How to analyze competitor weaknesses and make them your strengths

A valued Kalibrate client once said, “You don’t know where you’re going until you know where you are.” Leading in fuel and convenience retailing means understanding where you are in relation to both the market and the competition.

By conducting a competitive analysis, you can identify gaps in your competitor’s offerings. But once you’ve identified these gaps, how do you use this knowledge to make confident decisions about your retail network? Understanding how to analyze competitor strengths and weaknesses is essential for increasing volume and driving revenue.

Here are some key practices for identifying competitors’ weaknesses and using them to your advantage.

Know Your Market

It’s impossible to make strategic decisions for your business until you understand the market landscape. Before you begin analyzing individual sites, gain a holistic view of where you stand in the market.

Maybe your site doesn’t have the power to continue generating revenue over time. Looking at your competitors’ location and volume will give insight into your own site’s potential. Location, population, fuel pricing, and demographics can influence the volume potential and expected margins of a given market. By understanding where customers live and commute — and which fuel and convenience brands are serving them — you can predict whether or not your business will succeed there.

Know Your Competitors

Once you’re familiar with the market potential of an area, zero in on your competitors by conducting a competitive analysis. How are competitors attracting customers? Where are they offering value?

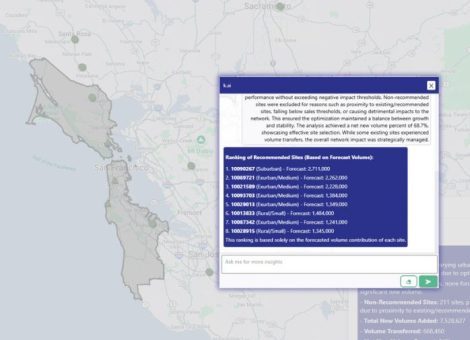

Of course, analyzing every element to maximize your performance, including market, location, facilities, operations, merchandising, brand, and price, on a site-by-site basis can be a daunting task. The ability to get more granular is a great asset, and the best way to do that is with a tool like Kalibrate’s retail network planning solution.

Our business intelligence analytics give you access to invaluable information about all the retailers in a given area, including physical attributes, brand performance, pricing, and number of fueling positions. The tool can help you identify sites that may need continuous monitoring or sites that have huge volume potential. Comb through these factors and identify what the competition is doing well, and where it’s lacking.

Remember, you don’t need to do something just because competitors are doing it. If other competitors are offering car wash, and there’s no demand for car washes in the area (perhaps due to many standalone car washes in an area), then it may not be the best choice for your business. That doesn’t mean this information isn’t valuable. It simply means not all of it is actionable right now. Prioritize based on market demand, and use the information you have to inform future decisions.

Dial in on Differentiators

Think about what your competition isn’t doing, too. How can you leverage their weaknesses within your own site and make them your strength? For example, if all of your competitors have the same or limited hours of operation, consider keeping your site open 24/7. Run a predictive scenario to see just how much business you’d attract if you changed your hours of operation. Kalibrate’s retail network planning tool enables retailers to run simulations on hypothetical changes/investments and forecast their potential on volume performance. You can quickly determine which differences, large or small, have the greatest impact.

Forecasting is critical to your ability to capitalize on competitor weaknesses, as you won’t be able to maximize potential on a site that has none. The tool can help you gauge whether an upgrade in one key area is worth the investment or not. Running these simulations gives you strategic insight and the ability to plan your next steps with confidence, so you don’t dive into an area with little potential return just because your competitor isn’t operating there.

Rinse and Repeat

Remember, even after successfully implementing a new offer or strategy, the market and competition still need continuous monitoring. The market changes, the population grows, and competitors find new strengths — and develop new weaknesses. The best retailers will continue to monitor their own sites’ performance and make adjustments accordingly, all the while keeping a sharp eye on the competition.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...

Fuel pricing

June 2025. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....