when evaluating age by year. The number of people in each year band has been shrinking steadily – there were 4,077,000 7-year-olds in 2021, but only 3,564,000 0-1-year-olds, representing a 13% decline in just 7 years. A longer time frame affords even a bleaker picture – a 20% decline from the 4,433,000 14-year-olds in 2021.

Four questions immediately come to mind when assessing this: why is this happening, will it reverse itself, is it happening elsewhere, and what are the implications for the economy?

Why is this happening?

There are a number of researchers who have delved into the issues underlying this decline in newborns. In a Winter 2022 article in the Journal of Economic Perspectives¹, Melissa S. Kearney Phillip B. Levine, and Luke Pardue, three researchers from the University of Maryland and Wellesley College, conducted a deep dive into the factors that may be responsible for a declining birth rate:

- Maternal age – the drop in births per 1,000 women is particularly acute in women under the age of 30 over the past 14 years. Birth rates for older women are relatively flat or slightly higher than 2007, but not nearly enough to overcome the declining birth rate in younger women.

- Ethnicity – birth rates have dropped among all ethnic groups, and particularly among Hispanic women.

- Great Recession of 2007–2009 – the birth rate declined during the Great Recession earlier this century, but has failed to bounce back concurrent with the economic rebound in the 2010s.

- Economic trends – with the exception of the short-term decline in birth rates corresponding to the Great Recession, there is little indication that other economic trends (unemployment rate, government assistance, childcare costs) have been causative factors in the decline in birth rates.

The COVID-19 pandemic may certainly have impacted birth rates beginning in December 2020 (nine months after the initial lockdowns), but the declines were well established before the first news came out of Wuhan. Kearney, Levine, and Pardue suggest that shifting priorities (individual autonomy, decoupling of marriage and childbearing, rise in childlessness, and establishment of a two-child norm for women having children) may instead be responsible for the decline in births.

Will this reverse itself?

The simple answer is: nobody knows for sure. To the extent that the decline is attributable to the shifting priorities referenced above, it seems unlikely that there will be a sea change in the near future. The only factor that could have a discernible impact on birth rates would be immigration – enabling more young families and couples into the U.S. Given the politically fraught nature of any attempted immigration reform, this seems unlikely as well. As such, it would appear prudent to assume that lower birth rates are here to stay for the foreseeable future.

