The high cost of opening new stores

Opening new stores in 2025 is proving to be more difficult than ever for retailers and restaurants interested in continuing their expansion plans. There are a number of factors that are contributing to this result:

Construction costs

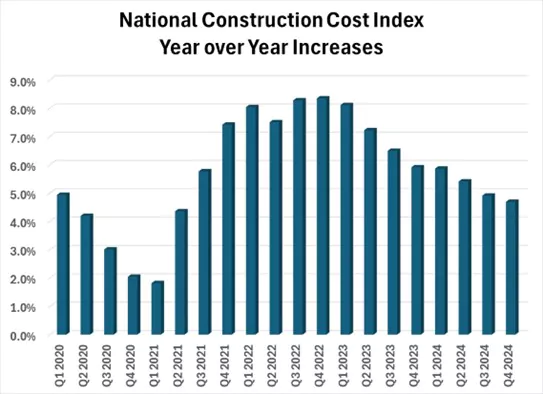

The cost of building or outfitting new stores has increased significantly over the past 5 years (see illustration below). This was particularly true during and immediately after the COVID-19 pandemic, when the combination of supply chain challenges and worker shortages contributed to significant increases in construction costs.

Two recent political developments will likely contribute to further cost increases. The Trump administration recently imposed a 25% tariff on imported steel and aluminum. Imported steel represents about one quarter of steel used in the United States, which will result in upward pressure on building costs. Further, the administration has vowed to accelerate the pace of deporting illegal immigrants from the U.S. Given that illegal immigrants represent an estimated one-sixth of construction workers, successful implementation of this policy will lead to labor shortages and higher labor costs. (Even if the number of actual deportations does not result in a significant reduction in the estimated 11.7 million illegal immigrants in the U.S., fear of deportation may keep many workers from showing up at job sites.)

Retail sales growth

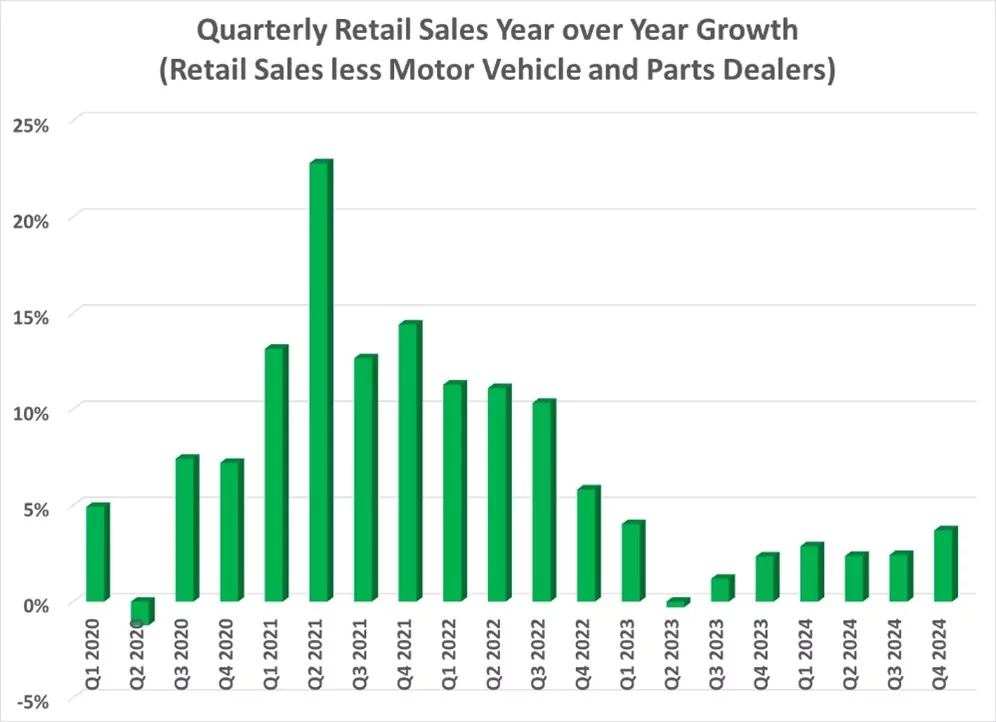

Retail sales have grown post-pandemic, but have not kept pace with construction costs.

Overall, construction costs have increased an estimated 20.1% from 2021 to 2024, while retail sales only grew 14.6% during the same period.

