Retail site selection: best practices

Introduction

Effective decision-making in retail site selection is a skill real estate professionals perfect over the course of their careers. Through our experience working with leading multi-unit brands, we have identified best practice approaches to data and insight that deliver the greatest levels of certainty when creating a location strategy.

The principles covered in this guide focus on the importance of accurately defining trade areas, how site and situational characteristics should be considered, and methods for quantifying competitive impacts, to remove the guesswork from the site selection process.

Defining trade areas

In retail site selection, trade areas are defined as the geographic areas where the majority of a business’s revenue or customers come from. For retailers, trade areas are often residence-centric, meaning that most shopping trips originate from the customer’s place of residence. On the other hand, restaurants typically serve multiple trade areas that include customers who reside, work, or shop near the restaurant.

When defining trade areas, it is crucial to consider various factors such as drive time, the presence of other units in the same brand, urbanicity, and barriers that may impede access to a location. A concentric mile or drive-time rings can be used to approximate trade areas, but a more rigorous approach is to model and define each trade area based on actual sales and customer distributions.

Accurately defining trade areas is essential for customer profiling, predicting future sales, estimating cannibalization, and identifying infill opportunities.

Understanding the trade area extents of existing units and how they vary by market size, location type, and prototype provides a means to estimate the trade area extent(s) of future locations. Over-defining or under-defining trade areas can result in over- or under-forecasting a location’s potential.

The gold standard approach for defining trade areas considers both the characteristics of the location and the surrounding neighborhoods. However, flexibility is also necessary as unique situations may require adjustments to the forecasting model. Mobility data can be used to study the sales distributions and trade areas of competitors or shopping centers near a unit under consideration, providing a point of validation against the trade area defined.

Learn more about retail trade areas

Analyzing site and situational characteristics

Site and situational characteristics play a crucial role in retail site selection process determining the effectiveness of a specific location in tapping into underlying demand. Site characteristics refer to the physical characteristics associated with a particular location, including:

- Visibility

- Signage

- Parking

- Ingress/egress

Type of location. Situational characteristics include refer to the type of landmarks that could impact the effectiveness of a location including:

- Co-tenancy

- Proximity to regional hubs

- Access to Interstates and highways

- Proximity to worker and daytime population concentrations

- Traffic counts/flow

- The “going home versus going to work” side of the road.

Co-tenants are among the most important situational characteristics, and retailers should seek locations in a retail node that attracts “like” types of consumers to capitalize on the synergy created by other proximate retailers.

The level of importance of site and situational characteristics varies considerably by category. For some operators such as gas stations, quick-service restaurants (QSRs), coffee shops, and convenience stores, site and situational characteristics are very important. For destination retailers such as IKEA, Costco, or Sam’s Club, proximity to regional accessibility is more important than site characteristics.

While site and situational characteristics generally matter most for convenience-based retailers, they matter for all brick-and-mortar locations to some extent. Building a revenue forecasting model for a site prospect requires evaluating the influence of its site and situational characteristics, trade area demographics, and the competitive environment. Neglecting to consider any of these important drivers of performance will result in an inaccurate forecast.

Learn more about site and situational characteristics

Competitive impacts

In the retail site selection process, competitors are classified as “adjacent” if they are in the same shopping center or on the same stretch of roadway.

A critical aspect of the competitive analysis is uncovering how well clients perform when sharing a shopping center or retail concentration with their competition.

The larger trade area that the clients and their competitors serve is also a focus of analysis. Specific competitors are classified as “impacting” if both the client and competitor(s) are located 5 minutes away from the consumers they both have the opportunity to serve. On the other hand, competitors are “intercepting” if the consumer must drive past a competitor to reach the client’s front door.

When building the model, operators usually have a good understanding of their primary competitors, but an outsider’s perspective is essential in making recommendations on which operators to include in the analysis. The competitors that impact the client’s bottom line are determined, and specific groups are segmented based on the industry, breadth of products and services, and other factors. The strongest correlation between client performance and individual competitors and groups of competitors results in the creation of competition scores. Ultimately, controlling for the most impactful competitors is necessary, which may require regional considerations.

Regionality is also a factor to consider as the strength of the competition may vary depending on geographic regions and markets. For instance, Hobby Lobby is dominant in the Southeast, while Jo-Ann’s is strongest in the Great Lakes and Rustbelt regions. Fuzzy’s Tacos is another example of a regional competitor that is strong in Texas in the fast-casual sector but not as competitive in the Southeast.

In some sectors, it is nearly impossible to isolate the impact of an individual brand as a competitor. In the quick service restaurant space, for example, McDonald’s impact on Chick-fil-A’s performance is hard to know. It is essential to consider the varying degrees of competitors to create a comprehensive and accurate forecasting model.

See how you can measure your competitive impacts with Kalibrate Competitive Insights

Site selection for your brand

Read more articles about:

Location intelligenceRelated Posts

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

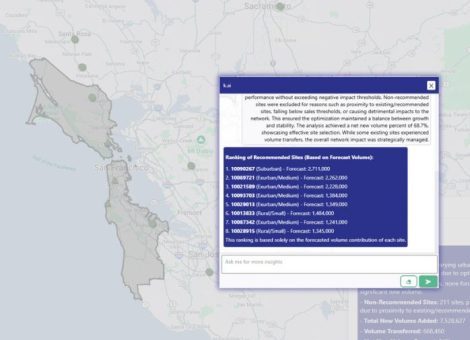

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...