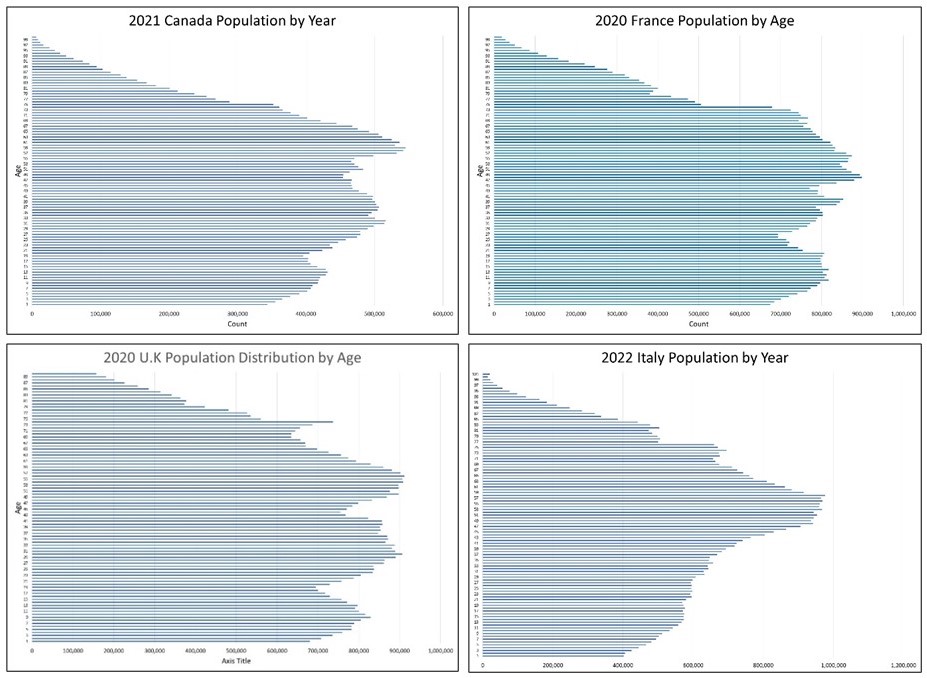

Is this happening in other countries?

Overall, current trends in the U.S. are similar to those of other first-world countries. Canada, France, the United Kingdom, and especially Italy, are all experiencing significant declines in the number of newborns over the past few years:

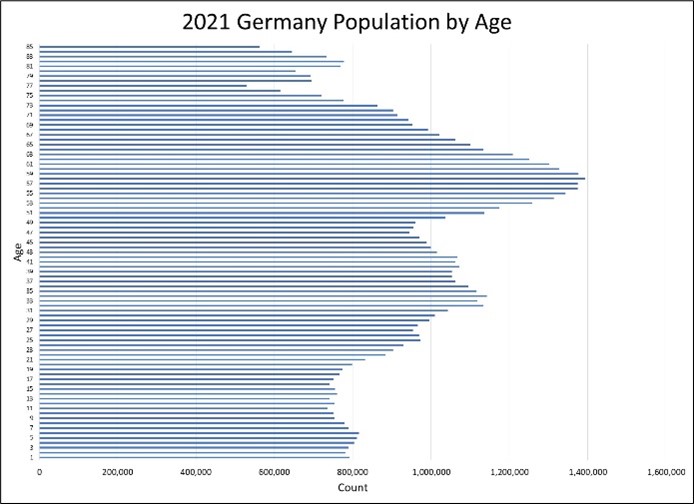

Germany is an interesting exception to the rule – Germany has actually experienced increases in birth rates over the past 10 years relative to earlier time periods.

How will this impact the economy?

It is beyond the economic expertise of this author to quantify the overall impact on the U.S. economy that may accrue from this decline in birth rates (such as the ability of a smaller working population to support increased healthcare and retirement program costs). As such, we have limited our observations to the retail, restaurant, and services clients which Kalibrate has experience working with.

- Childcare centers – the first (and most obvious) sector that will be impacted is childcare centers. The childcare industry has always faced a unique challenge: the audience for a childcare center 5 years from now does not yet exist. The childcare industry, and particularly independent operators, took a financial toll during the COVID-19 pandemic, and are finally returning to pre-pandemic levels. However, ongoing lower birth rates will obviously result in reduced demand for childcare, resulting in lower occupancy levels or center closings.

One point that should be emphasized, however, is that an overall national reduction in birth rates does not mean that all areas will have a reduced number of newborns. Growth areas in the U.S., particularly in areas with housing appealing to young couples (such as Prosper, Texas or St. Cloud, Florida), will still be experiencing increased birth rates and ongoing opportunities for expansion. Tracking growth areas will be a key focus for childcare centers.

- Schools – elementary, middle, and high school enrollments will be successively impacted by falling birth rates over the next couple of decades. The result will be reduced new school construction activity and reduced demand for teachers over time.

- Toys, diapers, and baby clothes – demand for consumer goods focused on kids will decline on an annual basis, with corresponding impacts on the retailers and e-tailers that serve those markets. (Not the best news for the Macy’s / Toys R Us rollout this year, although that venture has enough stacked against it even with without declining birth rates).

- Healthcare – the need for obstetricians and pediatricians will continue to decline annually. However, this should be a self-correcting process from a healthcare professional perspective – as the demand for pediatricians drops, medical students will instead focus on specialties such as gerontology and orthopedics that cater to an older clientele.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.