Anyone reading the business news during the first two weeks of March to get a handle on the impact of the US economy on retail expansion has to be as confused as ever.

On the one hand, several large retailers announced ongoing expansion efforts:

- Aldi will invest $9 billion (!) to open 800 stores in the US over the next 5 years

- Burlington Stores will open 100 new stores in 2024

- Target will open more than 300 new stores over the next 10 years

- Ross Stores will open 90 Ross and DD’s units this year

- Home Depot announced that new store growth was one of three growth strategies for the company

- Grocery Outlet will open 15-20 new stores this year, with 100 new sites approved for 2025-2026

On the other hand, more sobering news related to contractions and store closures have been announced as well:

- Dollar Tree will close 600 Family Dollar stores in the first half of 2024, and will close another 370 Family Dollar stores and 30 Dollar Tree stores when their leases expire

- Allbirds will close about one-quarter of its 58 stores

- Outdoor Voices, a technical apparel chain, closed all 16 stores on March 17 to go online only (so much for a St. Patrick’s Day celebration)

- Macy’s announced plans to close upwards of 150 underperforming stores in the next few years, including up to 50 in 2024

- The Body Shop, after 48 years of operation, has filed for restructuring administration in the UK and will close all 50 of its US stores

A closer look at the upcoming store closures, however, reveals that more than economic headwinds may be at play. The Family Dollar closures come nine years after its acquisition by Dollar Tree and reflect the fact that even growth companies need to constantly assess and re-position their store portfolio to meet changing demographics and competitive pressures. Allbirds is closing stores meant for a broader apparel selection and will focus on its core footwear offerings. Body Shop has struggled for years – after being a leader in ethically-source natural ingredients in the 1980s and 1990s, the chain’s 2006 takeover by L’Oréal challenged its ethical credentials for many and it has struggled against a wide range of competitors.

From our perspective, there are three primary takeaways from these announcements:

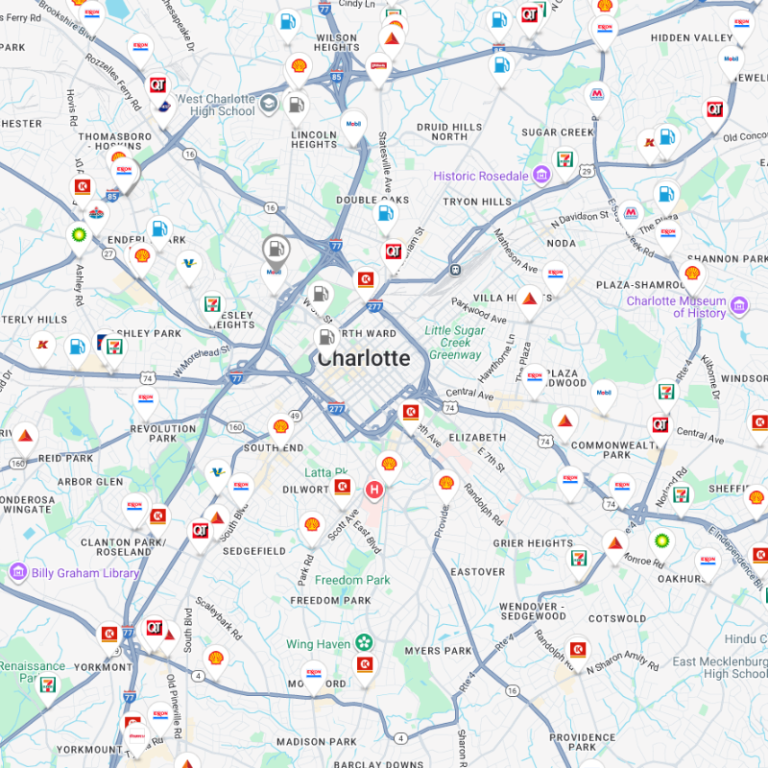

- The US economy remains strong, with little or no indication of a recession in the near future. Retailers continue to face challenges, including increased store construction costs and higher interest rates (higher than the low rates of the 2010s, in any event), but the overall retail environment is moderately encouraging.

- Retailers need to stay attuned to their core offerings as their competitors enter and exit their markets.

- Leveraging demographic and psychographic trends helps decision makers keep their brands relevant as the environment shifts around them.