Network performance: banish the guesswork

Network planning and optimization has significantly changed over the years. It has evolved from a manual, intuitive process to become highly scientific, and — when done correctly — is backed up with in-depth human knowledge and expertise.

The problem is, if your network optimization processes are still stuck in the past, it can be hard to tell if your network is performing as well as it should be. Even if your sites are successful and profitable, do you know why? You need detailed competitor analysis, granular customer data, and location assessments, as well as accurate forecasting for complete peace of mind.

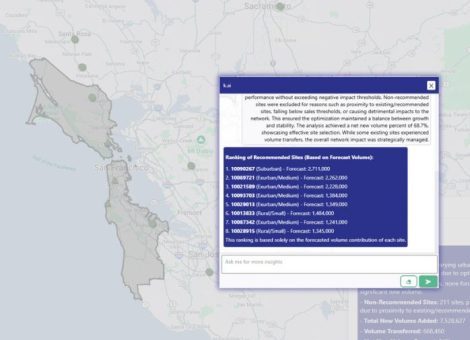

The process of network planning shouldn’t rely on guesswork. Here’s what the best network optimization platforms, like Kalibrate Planning, should highlight:

Competitor positioning

An intuitive planning tool is backed up by data at every stage, allowing you to accurately evaluate your competitors’ strengths and weaknesses at micro and macro level. This gives you the chance to respond rapidly to competitors’ changes and market opportunities, as well as understand how each decision you make will impact your competitive landscape.

The best network planning tools use business intelligence analytics to give you access to invaluable information about all the retailers in a given area (including physical attributes, brand performance, pricing, and number of fueling positions). The tool can help you identify sites that may need continuous monitoring or sites that have huge volume potential.

Location optimization

No retailer opens a new site with the intention of stealing volume from its other sites, but it can happen, usually as a result of poor planning or misguided intuition.

How well two sister sites perform will depend on how the two sites relate to each other, and whether they are serving the same consumers. An ideal planning platform uses technology that tracks vehicles (and therefore consumers) anonymously through unique identifiers, enabling you to visualize how your network changes are affecting consumption patterns.

Acquisition potential

There are two types of site acquisitions. “New to industry” opportunities are locations where a service station has never existed before. “New to business” opportunities are service stations that already exist in the market but are owned or leased by another company.

Network planning tools can correctly identify best locations for fuel and retail businesses by seeking locations that have high traffic, high demographic demand, and low competitor activity. The platform is able to highlight “hot spots” in conjunction with your company investment strategy and cost to serve, so network planners can make decisions about where to procure land on a proactive basis.

But remember, high volume is not the only indicator of a prime target. In fact, focusing on volume alone can be misleading and result in unwise investments. You have to consider each site through the prism of its future potential. By analyzing each site’s performance against its present and future potential, you can validate your decision-making and acquire only the sites that you can improve, even if they are currently underperforming.

Opportunity to improve

Finally, even after successfully optimizing your sites and improving the performance of your network, the market and competition still need continuous monitoring.

The market changes, the population grows, and competitors find new strengths — and develop new weaknesses. Using robust planning analysis allows you to continually monitor your own sites’ performance and make adjustments accordingly, all the while keeping a close eye on your competition. For more information about the Kalibrate planning tools, the power of data-driven decision making and advanced predictive modeling, watch our demo video.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related posts

Location intelligence

AI in location intelligence: The force multiplier for smarter site selection

AI is rapidly advancing in the world of real estate - this is the first blog in a two-part series on incorporating AI...

Fuel pricing

June 2025. Kalibrate's Canadian Petroleum Price Snapshot

Kalibrate conducts a daily survey of retail gasoline, diesel, propane, and furnace fuel prices in 77 Canadian cities....