Sister store impact: The need for sales transfer studies

One of the most painful conversations in leadership meetings, “Sales are down more than 40% at store 123 since opening store 456. How did we miss so badly on that estimate?”

Every growing retail or restaurant company faces the challenge of quantifying sales transfer or cannibalization to truly understand how a new location will impact nearby sister units.

This issue is less of a concern during the early days when the “world is your oyster” and cannibalization concerns can be avoided by simply going to a new market. However, as a chain matures and needs to consider opportunities located closer and closer to existing locations, cannibalization becomes a more significant issue.

Corporate vs Franchise

Corporate and franchise operators take dramatically different approaches to cannibalization.

Most retail chains and select restaurant chains (e.g. Chipotle and Shake Shack), own their own facilities. As such, the decision to open a new location is typically based on the projected return on invested capital or the overall impact on chainwide profitability.

Chains with corporate locations have opened new stores with projected sister store cannibalization impacts of 25% and higher, either to alleviate overcrowding in existing units or because the net impact on corporate profitability and capitalization is positive despite the cannibalization impact.

The exact opposite is true for franchisors.

Generally, a franchisor will always benefit from deploying additional units, as they receive a percentage of new store revenue. However, an existing franchisee has a very different motivation, particularly if they only operate one unit – any cannibalization impact from a nearby location will negatively impact their sales and profitability.

As a result, franchisors need to walk a fine line when assessing new locations. Placing new units too close to existing franchisees can damage the overall franchisor/franchisee relationship, potentially poisoning the well in attracting future franchisees.

So, what’s the solution?

Fortunately, predictive analytics professionals have developed models that can accurately predict future cannibalization. One key input for these models is an accurate assessment of customer distribution – where are the customers patronizing an existing restaurant coming from and going to before and after their visit?

Traditionally, customer intercept surveys were used to collect this information – an interviewer asked a representative sample of customers where they were coming from and going to in relation to their restaurant visit, and aggregated this information to estimate the proportion of customers coming from each sector.

However, this approach suffered from both cost and reliability issues. Human-conducted surveys introduced inherent variability in data quality, from interviewer bias in sample selection to inconsistent questioning techniques.

More critically, the subjective nature of the process meant that franchisees could easily dispute unfavorable results. They would question the integrity of the data collection and demand new studies whenever outcomes didn’t align with their expectations. If the study suggested a lower cannibalization impact than the franchisee expected, they could always complain about the study’s integrity after the fact and demand a new study.

Many restaurants and retailers have comprehensive CRMs which can include customer home addresses. However, this data is of limited value in projecting cannibalization impacts for customers who don’t visit a location because it’s close to home.

Consider an employee who drives from their workplace to a restaurant for lunch. The location of the subject restaurant and the proposed location relative to the customer’s home address has no impact on whether they will shift their lunchtime patronage patterns. The same concern applies to credit card data, which typically only has access to the home address or geographic sector of the cardholder.

The mobile data revolution

Today, massive mobile data (MMD), or cell phone location data, is increasingly used as the basis for estimating customer distributions. MMD has several advantages over survey data:

- Can be collected for an entire year, accounting for any differences attributable to time of day, day of week, and seasonality

- Can be used to accurately identify where a customer has come from and where they are going to

- Generally provides a statistically significant sample

- Is not subject to any potential surveyor bias

- Is less expensive than survey data

What mobile data can’t tell you

Here’s the catch with mobile data: it tracks people, not purchases. We know someone visited your location, but not whether they bought a $5 sandwich or a $50 catering order.

This limitation matters more for some businesses than others. Jewelry stores see massive spending variations—one customer might buy earrings for $100 while another drops $10,000 on an engagement ring. Auto dealers deal with tire-kickers who browse for hours without buying anything.

Restaurants are different. Sure, some customers order more than others, but the range is relatively small. Most orders fall within a predictable window, making mobile data extremely reliable for forecasting customer behavior.

How the technology works

Think of geofencing like casting a digital net around your restaurant. Every smartphone that enters this invisible boundary gets captured in our data.

But precision matters.

Miss the drive-thru area, and you’ve ignored half your customers. Include too much surrounding area, and you’ll count people walking by who never intended to stop.

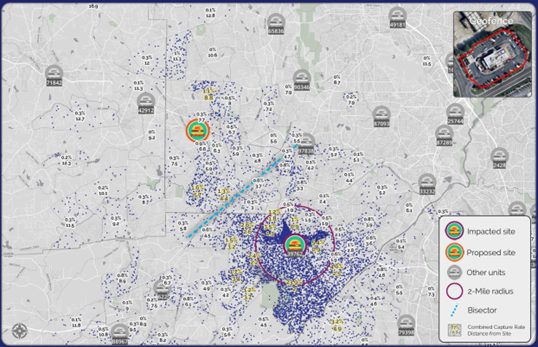

We also clean the data by removing phones that linger too long—typically over two hours. These usually belong to employees, not customers. The resulting data gets organized by a unit geography (think block group, census tract, etc) creating a map of exactly where your customers come from.

Sales transfer: Predicting who will switch locations

Here’s where things get interesting: just because customers live in a certain area doesn’t mean they’ll automatically switch to a closer location.

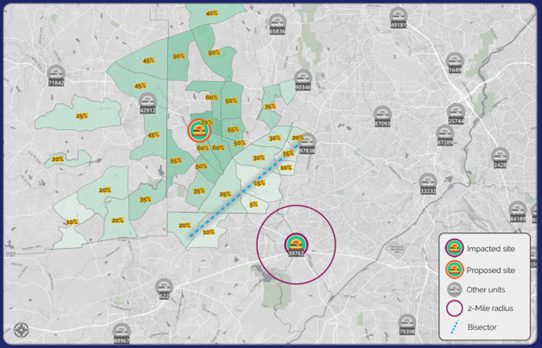

Kalibrate has conducted before and after surveys to quantify the impact that relative locational convenience has on the likelihood of customers switching to a new location and applies the findings prospectively to project the proportion of each sector’s patrons who are likely to stop patronizing the existing unit.

The projected impacts are then aggregated to provide an overall cannibalization impact on the existing unit. This result can be used by the franchisor to make a determination concerning the proposed location.

Three options emerge: proceed (if the impact will be small enough that the pre-existing franchisee will still have a viable location), proceed with compensation (provide the pre-existing franchisee with money to compensate for lost profits over a given period), or abort (if the impact will be too large).

Many franchisors elect to have cannibalization studies conducted by third-party firms, who have no vested interest in the outcome. Franchisees are inherently skeptical of a franchisor who tells them everything is going to be fine.

In fact, the only interest third-party firms have is to ensure that projected cannibalization impacts are as accurate as possible. This means franchisors are comfortable relying on those projections going forward.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

Forman Mills accelerates growth with the Kalibrate Location Intelligence platform

The value apparel and home goods retailer selects Kalibrate to to support its national expansion strategy.

Location intelligence

The Kalibrate news round-up: November 2025

In this monthly feature, we look across the industry and mainstream news to uncover stories of note that we think are...