As market changes, it’s perfectly natural for mature brands to evaluate their portfolio through the lens of network size and coverage.

When making decisions around closures, understanding the impact on the wider network is a critical capability. How can we identify closure candidates? To what extent will sales at closed units be recaptured by sister units? What role might e-commerce play in the strategy?

Answering these questions, guided by analytical approaches, can provide a foundation of insight to support strategic portfolio decisions when considering closures.

Closure candidates

Various criteria are collected to determine viable closure candidates – for example: profitability, age, comp sales trends, demographic shifts, and lease expiration. In many cases, manual exceptions are required for various circumstances which preclude a unit from being considered as a closure candidate.

Recapture analysis: sister store and e-commerce

The sites identified as closure candidates then progress to a sales recapture analysis.

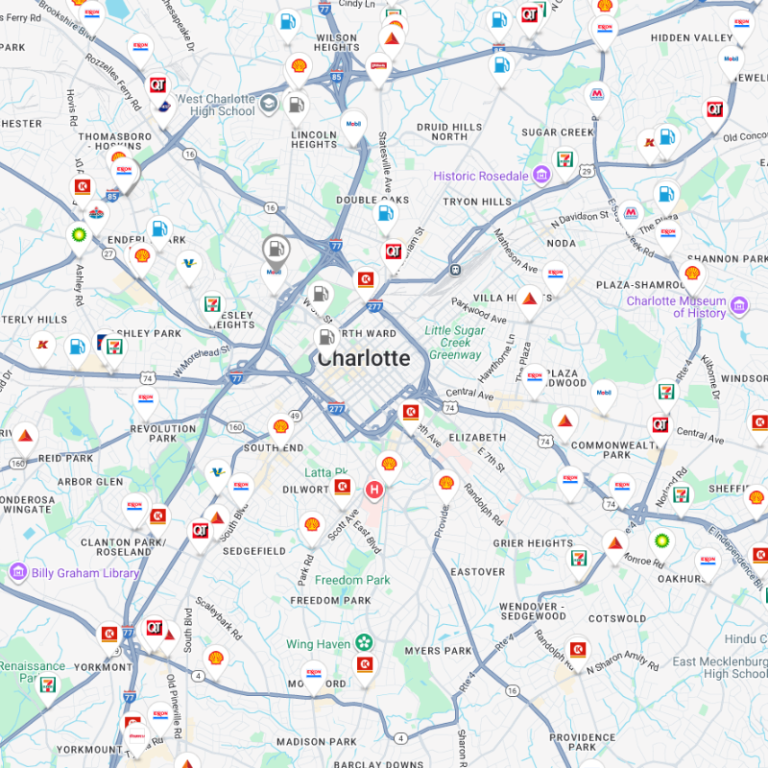

Typically, this simulation would consider the relevant trade areas, customer distributions, and competitor locations intercepting potential sales transfer. Kalibrate’s propriety methodology automates a large part of this analysis.

Ultimately, the result is a quantification of the estimated percentage of sales a sister unit(s) could expect to recapture if the closure candidate was removed from the portfolio. A similar analysis can be applied to consider potential e-commerce impact, as appropriate.

Once the transfer analysis is complete, we can begin to analyze which closure candidates should be retained and which should be closed, based on collaboratively determined thresholds and criteria. Prioritization of closure candidates may vary based on the analysis objectives (i.e., earliest least expiry or lowest EBIDTA as our key criteria for prioritizing closure candidates) and the exact criteria will be led by the strategic direction of the operator.

Once a closure candidate is confirmed for closure – passed all thresholds/hurdles – the anticipated recaptured sales are distributed to impacted sister unit(s).

The process is then repeated for additional closure candidates to determine if closure or retention is the appropriate action. Once the process has evaluated all candidates, a complete list of prioritized closure candidates is finalized, and the aggregate impact of the recommended closures on total sales and profitability can be calculated.

Analytics to insight

Portfolio optimization exercises that include store closures are becoming more common as brands look to right-size their portfolios. Factors such as the growth in online channels, renormalization post pandemic, or simply different market dynamics or competition are key drivers.

Closure decisions are rarely taken lightly, but understanding how to act strategically when making decisions, maximizing the sales volumes recaptured while growing profitability, can be achieved with data-led approaches.

>> Learn more about our location solutions