Industries bouncing back post pandemic and the challenges they may be facing

Every industry felt the impact of Covid 19 – and sectors reliant on in-person services suffered most acutely. But businesses were able to adapt, leaning on curbside pickup and a compelling omnichannel offer to navigate the pandemic. Since then, activity has picked up significantly, but which industries have seen the biggest bounce back in the US?

Restaurants

From quick service restaurants to fine dining concepts, eating out was one of the major casualties of the various stages of lockdowns. So how have restaurants fared post-pandemic? According to the National Restaurant Association:

- Some 90,000 restaurants have closed, some permanently, because of the pandemic

- The foodservice industry is projected to reach $898 billion in sales this year, up from $799 billion in 2021, surpassing pre-pandemic sales levels from 2019 of $864 billion.

- When adjusted for inflation, sales in 2022 are projected to remain below pre-pandemic levels.

The current food service environment is volatile due to national labor and supply shortages. According to CNBC, 7/10 restaurant owners are struggling to recruit sufficient staff.

Toast, a POS provider, reported that the industry is nearly back to pre-pandemic levels after seeing an 18% growth between Q1 and Q2 2022. As a result, brands like Sonic, Chipotle, and Taco Bell have and are planning aggressive growth strategies to open hundreds of new locations in the coming years.

Gyms

Fitness centers and gyms suffered massively during the pandemic, but there are green shoots of revival. According to Wellness Living:

- As of Jan 1, 2022, 30% of fitness studios closed which is an 11% increase from the previous year

- Between March 2020 and June 2021, the industry lost $29.2B

- The industry is projected to reach $190.5B this year

During the pandemic, many clubs adopted virtual fitness classes allowing members to participate via digital channels. Once the gyms reopened, this trend struck with some. According to Club Industry:

- 70% of adults are using digital classes and memberships as part of their regiments

- 15% of those believe digital platforms eliminated their need for a gym.

This new trend caused people to invest in more digital and convenient virtual fitness options, some with their own hefty memberships such as Peloton, whose sales increased by 120% in 2021 (Business of Apps).

The fitness industry is still projected to recover in 2023 or 2024 and as of 2022:

- There are 11% more active memberships to fitness clubs than there was in 2021

- A 9% increase in new members joining

- 24% more in member check-ins in 2022 compared to 2021

- 20% increase in revenue since 2021

Club owners will need to acquire the next generation of gym-goers with a compelling omnichannel offer, to ensure the bounce back of the sector is sustained.

Wellness services

One of the first industries to recover from the pandemic was the spa and salon industry; Salon Today recorded that:

- 24% of consumers have added wellness services or treatments to their routine at salons and spas since the pandemic started.

- 53% of consumers say they are more open to trying new beauty services or treatments

This positive consumer sentiment towards health and beauty has allowed the industry to be on track to make a full recovery to pre-pandemic numbers. The ISPA conducted a study that found:

- The total number of U.S. spas fell only slightly from 21,560 in 2020 to 21,510 in 2021.

- U.S. spa industry revenues grew from $12.1 billion in 2020 to $18.1 billion compared to an all-time high of $19.1 billion in 2019.

- Spa visits grew from 124 million in 2020 to 173 million

A main contributor to this recovery was that this industry seemed immune to the staffing shortage that plagued other industries. In 2021, the number of industry employees increased to 345,000 from 304,800 in 2020.

Takeaways

Across verticals, the pandemic’s impact continues to resonate. The built-up demand led to significant bounce back recoveries in certain industries – particularly in concepts reliant on social, equipment, and close-contact services in the examples above.

We may have resumed a degree of predictability, but it’s critical that brands operating in bounce back sectors regularly review how their customers are behaving and their locations are performing. While they may be riding the wave of a clamor for pre-Covid normality today, that could all change and consumer habits and the competitive horizon continues to evolve.

Read more on our site selection solutions to help you understand the impact of these changes in your market

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related Posts

Location intelligence

Right-size your franchise territories: Maximize revenue per market

Franchise territory management tools are evolving changing with advances in location intelligence.

Location intelligence

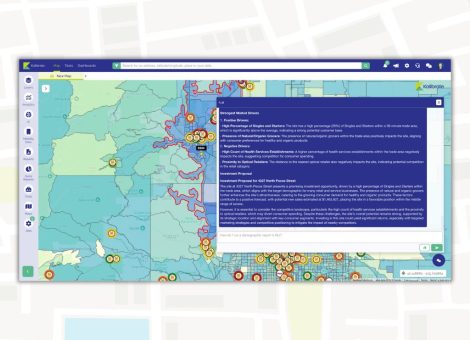

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.