Rightsizing a store portfolio: where to start

Having been a buzz phrase for several years, ‘changing consumer behavior’ has come into sharp focus during the past 18 months. The acceleration of e-commerce as a preferred shopping channel has caused many to re-assess their brick and mortar portfolios.

But what information do retailers need to make sure their portfolio is the right fit for their customers? Here, we explore some of the insights our clients use to inform their rightsizing strategies.

We asked Greg Rutan, our VP of Sales and Marketing to explain more…

Customer visualization based on trade areas

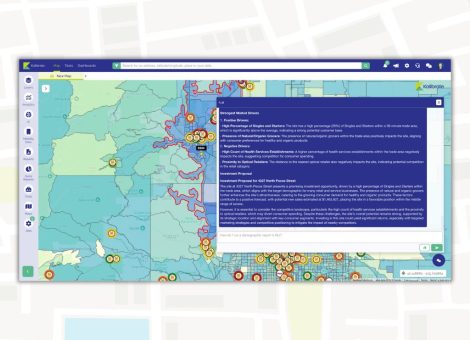

Let’s start simple. A quality GIS tool allows retailers with customer data to visualize their locations on a map to determine trade areas, service areas, market penetration, potential cannibalization, and more.

Real estate professionals can then use insight to identify where demand for their goods/services may be high, but reach is low, for network analysis and potential new store planning.

This is the obvious starting point when rightsizing your portfolio, but a gateway to much deeper levels of insight that can support a successful strategy.

Understanding the e-commerce halo

Much discussed but rarely mastered, the e-commerce halo helps retailers understand the relationship between online and in-store transactions.

Retailers with data on e-com customers can visualize this segment to understand how they prefer to engage with physical stores. This can be useful in understanding online reach versus in-store and, most crucially, the overlap.

Once visualized, this data can also be used in-store optimization exercises to determine where more – or fewer – stores are needed based on the habits of those consumers.

For example, where more customers are inclined to shop online with delivery, you may seek to optimize your distribution strategy. If shopping online for in-store pickup is a preference, how you can serve those needs better. Some customers are likely to make additional spend when they do collect items in-store.

Identifying cannibalization using analytics

Once you understand where your customers are and how they access your stores, you can begin to identify any cannibalization concerns.

As TAS (now Kalibrate), this is something we help retailers with a lot. Clients create trade areas for new stores using analytics and/or mobility data to determine potential cannibalization and understand the impact of portfolio change at an individual store level.

This insight is valuable when it comes to making big portfolio disposition decisions about consolidating, closing stores, or adding stores in markets that could be at risk of saturation.

If you’re unable to accurately forecast cannibalization, it’s likely your real estate strategy has a serious blind spot that will ultimately undermine your chances of successfully optimizing your portfolio.

Distribution centers and selecting the right model

Quality e-commerce data on your customers can also contribute to selecting the right distribution model. Retailers that get last-mile distribution right see a significant positive impact on their bottom line and it’s an important consideration when rightsizing a real estate portfolio.

Most retailers shipping to customers should have lots of data about delivery addresses, which can be used to see where they may need better coverage for faster shipping, last-mile delivery, and more.

In recent years, more and more Kalibrate clients are using data and analytics to consider shrinking the retail space and adding warehousing and distribution capacity within their existing fleet.

Marketing analytics using customer data

Good customer data also supports segmentation analysis to help retailers assess the preferred types of media consumption. This is valuable insight to drive potential sales through selecting the appropriate marking channel.

At Kalibrate, we often work with clients to help them execute marketing plans to support new store openings, increase sales in existing stores, or attempt to convert consumers to shopping at competitors using strategic sales, coupon offers, and more.

By understanding how to best reach a target audience, and what their shopping behaviors are most likely to be, retailers can better optimize their network by understanding and predicting target customer behavior and open stores that are already “right-sized” and suited to the consumer profiles they intend to serve.

The Kalibrate approach to optimize your real estate portfolio

Because every retailer’s customer base is different, there’s no single correct approach to rightsizing. The data sets and approaches discussed above provide the context for starting to think about how to optimize your real estate portfolio to grow your bottom line while continuing to best serve the needs of your customer.

At Kalibrate, we start with our client’s proprietary data – usually, they have much more than they expect, but it’s not centralized in a way to provide actionable insight.

Once you begin to collate your data alongside third-party sources available on the market, you can have far greater confidence that your rightsizing decisions will deliver on your goals.

If you’d like to know more, reach out to speak to a member of the Kalibrate team or explore Kalibrate Location Intelligence.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.