Rich Wilcox: 2023 predictions - price conscious consumers, data, expansion plans, and more

Consumers will become even more price conscious

With household bills and other prices continuing to rise, more consumers will become price sensitive. We’ve already seen discount grocers catch or even overtake more conventional supermarkets in many markets around the world. After their growth in recent years, discounters are continuing to invest heavily in new locations, new markets, and their omnichannel experience. This isn’t just the case in grocery; fuel, convenience, food, and even the likes of barbers, pet suppliers, and homeware stores are seeing similar trends. It’s critical that brands invest in insight to understand how their customer profile is changing as inflationary pressures increase, both from a retention and acquisition perspective.

Customer data will unlock more insights than ever before

In past predictions, we said that technology adoption would accelerate significantly because of restrictions placed in the physical world, and of course that happened with the likes of home delivery, click-and-collect/curbside pick-up, and associated loyalty schemes.

The brands best placed to succeed in the year ahead will be those that understand the relationship between physical and digital sales. This insight empowers strategic decisions in areas as diverse as optimum store count, effective use of marketing budgets to reduce the cost of acquisition, and fulfillment factors such as warehousing and delivery channels.

Many retailers invested significantly in their omnichannel proposition during the pandemic. Whilst these new technologies are serving their intended purpose of providing a better customer experience, they are also harvesting vast quantities of data that support decision-making. In most cases, retailers will now have the 12 months+ of data required to start gaining meaningful insights into how their customer and market has changed post-pandemic. There’s also an array of third-party data, including the growth of mass mobile and connected car data, to enrich the data retailers collect directly. Critically, it’s not just having the data – it’s about being able to collate and work with data to generate actionable insight.

Retailers will look to validate the growth potential and look to new markets for expansion

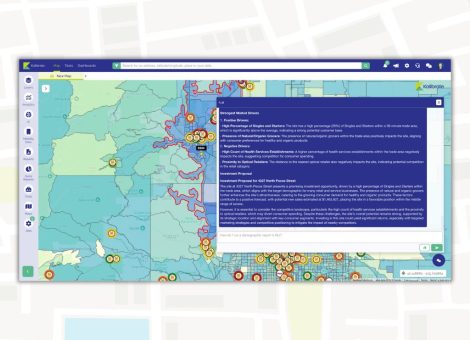

Many retailers had a good feel for what their growth potential was in their existing markets, but the world has changed. As we look to the future, many retailers will seek to validate their market saturation point and identify where they can expand.

I’m fortunate enough to speak to retailers around the world daily, and a firm theme that we’re seeing is around international growth. Whether retailers have a specific market in mind or a blank canvas, the key questions being asked are; where do I have the highest potential? How does my customer profile translate to a new market? Most specifically, where should I open my first store(s) to ensure success upon entry and a solid foundation that can be built on?

Highly targeted channel selection and audience segmentation in marketing activity

We’re speaking to retailers who are exploring new marketing tactics to acquire customers – particularly with the next generation in mind. They’re asking themselves how to safeguard their future profitability by increasing their share of millennial and Gen-Z customers.

In some instances, retailers are engaging local influencers to deliver sustainability messaging to Gen-Z via a trusted influencer channel. Their research shows that Gen-Z is more receptive to messages delivered through influencers, especially when it comes to product recommendations and messages around sustainability.

The challenge for any retailer engaging in tactics involving new emergent marketing channels activity is tracking the conversion to bottom lines sales. Retailers that have visibility on how evolving marketing channel activity supports both online and physical sales are best placed to optimize their budgets in 2023.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.