Progressing from data to insights

Over the past several years, I have worked with TAS (now Kalibrate) clients to better understand, and use data that is critical to their businesses and real estate decisions.

Traditionally, companies look at various data sets as ways to gain information about important aspects of their business, offering, and appeal to consumers. These data sets tend to include demographics, workplace data, customer data, lifestyle segmentation data, location data about their stores, competitors’ locations, and data about co-tenancy.

Generally, we can look at important data from two primary sources – internal proprietary data (stores, leases, sales, customers, product mix, pricing, site attributes, and more), and external data (demographics, segmentation, mass mobile data, geosocial data, traffic counts, etc.).

While many, if not most, retailers and shopping center owners understand the importance and impact of these data sets on their own, some – with exceptional results – are discovering how all these data sets relate to one another and how to leverage those insights into strategy and action.

Considering approaches with lifestyle segmentation

For example, for those with good customer data, many understand how powerful applying lifestyle segmentation to their customer data can determine which groups of people represent their most desirable and loyal customers.

This relatively simple exercise can help them create “heat maps” to show them where higher concentrations of these people are, and therefore where gaps may exist in their store network.

Others, with omnichannel offerings and data, can take this a step further and apply the same methodology to distinguish between where their core customer prefer to shop online versus in-store.

This is very powerful when considering store optimization – i.e. can we reduce the size of this store and expand our online distribution options? Or should we reduce the size of the retail space and add warehouse space for more effective delivery or ship-to-store options?

Now consider other data sets that many use or know about – including mobility data, geosocial data, non-resident population data, and others.

If you can analyze these external data sets against your known customer behaviors, you can then create even deeper insights. For example, how many of my customers are non-resident students or business travelers?

What other offerings are they seeking? What other types of retail do they prefer, and would be located nearby those offerings create more trips to our store or our website?

How do we optimize marketing engagements to increase the time and money they spend with our offerings? Savvy clients will also attempt to conduct some of this analysis on their primary competitors as well. How do we differentiate, and cannibalize business not from ourselves, but our competition?

The critical steps to considering how to leverage data into actionable insights begin with – what data do I have, and what do I need? From there, consider the data options available.

They may look the same from the outside but may vary in important ways. Ask where the data originates, how often it is updated, how large sample size does it represent, and can a particular data set provide better insights than others?

Price has an impact, but sometimes the more expensive data has more quality control, or a better base sample size to offer greater confidence in the application of the data to your insights.

Applications – work, testing, and collaboration

Once you have the data you decide is important to you the question becomes, how do these correlate and then apply to my business? This requires work, testing, and collaboration.

Whichever vendor you use, they should be able to openly offer best practices and lessons learned by other efforts. And the exercise needs to be done with complete transparency.

Black box insights are extremely difficult to both quantify and justify to senior executives. You need this process to be fully understood and then validated by people on your team who can help you determine if what you believe to be highly correlated data leading to insights can be proven.

From there the effort needs to be in applying insights derived from this combination of data sets and understanding how each data component affects the others.

In the end, you can get to a state where these various drivers of sales and market share can affect your real estate and omnichannel location decisions. I always ask my clients – “When’s the last time you assessed the data you have and use? Is it accurate and constantly updating? What’s missing?”

Also, what data sets do your company already purchase? In far too many cases our clients learn, through this exercise, that other departments already license some data they could find hugely beneficial in real estate strategy, or that multiple departments are licensing the same, or similar, data sets independently and failing to capture cost savings that may be significant.

Data tends to be the key to success in any business. Someone should be your “data champion” to both understand what data you already have access to, and what data sets are available or on the horizon, you should be considering.

The ability to progress from data to truly actionable insights lies in understanding how combining data sets should lead to deeper insights that can both feed analytics and offer exceptional competitive advantages.

For decision-makers, by decision-makers

Our team has decades of industry experience making location decisions for a range of household brands. Whether you are using Kalibrate’s software, data, or analytical models – or engaging with our consulting team – you’re using solutions built by retail location experts just like you.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

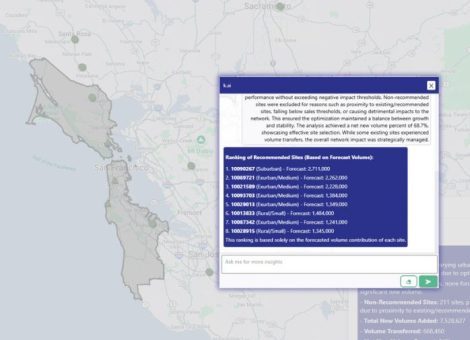

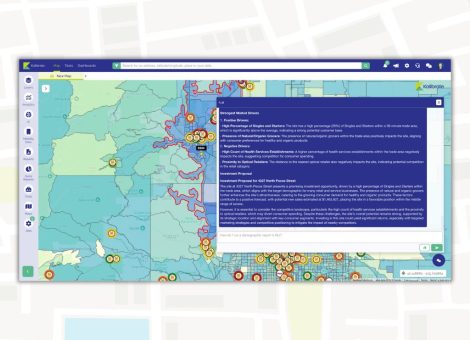

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.

Fuel pricing

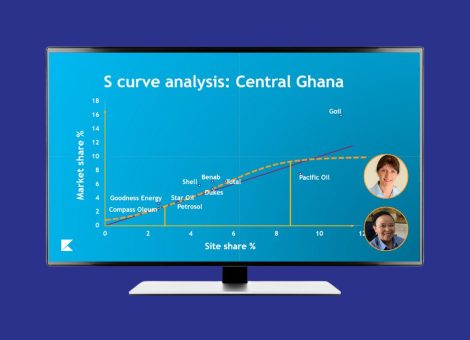

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...