How to approach a challenging real estate forecast

The decision to invest in a real estate forecasting model is often driven by the promise of conducting efficient site evaluations that will yield dependable results. Regardless of how sophisticated or robust your model may be, it is inevitable that you will face scenarios that pose unique challenges. It is important to keep the perspective that all analytical tools aim to mitigate risk, not to eliminate risks entirely.

Forecasting models effectively address most of the common and pervasive variables contributing to unit performance; however, the best models also provide an analytical framework that can be leveraged in support of more challenging site evaluations.

Scenarios that prove to be the most difficult are those with circumstances that deviate, often significantly, from the typical operating environment of the brand’s existing network of locations. Examples include:

- An operator predominantly positioned in suburban or rural markets that are considering an urban expansion strategy (or vice-versa)

- Geographic expansion into new markets or regions

- Greenfield development in an unestablished, high-growth trade area

- A unique layout and/or experimental prototype variation

The following iterative steps form the foundation for the advice that we often share with clients when faced with these more difficult site forecasts:

Step 1: Know the organizational appetite for risk

Challenging sites inherently carry a higher degree of risk, and forecasting models offer no assurances of success. If your organization is risk-averse, site approval faces an uphill climb. It is common that the site being considered, if successful, may open the door to additional opportunities, representing a worthy long-term reward for the elevated risk. The analysis will require additional effort – therefore, it is prudent to verify the time is well spent.

Step 2: Establish an initial baseline

Take the first pass run through the typical site forecasting process without overcompensating for the challenging component(s). This initial forecast provides a quick yet consistent baseline and helps frame the next stages of analysis and review.

Step 3: Define the hurdle

Compare the baseline forecast with an approximation of what might be required for the site to be successful. As an example, consider a greenfield opportunity in a developing, high-growth trade area growing at an annual rate of 3.5%. Through some calculation, you determine that the site would successfully hurdle if the growth rate exceeded 4.2%. You have identified a key forecast metric which merits additional exploration. Is it possible that your demographics are underreporting new housing development? Are you referencing the most current vintage of data? Incremental research into the variables that carry the most risk will be valuable when making an approval decision.

Step 4: Leverage the framework

Utilize the research that was conducted during the development of the forecasting model. Ideally, this information is readily available for querying purposes and can be easily manipulated to provide specific insights. Using the example from Step 3, it would be useful to query a subset of existing units that are also positioned in high-growth trade areas for comparison. Are any trade areas for these existing units experiencing growth rates above 3.5%? What are the key similarities or differences between the site in question and the high-growth peer group? What type of environment and/or market conditions exist in trade areas where household growth has exceeded projections, and how does the site relate?

Step 5: Present information objectively

Try to avoid letting preconceived opinions from key stakeholders, brokers, or yourself bias the evaluation. One approach is to consider arguments both in favor of and against the site. Think about how both supporters and detractors might build their respective cases. Which variables would be highlighted in support of each position? Documenting those positions will clearly bring into focus the strengths and vulnerabilities of the site with relevant context.

It is worth repeating that challenging sites inherently carry a higher degree of risk. The above steps can help to isolate risk and to provide fact-based assessments that will empower the approval committee to make a much more informed decision.

To learn more about how Kalibrate mitigates risk through the development of analytical solutions for real estate, please contact us.

Read more articles about:

Location intelligenceSubscribe and get the latest updates

You may unsubscribe from our mailing list at any time. To understand how and why we process your data, please see our Privacy & Cookies Policy

Related resources

Location intelligence

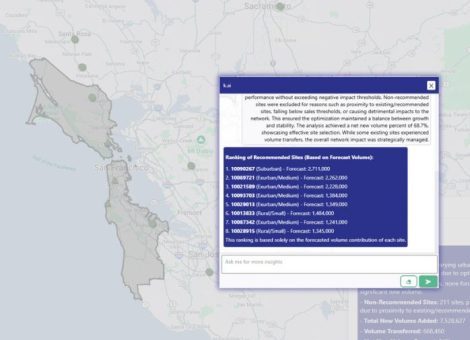

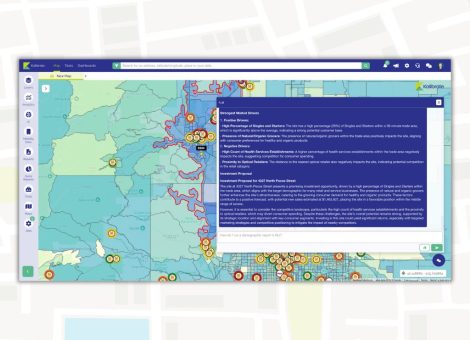

AI in location intelligence: See it in action

See videos and screen captures of how AI has been integrated into the KLI platform.

Fuel pricing

Middle East / Africa - Fuel network planning: Critical insights

Join our team as we look at the key points of insight that fuel network planners need to consider when making...