Interest rates

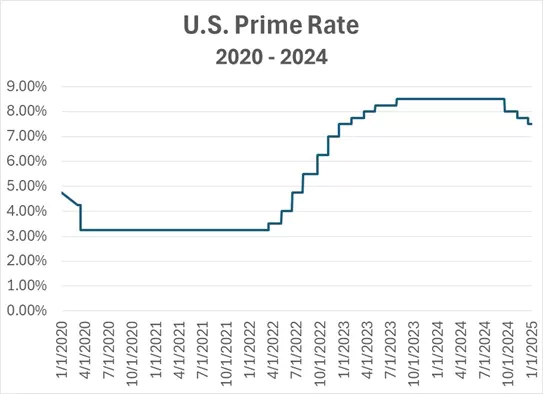

In the immediate aftermath of the pandemic, interest rates increased in an effort to curb inflation. Recent comments by Federal Reserve chair Jerome Powell suggested that they will not be dropping much, if at all, in 2025. The result is that borrowing costs will remaining relatively high, at least by 21st century standards.

Retail vacancy rates

Retail vacancy rates have declined over the past few years, due in large part to the limited amount of new shopping center space being developed. Retail vacancy levels currently sit at a relatively low ~5%, with much of that space in Class C and older retail developments. Given the limited number of shopping centers being built today and the lead time involved in new shopping center construction, there is little indication that this will become more advantageous to retailers in the near future.

To some extent, this limitation will be offset by store closures. Party City announced the closure of all stores in 2025, and Joann indicated they will be closing 533 stores as part of their most recent bankruptcy filing – together, these closures will make ~18 million gross square feet of retail space available to other retailers. However, absent a full scale recession with a corresponding impact on retail performance, it is doubtful that store closures alone will have a meaningful impact of space availability.

So what are the courses of action available to retailers seeking to profitably increase their store footprint?

Value engineering

Seeking to decrease the cost of new stores is one way that retailers can overcome higher expenses associated with construction costs. There are several ways that this can be accomplished, including:

- Decreased store size: Opening smaller units can reduce both capital investment in new construction and ongoing lease operating costs. However, the reduction in construction costs is not directly related to size reductions – a 20% smaller store footprint will almost never result in a corresponding 20% reduction in construction costs.

- Lower cost materials: Retailers can scale back the quality and expense of materials used in the construction of new stores (e.g. replacing tile with vinyl flooring).

- Decelerated growth program: Retailers can also reduce the number of new stores they plan to open in the coming years, acknowledging the reality of higher construction and leasing costs and their corresponding impact on the ROIC (Return On Invested Capital) associated with new store development. However, any such reduction must be measured against the expectations of ownership (whether private equity firms or institutional shareholders), and the corresponding impact on the company’s valuation.

- Projected sales levels and cannibalization impacts: The ability to accurately project how much sales a new store will generate and what impact that will have on surrounding stores has always been an important consideration in deciding when to open new stores. The increased costs of new store development, combined with lower shopping center vacancy levels, make reliable sales and cannibalization forecasts even more critical.

A cautionary note – any efforts to control costs by reducing the size or quality of new construction must be measured against the impact that those efforts will have on consumer perceptions and shopping habits. Reducing a store’s size will inherently result in diminished merchandise selection, which can make a retailer a less desirable shopping alternative. (On a personal note, I am constantly frustrated by retailers who do not have an item in stock, but tell me that I can order it on their website – if I wanted to use e-commerce, I never would have driven to the store in the first place). Furthermore, sacrificing the quality of materials used to furnish a store can impact how consumers feel about shopping there. The impact will vary based on the concept – warehouse clubs such as Costco and BJ’s Wholesale Club can benefit from a low cost perception, while more upscale retailers may see their image deteriorate as a result.

The good news

Fortunately for retailers today, there are a wide range of datasets that retailers can use to quantify the projected return associated with new store openings. Many retailers have CRM (Customer Relationship Management) systems that can provide valuable information concerning what types of customers are patronizing their stores, and how far they are willing to travel to shop there. For those operators who do not have their own customer databases, mobility data, or enhanced cell phone location data, can help to provide these insights. Furthermore, demographic and psychographic (lifestyle) data is widely available from a number of firms to help retailers understand who their best shoppers are.

There have also been significant developments in the analytical techniques used to develop and deploy retail sales forecasting and cannibalization models. While no modeling techniques will ever be perfect, particularly given the impact that store management and operations can have on individual store performance, the fact remains that current modeling techniques can be of significant value in helping retailers to ensure that their future store openings are profitable ones.

While the current retail landscape presents certain challenges, retailers who embrace data-driven decision-making and strategic adaptation can continue to expand successfully. The key lies in carefully balancing growth ambitions with market realities while leveraging available tools and analytics to make informed decisions.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

Forman Mills accelerates growth with the Kalibrate Location Intelligence platform

The value apparel and home goods retailer selects Kalibrate to to support its national expansion strategy.

Location intelligence

The Kalibrate news round-up: November 2025

In this monthly feature, we look across the industry and mainstream news to uncover stories of note that we think are...